A version of this post was originally published on Tker.co.

From Time To Time, we’ll obtain a single anecdote that succinctly reflects a much larger tale in the economic situation.

Recently, we obtained such a point of view from Walmart CFO John David Rainey after the launch of the business’s 2nd quarter monetary outcomes. Via WSJ (focus included):

We remain to think that clients are critical, they are choiceful, they are concentrating on basics versus optional things, however we have actually not seen any type of step-by-step fraying of customer wellness. … I would not state stamina, however absence of weak point

Simply put, the American customer isn’t investing as carelessly as they made use of to. Yet they aren’t breaking down.

This remains in line with an economic climate that has actually ended up being less coiled, highlighted by a cooling labor market that hasbecome more balanced And in spite of home excess savings falling and debt delinquencies rising as they stabilize to prepandemic degrees, consumer finances generally remain very healthy.

The customers’ capability and willingness to spend is a large bargain as individual intake make up68% of GDP If customers are investing, probabilities are the economic situation is expanding.

Walmart, America’s biggest seller, reported Q2 net sales that expanded a healthy and balanced 4.8% year-over-year, sustained by 4.2% development in united state same-store sales. Administration also increased its complete year advice, forecasting 3.75% to 4.75% development in financial 2025 (up from a variety of 3.0% to 4.0%).

And this is not simply a Walmart tale.

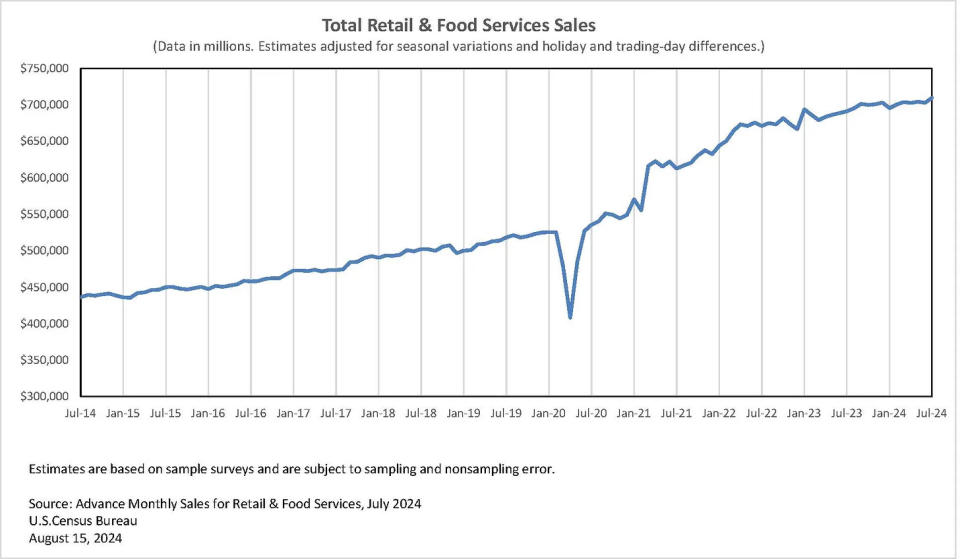

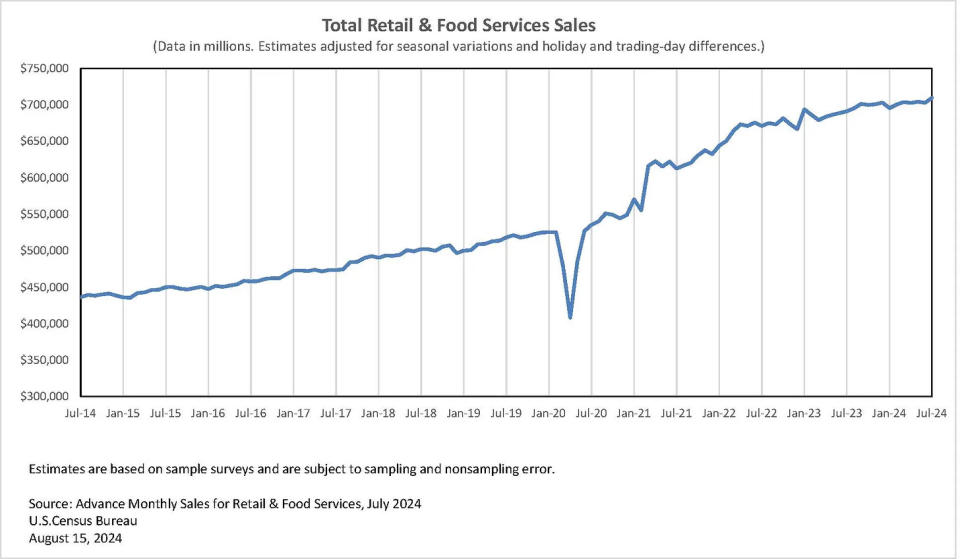

According to nationwide information launched by the Census Bureau on Thursday, retail sales in July expanded 2.7% year-over-year to a document $709.7 billion.

While retail sales were up an outstanding 1% from the previous month, I would certainly hesitate to state they’re reaccelerating. Information tends tozig zag month to month When you zoom out a bit, it’s clear that investing development has actually been plateauing, which remains in line with other cooling economic metrics.

A cooling down economic situation isn’t a poor point

Financial development isn’t as scorching warm as it made use of to be. Yet that isn’t always a poor point– we appear to be experiencing a “goldilocks” set of conditions where financial task is still expanding while rising cost of living stays great.

