BlackRock’s hostile press right into Bitcoin has actually brought its holdings to almost 350,000 BTC, making it the third-largest owner internationally after Satoshi Nakamoto and Binance, according to on-chain information.

This significant buildup comes as BlackRock remains to develop itself as a leading gamer in the cryptocurrency room, driven by its different ETF items and expanding passion from institutional capitalists.

BlackRock Currently Possesses Almost 350,000 Bitcoins

BlackRock’s access right into Bitcoin has actually been a significant pivotal moment for the sector. Historically, BlackRock Chief Executive Officer Larry Fink was a singing doubter of Bitcoin, rejecting it as a speculative and possibly hazardous property.

Nonetheless, his position has actually undertaken an extreme improvement over the previous years. Fink currently sees Bitcoin as an “worldwide property” with transformative possibility for money. This change of mind has actually been a stimulant for BlackRock’s strengthening participation in the cryptocurrency market.

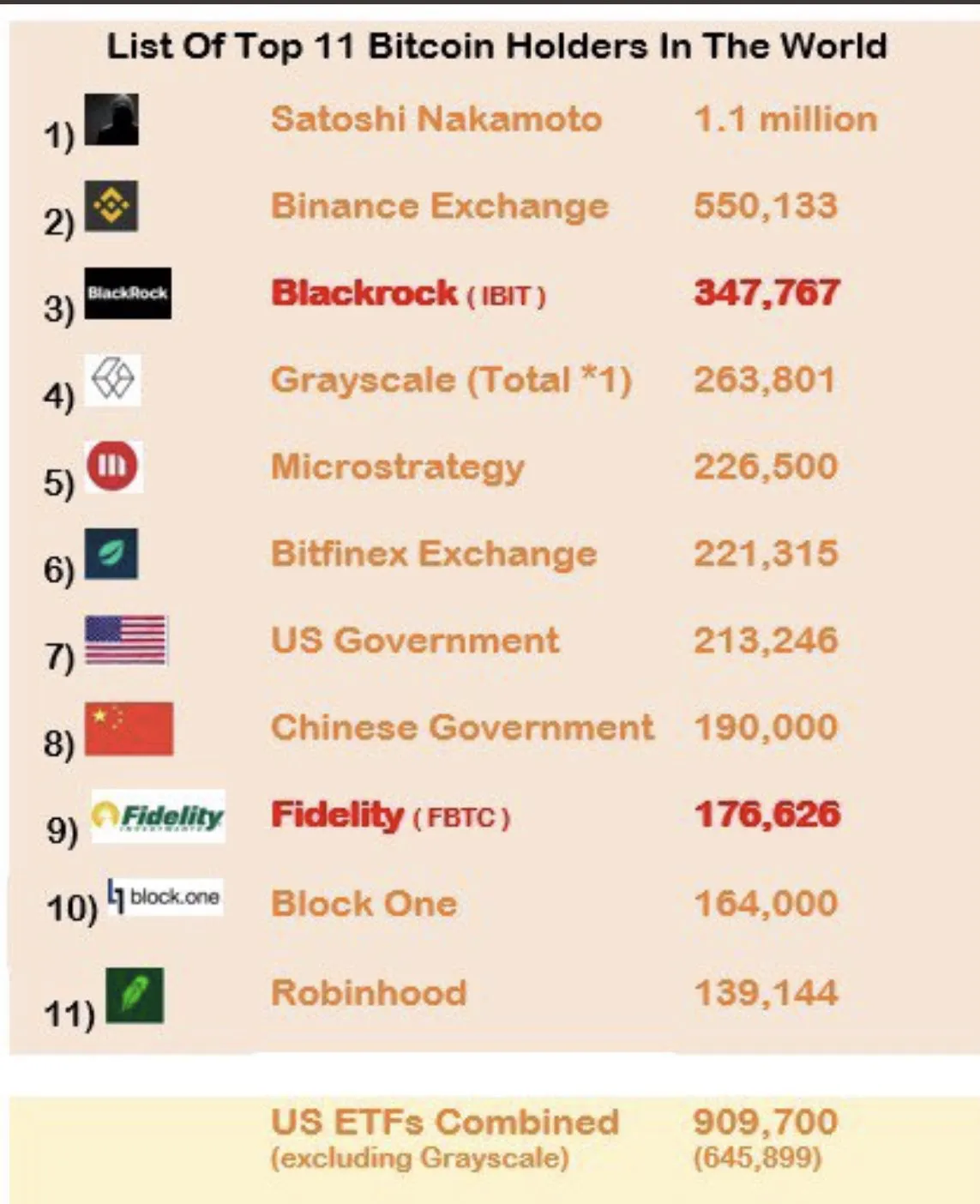

The company’s front runner item, the iShares Bitcoin Trust fund (IBIT), is a main part of this method. Released previously this year, IBIT promptly acquired grip amongst institutional capitalists trying to find safe and secure direct exposure to Bitcoin. Consequently, BlackRock’s holdingshave neared 350,000 BTC For viewpoint, this quantity is just gone beyond by Satoshi Nakamoto’s approximated 1.1 million BTC stock and Binance’s holdings, which are reported to be around 550,000 BTC.

” Really did not recognize United States ETFs get on track to pass Satoshi in Bitcoin kept in October. BlackRock alone is currently # 3 and on speed to be # 1 late following year, and will likely remain there for a long time,” Bloomberg ETF expert Eric Balchunas said.

Learn More: Who Owns the Most Bitcoin in 2024?

Surprisingly, the equilibrium of power in the ETF market was extremely various simply a couple of months back. Grayscale was leading the scene, holding even more Bitcoin than BlackRock.

Nonetheless, the circumstance has actually currently moved, with Grayscale facing consumer redemptions as capitalists take out. The key aspect behind this exodus is Grayscale’s high 2.5% charges, contrasted to the sector standard of 0.25%.

BlackRock’s expanding existence in the crypto room has actually unlocked for even more typical monetary gamers to go into the marketplace. Current filings reveal that significant establishments like Capula Monitoring, Goldman Sachs, DRW Resources, and numerous financial investment and retired life boards have actually been getting shares of BlackRock’s iShares Bitcoin Trust fund.

Learn More: How To Trade a Bitcoin ETF: A Step-by-Step Approach

While ETFs have undeniably played a key role in establishing cryptocurrencies as a legitimate asset class, opinions within the crypto community remain divided. Many argue that large financial institutions increasingly contradict the principles on which Bitcoin was founded. For these critics, institutional control in the crypto space erodes this original ethos, shifting power back to the very entities Bitcoin aimed to bypass.

“Does this not defeat the whole purpose of “decentralization”? BlackRock will be the biggest hodler, it doesn’t get much more centralized than that,” one X user noted

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to supply precise, prompt details. Nonetheless, visitors are suggested to confirm truths separately and speak with a specialist prior to making any kind of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.