Tether, the provider of one of the most capitalized stablecoin, produced $1 billion USDT symbols on Tron today, including in an accumulation of prints this month.

Blockchain tracker Whale Alert reported the deal, simply a week after a comparable $1 billion producing on the Ethereum blockchain.

Tether Includes $1 Billion USDT to Supply

Paolo Ardoino, Tether’s chief executive officer, explains that this minting is an “USDT supply renew,” implying the symbols are accredited yet not yet released. They are included in Secure’s supply for future issuance demands and chain swaps. This strategy aids guarantee adequate supply for reliable liquidity administration, with symbols launched right into blood circulation when formally released.

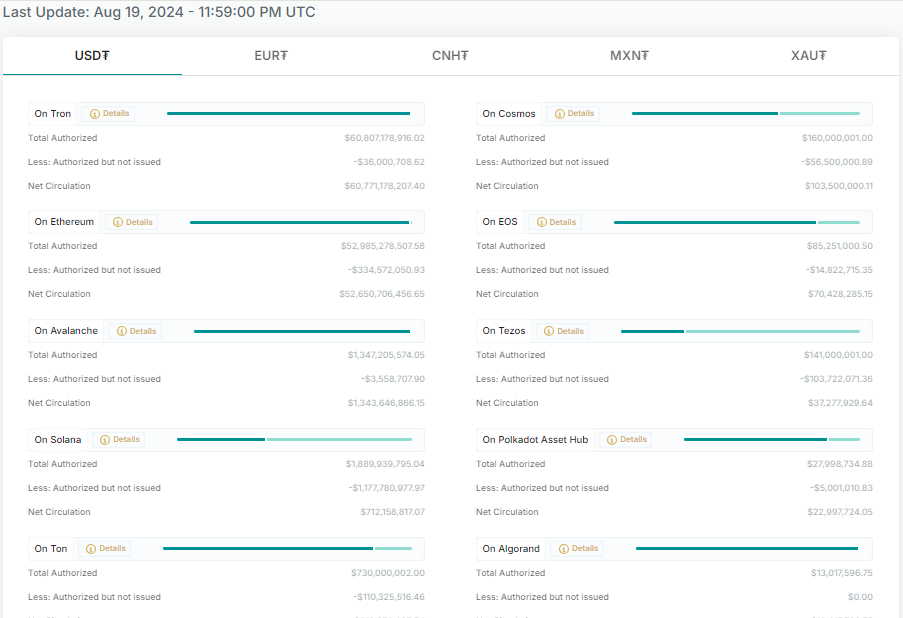

Normally, companies renew supply to fulfill expected need. Tether’s step recommends enhancing need for USDT on Tron, where supply has actually been running reduced. Since August 19, Tether’s openness web page reveals just $36 million USDT symbols on Tron, all accredited yet not released.

Learn More: 9 Finest Crypto Pocketbooks to Shop Tether (USDT)

In situation of an abrupt need rise on Tron, Tether can immediately fulfill this passion. With today’s $1 billion mint, the stablecoin provider’s complete issuance has actually gotten to $17 billion considering that Bitcoin came to a head over $73,000. Significantly, this constant minting straightens with current market rallies, sustaining supposition that these issuances might be driving the crypto market’s energy.