These problems aren’t always poor for the securities market either.

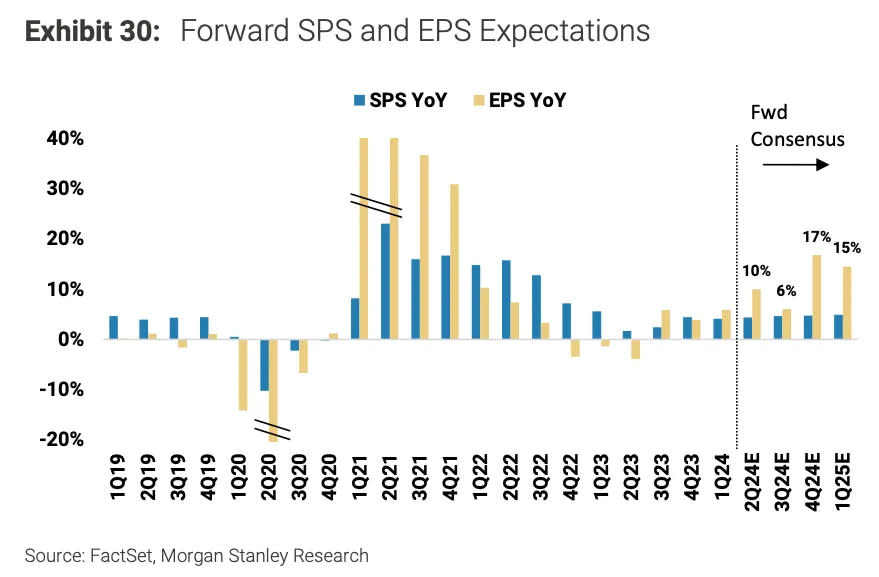

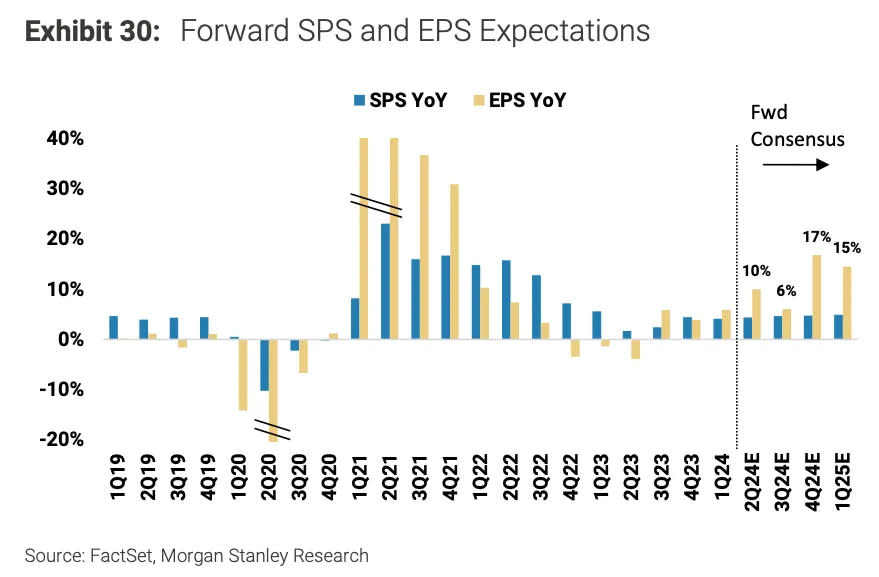

Sure, cooling down need in the economic situation is a headwind to buy. Yet as we’ve been discussing, business have actually revealed they can transform moderate sales development right into even more durable revenues development many thanks tooperating leverage This is essential, due to the fact that as we constantly state, revenues are the most important long-term driver of supply costs. It’s the “bottom line” Learn More here and here.

It’s a great pointer of just howthe stock market is not the economy Since, it’s possible for the stock market to outperform the economy.

Associated from TKer:

Evaluating the macro crosscurrents

There were a couple of remarkable information factors and macroeconomic growths from recently to take into consideration:

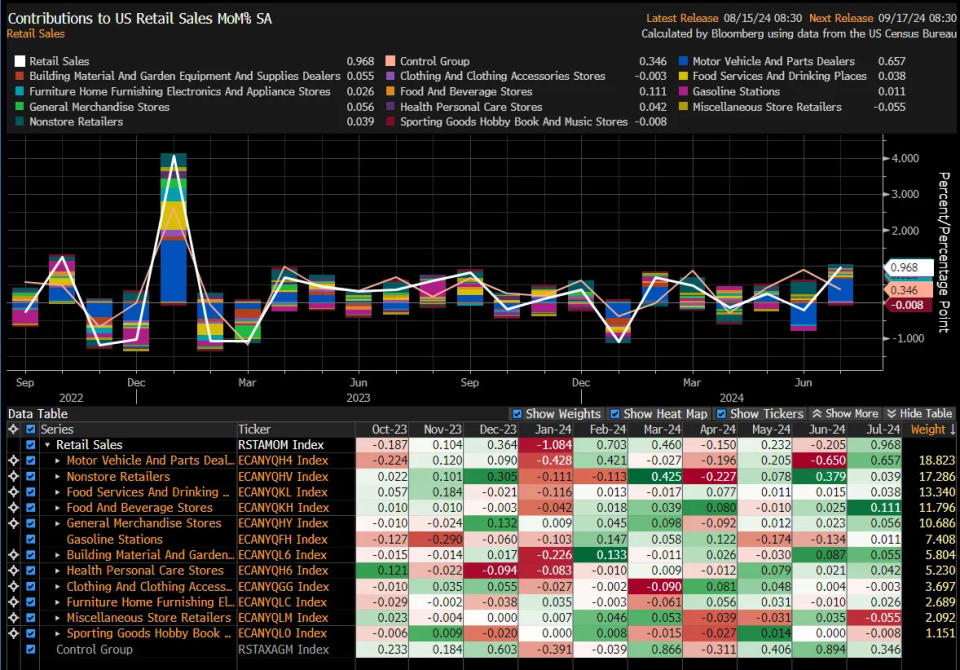

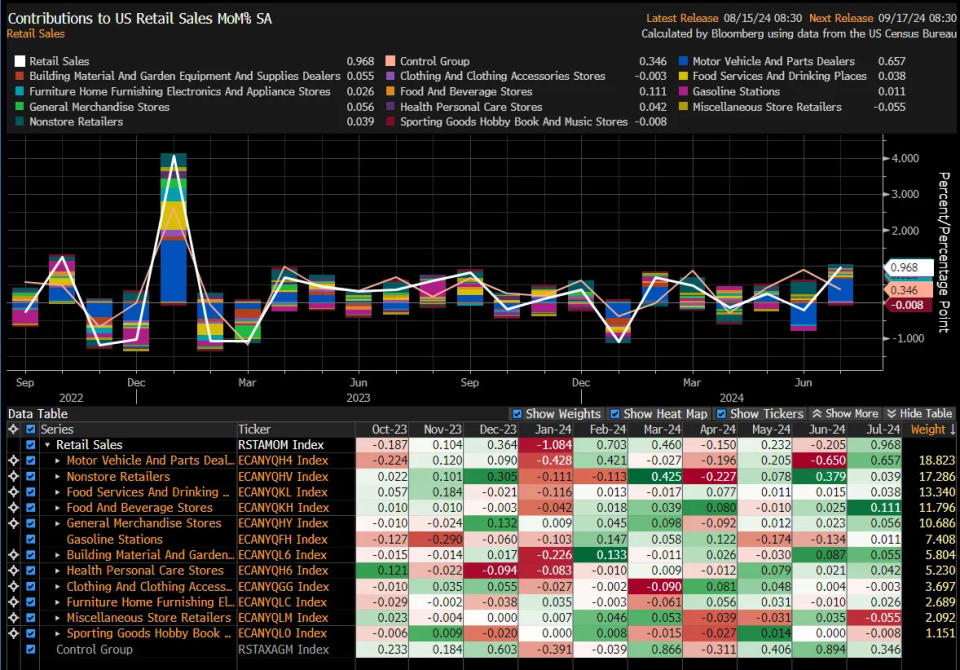

Purchasing climbs to brand-new document degree Retail sales inched greater in July to a document $709.7 billion.

Toughness was wide with development in autos and components, electronic devices, wellness and individual treatment, grocery store, dining establishments and bars, developing products, and furnishings.

For a lot more on the customer, read: There’s more to the story than ‘excess savings are gone’ and The US economy is now less ‘coiled’

