Bitcoin’s worth stays remarkably secure, also after Mt. Gox, the obsolete crypto exchange, moved 13,265 BTC. These BTC are around worth $782 million.

Especially, this purchase consists of 12,000 BTC moved right into a brand-new budget and 1,265 BTC to an interior budget.

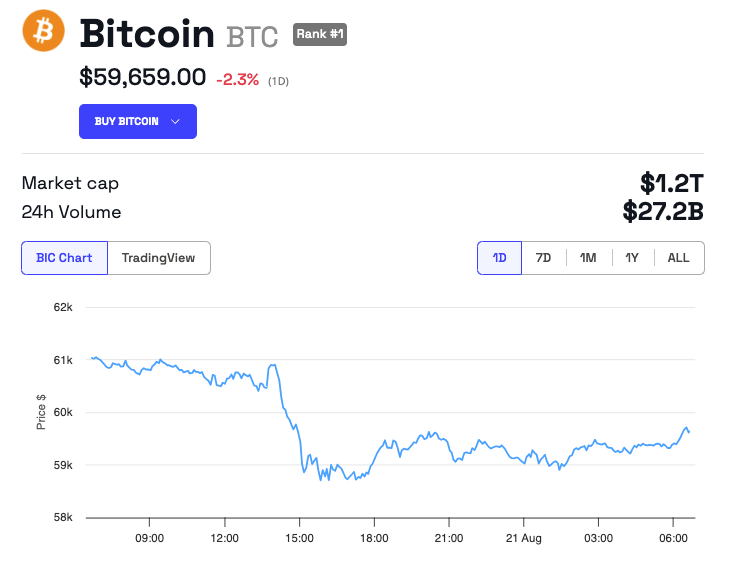

Bitcoin Trades Near $60,000 Regardless Of Mt. Gox Transfers

Formerly, on August 14, Mt. Gox made one more significant relocation by moving 33,140 BTC, valued at virtually $1.97 billion, right into 2 brand-new budgets. Of this, just 111.3 BTC discovered its means to significant crypto exchanges OKX and Binance, most likely component of an initiative to settle financial institutions.

According to Find On Chain, given that July 5, Mt. Gox has reallocated 61,670 BTC, equal to $4.04 billion, to exchanges such as Bitstamp, SBI VC Profession, and Sea serpent for comparable objectives. Presently, Mt. Gox’s holdings consist of around 79,186 BTC, which totals up to around $4.67 billion.

Regardless of these huge deals, market specialists, such as Alex Thorn, do not anticipate considerable marketing stress.

” We currently believe that of the 13,265 BTC relocated this purchase, just 1,265 ($ 74.5 million) is implied to disperse, with 12,000 mosting likely to estate fresh cold store so, extremely little,” Thorn, the head of research study at Galaxy Digital stated.

Since creating, Bitcoin is trading at $59,659, experiencing a small decrease of 2.3% in the last 24 hr.

Find Out More: Leading Crypto Bankruptcies: What You Required To Know

Nonetheless, numerous market signs mean a forthcoming favorable pattern. Experts at K33 Research study expect a possible brief capture, which can drive Bitcoin rates upwards.

They highlight the present reduced financing prices for Bitcoin continuous futures, which have actually reached their low point given that the United States financial situation in March 2023. Moreover, the experts Vetle Lunde and David Zimmerman recommend that the problems are ripe for a remarkable market motion.

” Continuous swap financing prices have actually balanced at adverse degrees over the previous week, while open rate of interest has actually greatly raised. This recommends hostile shorting, structurally developing an arrangement ripe for a brief capture,” K33 experts said.

This circumstance would certainly compel quick-profit investors to desert their bearish wagers, better enhancing the cost rise.

In addition, the international securities market are coming close to document highs, with gold rates attaining brand-new all-time highs. At the same time, Bitcoin has actually been delaying somewhat, possibly establishing the phase for a rebound.