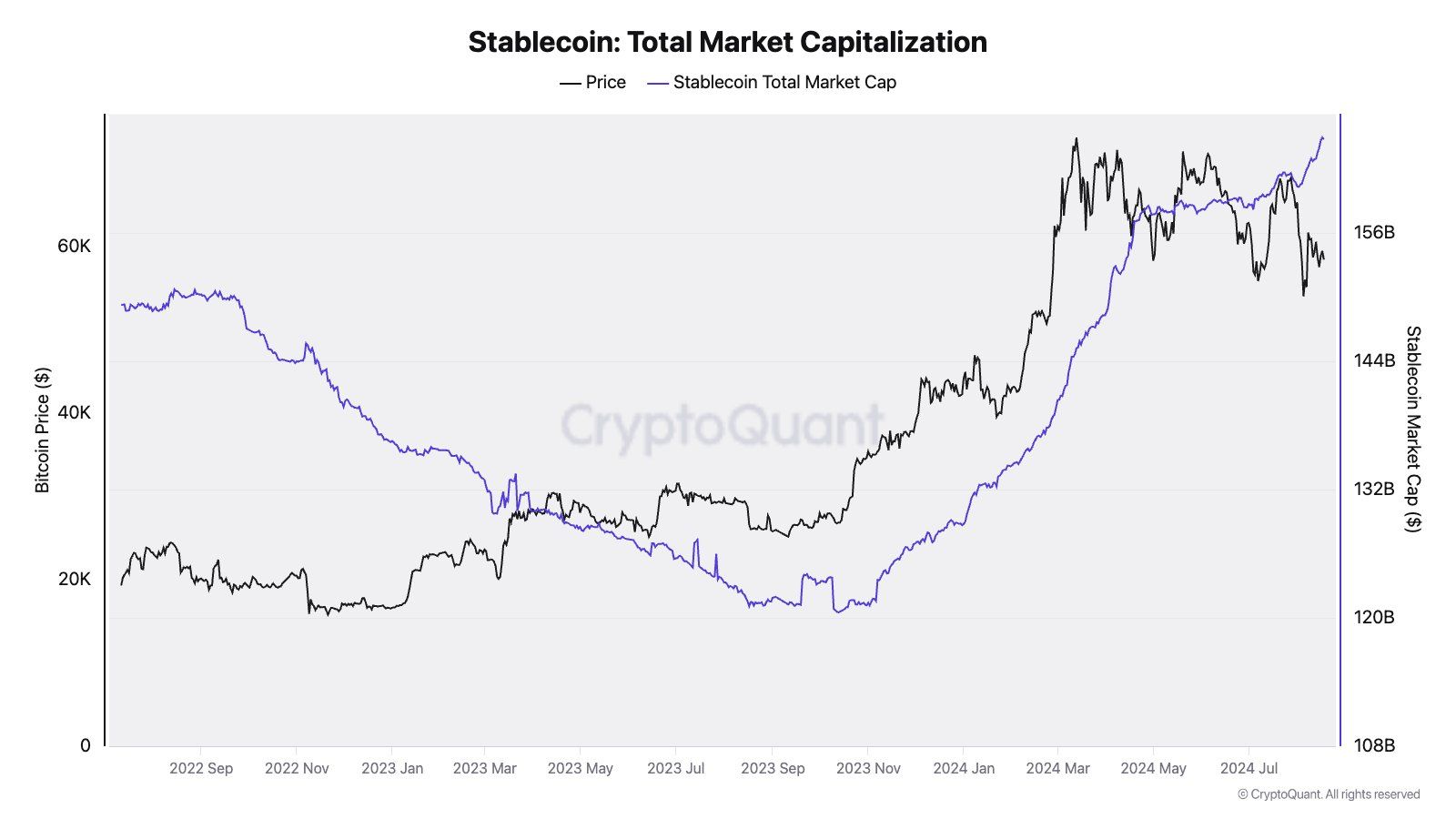

” Every person speaking about international M2 bursting out, yet I’m taking a look at complete stablecoin market capitalization: fresh document high over $165 Billion. This indicates greater liquidity in the crypto markets,” Julio Moreno, Head of Research Study at CryptoQuant, stated.

Based upon the graph below, the complete stablecoin market capitalization (blue) has actually risen considerably. This development can improve crypto market liquidity, making it simpler for investors to deal possessions. Boosted liquidity can enhance rate security and market performance, possibly increasing need for various other cryptocurrencies and adding to rate gratitude.

On the various other hand, it might likewise signify raised threat degrees in the marketplace, with capitalists looking for haven in stablecoins in the middle of market unpredictability or high volatility.

Learn More: Just How to Purchase USDT in 3 Easy Actions– A Newbie’s Overview

Somewhere Else, Tether has actually released USDT on the Aptos blockchain to enhance the stablecoin ease of access. This step leverages Aptos’ innovative design, using extraordinary rate and scalability. The combination will certainly likewise provide reduced gas costs, considerably minimizing deal expenses.

” We’re constructing a solid, international, and institution-grade DeFi and repayments environment that values rate, decentralization, and interoperability while leveraging Go on Aptos to make it all job. The launch of USDT on Aptos increases the schedule and energy of real-world worth for establishments, Web3 building contractors, and routine individuals worldwide,” Head of Grants and Community at Aptos Structure, Bashar Lazaar claimed.

Post-integration, Tether will certainly have the ability to mint USDT straight on Aptos, similar to it does on Tron and Ethereum.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to give exact, prompt info. Nevertheless, visitors are encouraged to validate realities individually and seek advice from an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.