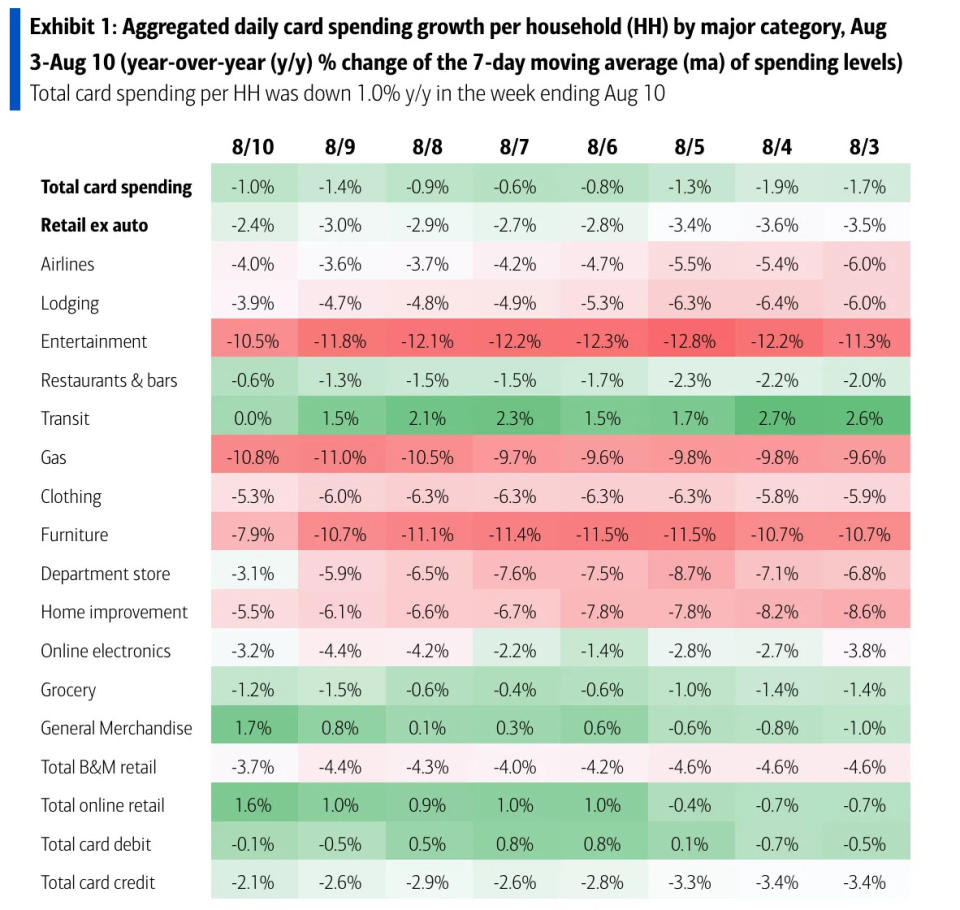

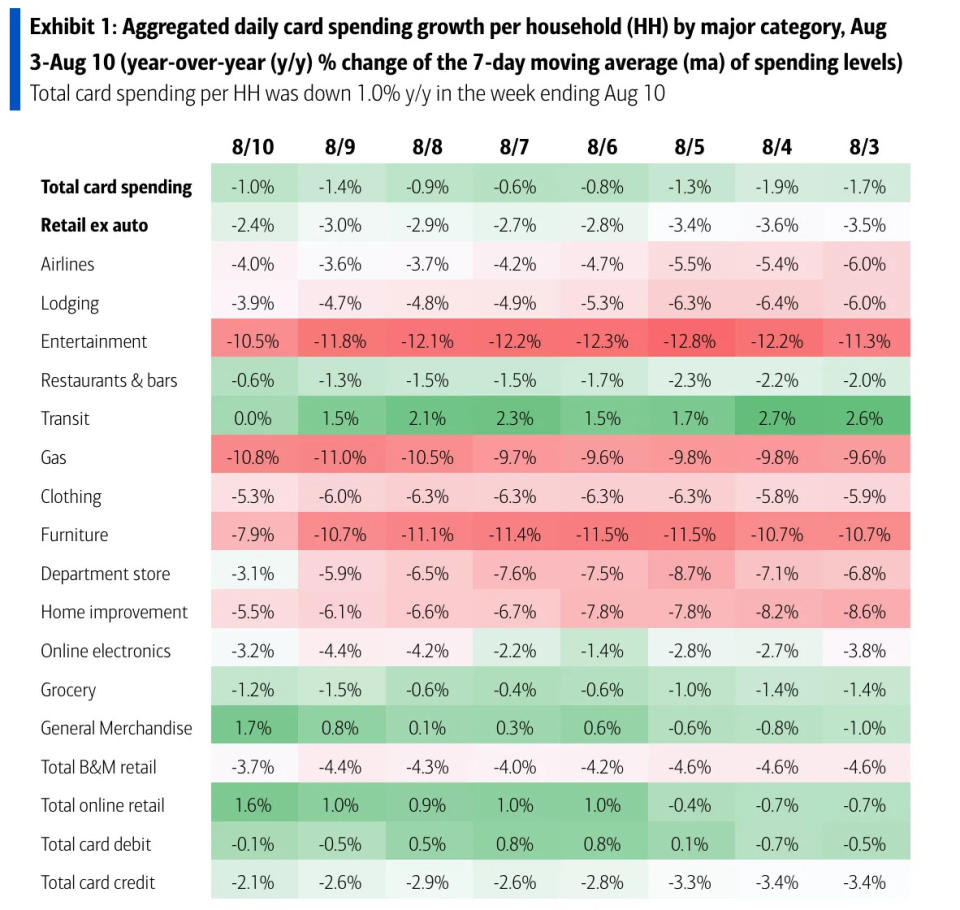

Card costs information is cooling down From Financial institution of America: “Overall card costs per HH was down 1.0% y/y in the week finishing Aug 10, according to BAC aggregated credit rating & & debit card information. While still unfavorable, outlet store, home renovation & & furnishings costs development saw the biggest boost because recently. At the same time, transportation and gas were the only 2 fields we report on listed below that saw a decrease in investing development because recently.

For a lot more on customer financial resources, read: Unsettling stats about consumer health are missing the bigger picture

