Metaplanet’s supply rose 12% after the Japan-based investment company broadened its Bitcoin (BTC) holdings. Following its dedication previously this month, the business spent 500 million yen (roughly $3.4 million) right into Bitcoin.

Japan remains to enhance its setting as a leader in cryptocurrency fostering. With the yen weakening and federal government authorities providing cautions, even more capitalists are transforming to electronic possessions as a bush.

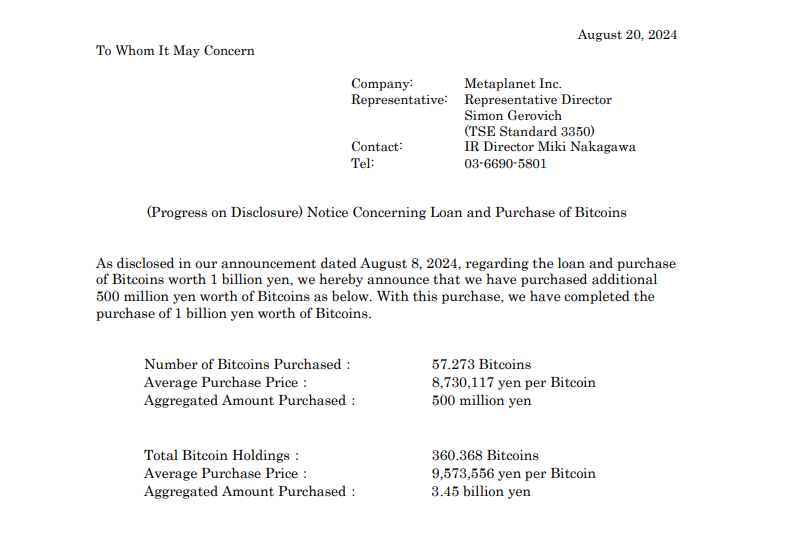

In an August 8 commitment letter, Metaplanet introduced strategies to buy 1 billion yen well worth of Bitcoin. The current purchase satisfies that pledge.

The investment company acquired 57.273 BTC at a typical rate of 8,730,117 yen per token. With this acquisition, Metaplanet’s overall Bitcoin holdings have actually expanded to 360.368 BTC, obtained at a typical rate of 9,573,556 yen per BTC.

As formerly reported by BeInCrypto, the company bought 20.195 BTC valued at $1.02 million in very early July, making it Japan’s biggest business Bitcoin owner. The current purchase additionally reinforces this setting, suggesting increasing crypto fostering in the nation.

Find Out More: That Possesses one of the most Bitcoin in 2024?

Metaplanet associates its rate of interest in Bitcoin to MicroStrategy, with chief executive officer Simon Gerovich pointing out Michael Saylor as the driving pressure behind their technique. Comparable to MicroStrategy, Metaplanet has actually progressively broadened its Bitcoin holdings considering that April 2024.

” It was an honor and opportunity to fulfill Saylor in Nashville in advance of the Bitcoin seminar. Many thanks for motivating Metaplanet to embrace a Bitcoin requirement,” Gerovich indicated.

The company’s technique consists of a $1.6 million BTC acquisition on June 11, adhered to by a June 24 dedication to get an added $6 million well worth of Bitcoin via bond issuance. MicroStrategy’s plan has actually influenced many various other companies past Metaplanet, as companies throughout various markets significantly include Bitcoin right into their financial investment methods.

Japanese Companies Take Off to Bitcoin In The Middle Of Weakening Money

In July, Metaplanet introduced that lasting Bitcoin holding had actually become its main technique. This change belongs to a more comprehensive initiative to decrease direct exposure to Japan’s weakening money, the yen, while using Japanese capitalists accessibility to crypto with a positive tax obligation framework.

BitMex chief executive officer Arthur Hayes lately recommended that the Federal Book may consider limitless dollar-yen swaps to support the yen’s devaluation. Regardless of the Financial institution of Japan’s (BOJ) hawkish position, the money stays unstable.

” We sustain the BoJ’s sight and bodes well for more price walkings, although the reserve bank would certainly continue to be mindful as the last price boost had actually created a sharp spike in the yen,” Kazutaka Maeda, an economic expert at Meiji Yasuda Research study Institute, claimed.

Japanese Economic Situation Priest Yoshitaka Shindo included that the yen is anticipated to recuperate progressively which earnings must enhance. Shindo additionally stressed the federal government’s dedication to functioning carefully with the BOJ on adaptable macroeconomic plans.

With the yen encountering substantial obstacles, capitalists might look for different possessions to shield their wide range. Bitcoin, seen by some as a shop of worth, is one such choice. Metaplanet’s choice to embrace BTC as a book possession shows its technique to alleviate dangers from Japan’s financial debt worry and the yen’s volatility.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to give precise, prompt info. Nonetheless, viewers are suggested to confirm truths individually and talk to a specialist prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.