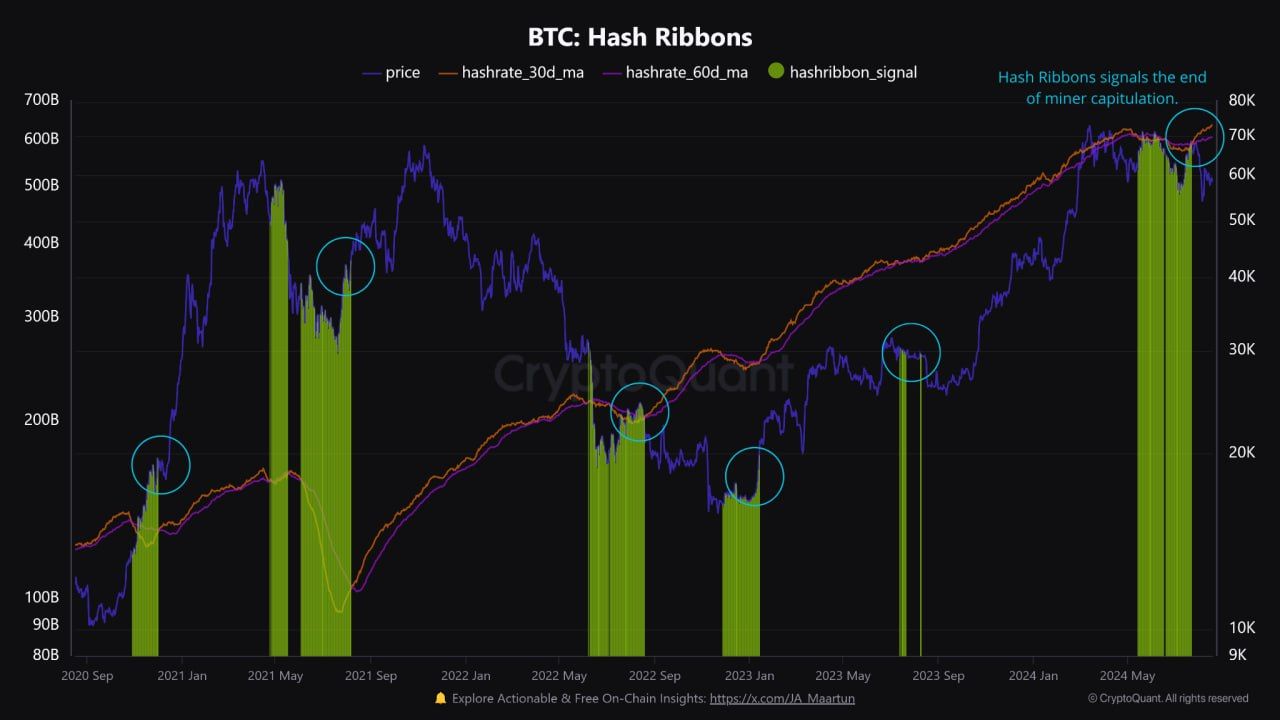

In addition, the crypto mining market presents indications of healing. The Hash Ribbons indication from CryptoQuant, which checks the 30 and 60-day standards of the Hash Price, lately indicated completion of miner capitulation. Simultaneously, the Hash Price has actually gotten to a brand-new top of 638 exahash per secondly.

Find Out More: Bitcoin Halving Background: Whatever You Required To Know

This healing is specifically essential as it complies with a Bitcoin cutting in half occasion, which normally comes before significant cost boosts.

” Miner capitulations after the halvings have actually been adhered to by huge cost rallies (4x-6x rise in 2016 and 2020), although the cost rally is not always a straight outcome of the miner capitulation occasion,” Julio Moreno, Head of Research study at CryptoQuant informed BeInCrypto.

Please Note

In adherence to the Count on Task standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to offer exact, prompt info. Nonetheless, visitors are encouraged to confirm realities separately and speak with a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.