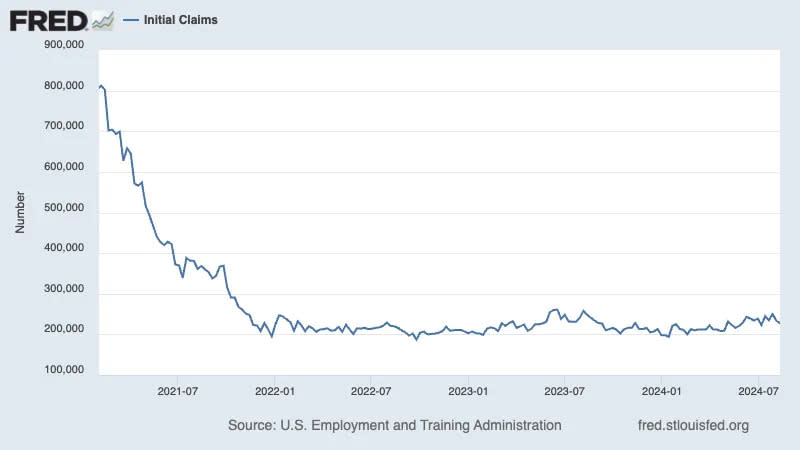

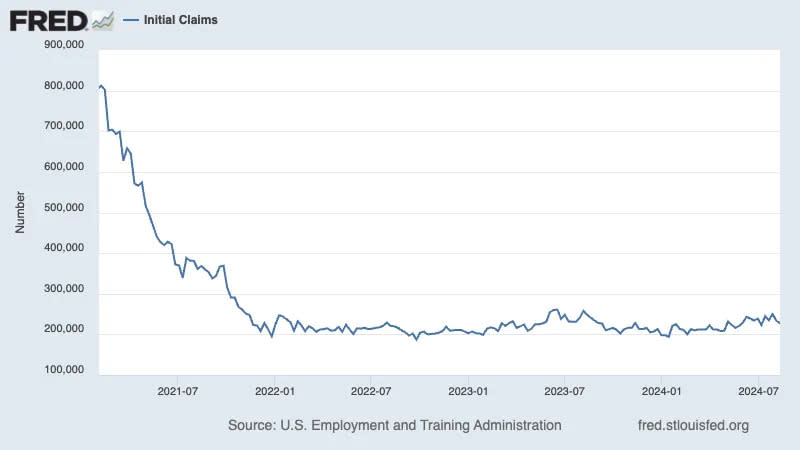

Joblessness asserts ticked reduced Initial claims for unemployment benefits decreased to 227,000 throughout the week finishing August 10, below 234,000 the week prior. While this statistics remains to trend at degrees traditionally connected with financial development, current prints have actually been trending greater.

