On August 5, Ethereum’s (ETH) cost went down to $2,226, creating the more comprehensive market to panic. Yet ever since, the altcoin has actually had the ability to eliminate a few of the losses, trading at $2,660 at press time.

Nonetheless, capitalists are asking yourself whether ETH has actually endured its most hard stage. This on-chain evaluation exposes the response.

Ethereum’s Bull Run Is Back on the right track

One method to analyze this is by assessing the marketplace Worth to Recognized Worth (MVRV) prices bands. These bands enable capitalists to approximate the cost degrees at which a cryptocurrency will certainly get to a high degree of latent earnings or losses.

When a cryptocurrency reaches its highest degree of latent earnings, it implies that the cost has actually reached its cycle top. Nonetheless, when there is a high degree of losses, the crypto seems near all-time low.

According to Glassnode, the very high MVRV prices degree (red) goes to $6,759. This worth indicate the possible cost that develops the top of the Ethereum market cycle.

As pointed out previously, this metric likewise finds possible bases. As seen over, the very reduced MVRV prices degree (blue) was $1,687. The last time ETH reached this degree remained in December 2023, recommending that the cryptocurrency’s cost could no more go down listed below this factor prior to completion of this cycle.

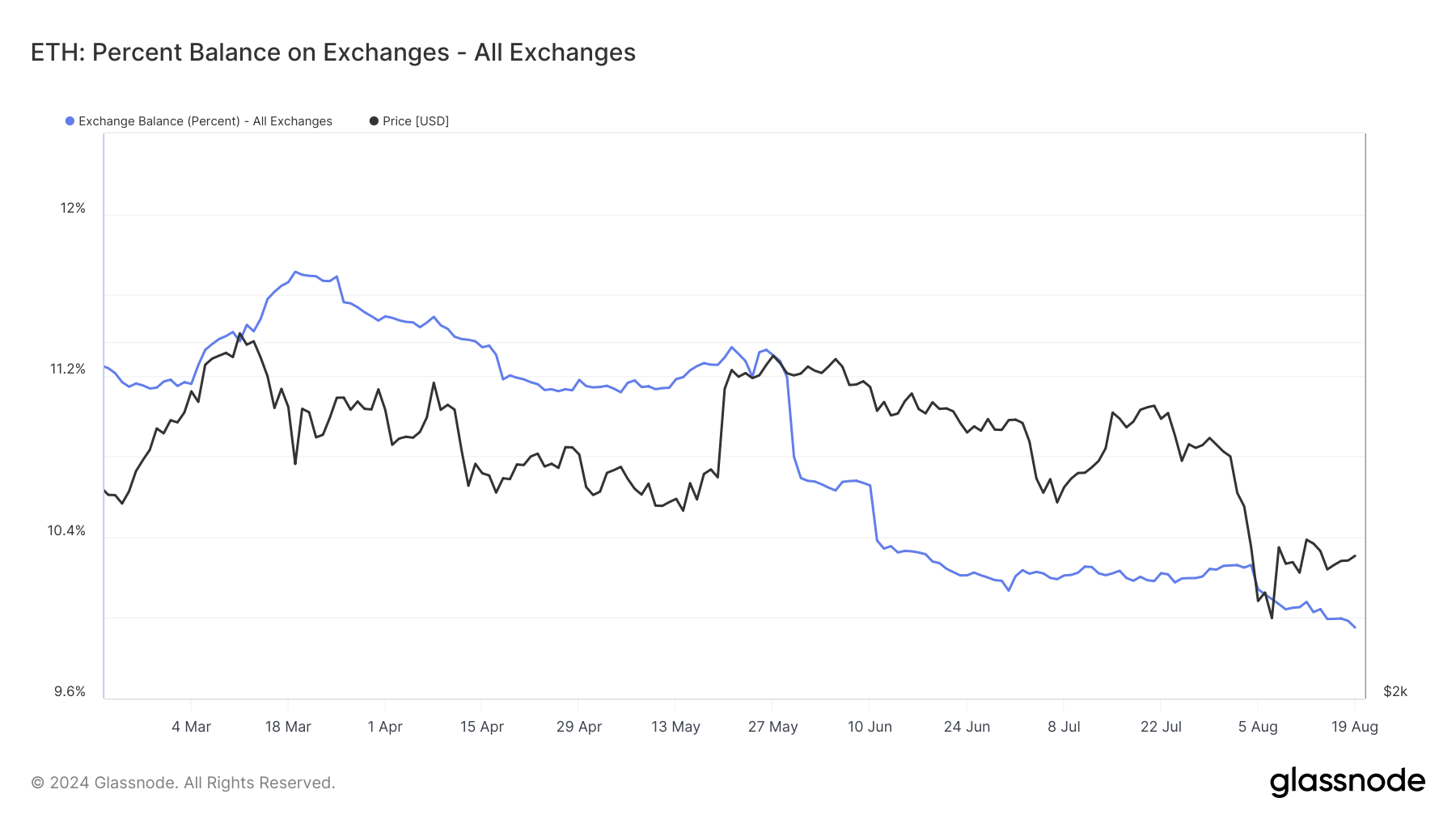

In addition, the percent of ETH hung on exchanges remains to decrease, showing a change in financier actions. Commonly, when even more cryptocurrencies are kept on exchanges, it indicates an intent to offer, which can place descending stress on rates.

Since March 19, the percent of ETH on exchanges stood at 11.71%. Presently, that number has actually gone down to 9.95%. This decrease recommends that Ethereum owners are progressively deciding to preserve their possessions as opposed to offer them, showing an expanding self-confidence in the coin’s lasting worth.

Learn More: Exactly How to Acquire Ethereum (ETH) and Every Little Thing You Required to Know

Historically, a choice similar to this indicate the sentence that the cost might boost and is an essential indication that the advancing market is not down and out. Hence, if this proportion remains to go down, ETH’s possibility of exceeding $6,000 this cycle likewise leaps.

ETH Cost Forecast: $2,900 First, $4,700 Later

On the day-to-day graph, Ethereum paints a favorable photo, intending to leave the supply area in between $2,625 and $2,693. From the graph below, ETH was around a comparable area in January. In between that duration and March, the cost of the cryptocurrency leapt by 88.20% and struck $4,082.

For That Reason, if the altcoin intends to reproduce such a pattern, the worth of the ETH’s cost might climb as high as $4,770 in a couple of months. On a temporary perspective, ETH cost looks readied to get to $2,932 as long as purchasing stress rises.

Learn More: Ethereum (ETH) Cost Forecast 2024/2025/2030

Nonetheless, the crypto deals with resistance around $2,779. If bulls stop working to damage over it, the altcoin cost might be turned down. Need to this hold true, ETH’s cost might backtrack to $2,487.

Please Note

According to the Count on Task standards, this cost evaluation write-up is for educational functions just and must not be taken into consideration economic or financial investment guidance. BeInCrypto is dedicated to precise, objective coverage, yet market problems go through alter without notification. Constantly perform your very own research study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.