For a lot more on the labor market, read: The labor market is cooling

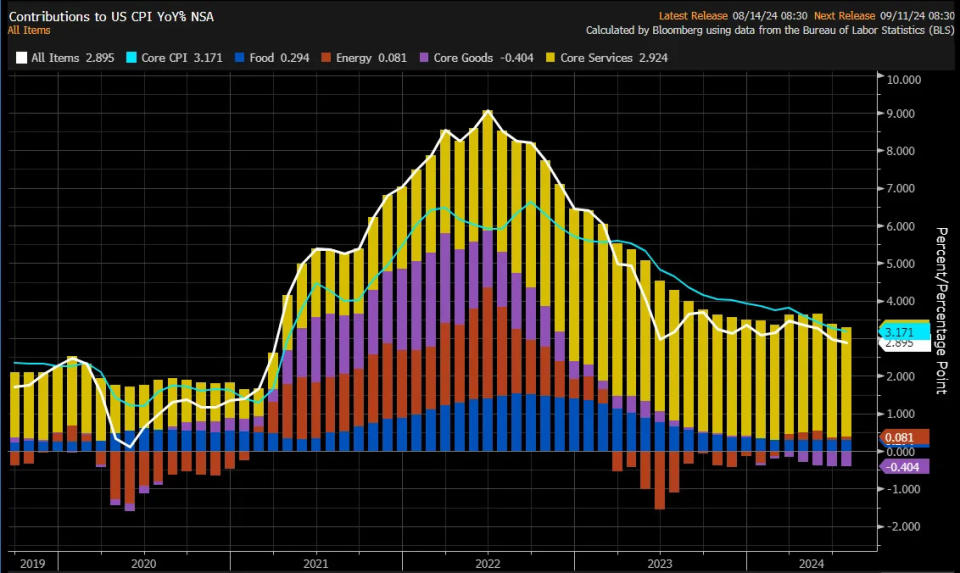

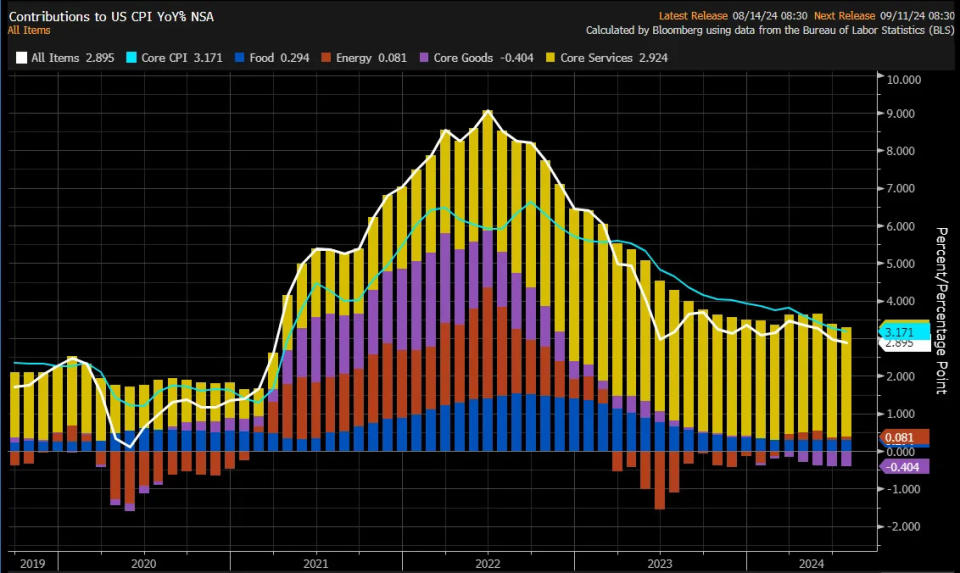

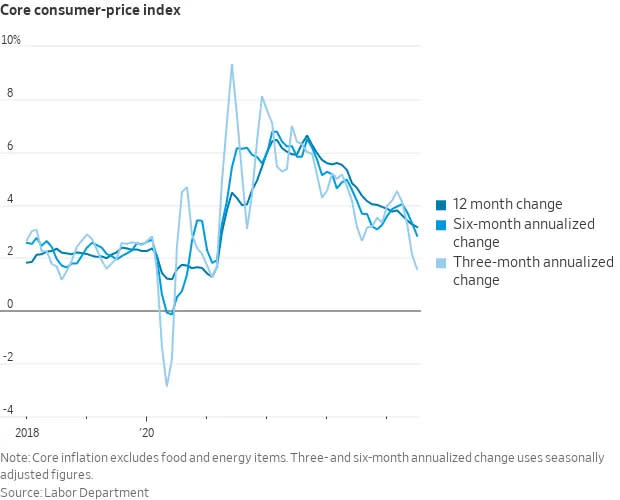

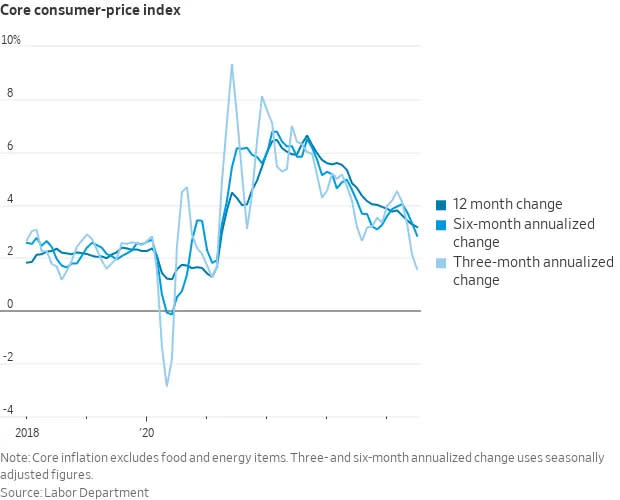

Rising cost of living cools down The Consumer Price Index (CPI) in July was up 2.9% from a year back, below the 3.0% price in June. This was the most affordable print because March 2021. Readjusted for food and power costs, core CPI was up 3.2%, below the 3.3% price in the previous month. This was the most affordable boost in core CPI because April 2021.

On a month-over-month basis, CPI increased simply 0.2%. Core CPI additionally boosted by 0.2%.

If you annualized the moving three-month and six-month numbers– a much better representation of the temporary fad in costs– the core CPI was up 1.6% and 2.8%, specifically.

Broad steps of rising cost of living are method below peak degrees in the summer season of 2022 and are currently trending near the Fed’s target price of 2%.

For even more, review: Inflation: Is the worst behind us?

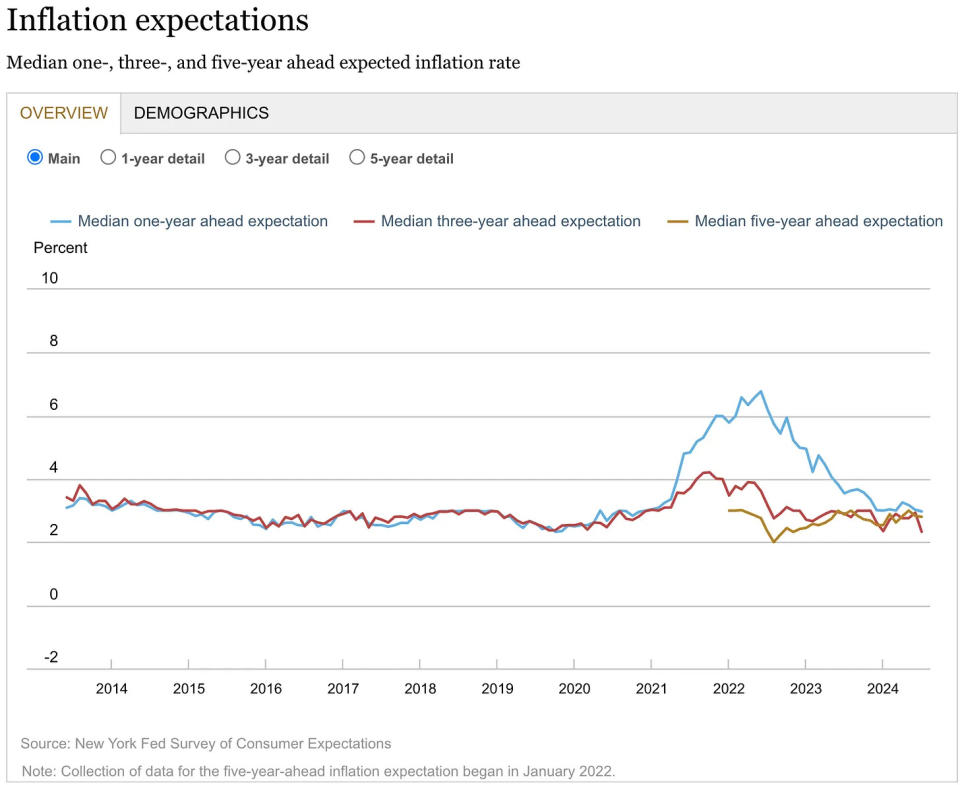

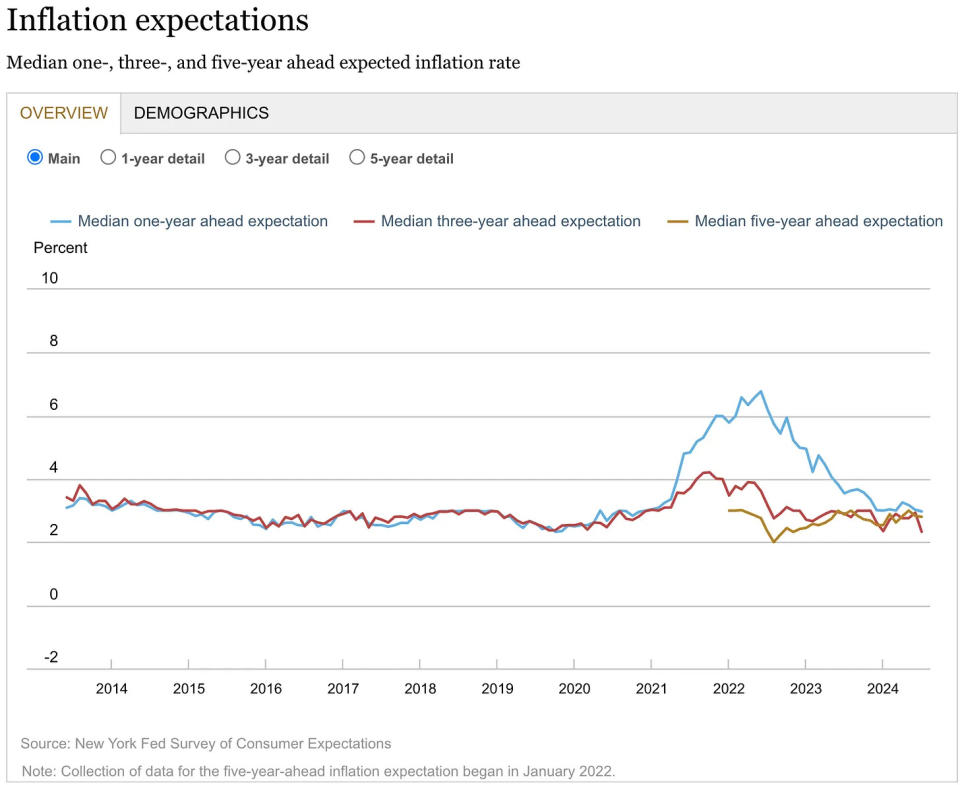

Rising cost of living assumptions continue to be great From the New york city Fed’s July Survey of Consumer Expectations: “Typical one- and five-year-ahead rising cost of living assumptions were the same in July at 3.0% and 2.8%, specifically. Alternatively, mean three-year-ahead rising cost of living assumptions decreased dramatically by 0.6 portion indicate 2.3%, striking a collection reduced because the study’s beginning in June 2013.”

For even more, review: The end of the inflation crisis

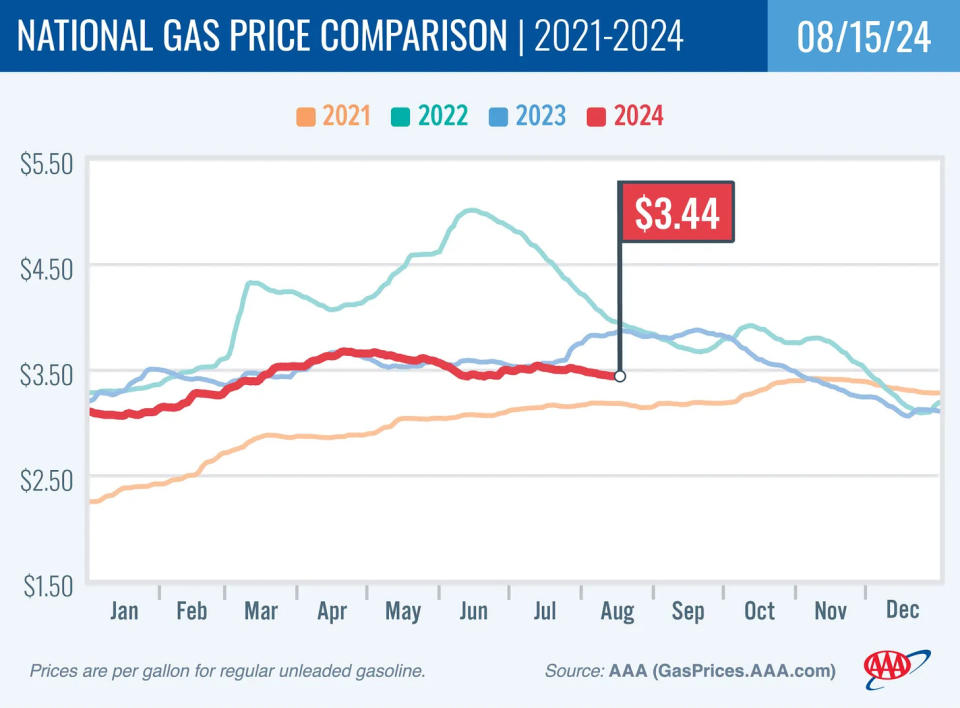

For a lot more on power costs, read: Higher oil prices meant something different in the past

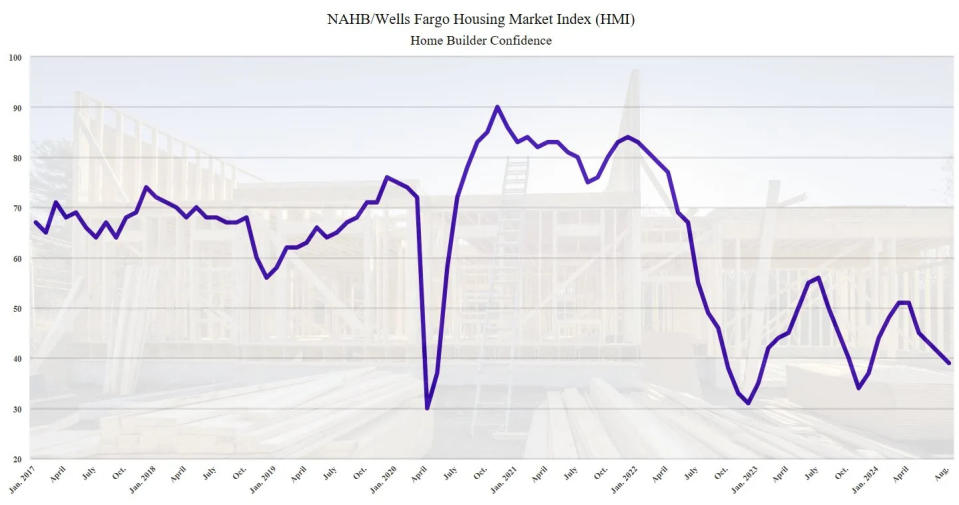

Homebuilder belief drops. From the NAHB’s Carl Harris: “Tough real estate cost problems continue to be the leading worry for possible home customers in the existing analysis of the HMI, as both existing sales and web traffic analyses revealed weak point. The only lasting method to efficiently tame high real estate prices is to carry out plans that permit building contractors to build even more possible, budget-friendly real estate.”

New home building and construction drops Real estate begins dropped 6.8%% in July to an annualized price of 1.2 million systems, according tothe Census Bureau Structure allows decreased 4% to an annualized price of 1.4 million systems.

For a lot more on real estate, read: The U.S. housing market has gone cold

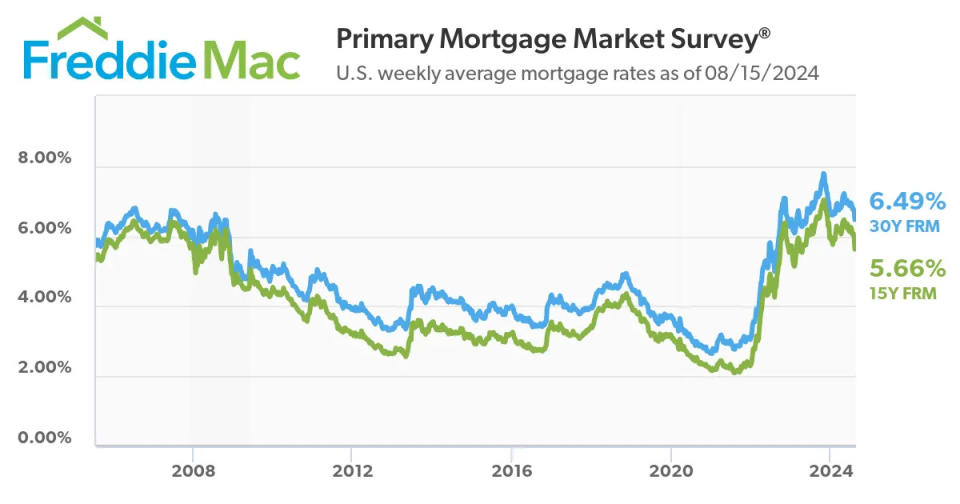

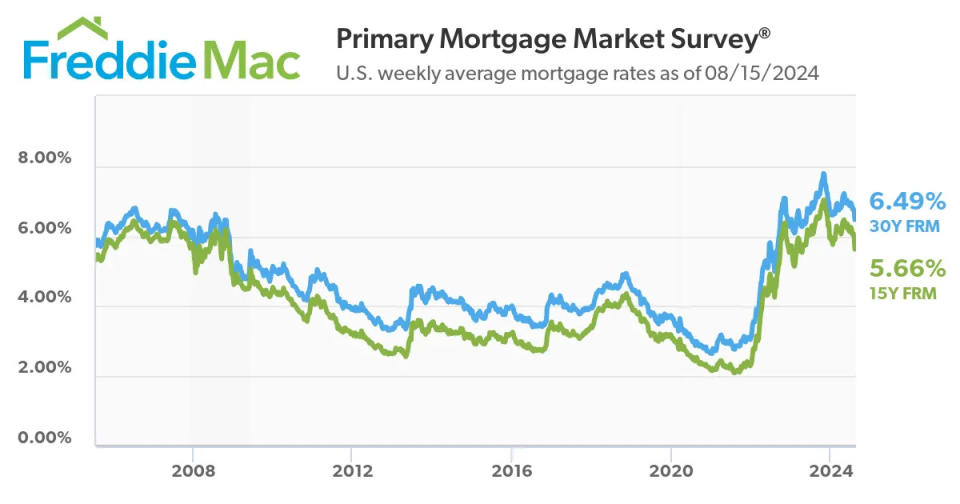

Home mortgage prices trend reduced According to Freddie Mac, the ordinary 30-year fixed-rate home mortgage goes to 6.49%. From Freddie Mac: “While prices boosted a little today, they continue to be over half a percent less than the very same time in 2015. In 2023, the 30-year fixed-rate home mortgage virtually struck 8%, pounding the brakes on the real estate market. Currently, the 30-year fixed-rate hovers around 6.5% and will likely trend down in the coming months as rising cost of living remains to reduce. Reduced prices are excellent information for prospective customers and vendors alike.”

There are 146 million housing units in the united state, of which 86 million are owner-occupied and 39% of which aremortgage-free Of those bring home mortgage financial obligation, mostly all have fixed-rate mortgages, and the majority of those home mortgages have rates that were locked in prior to prices rose from 2021 lows. Every one of this is to state: The majority of home owners are not specifically conscious activities in home costs or home mortgage prices.

For a lot more on home mortgages and home costs, read: Why home prices and rents are creating all sorts of confusion about inflation

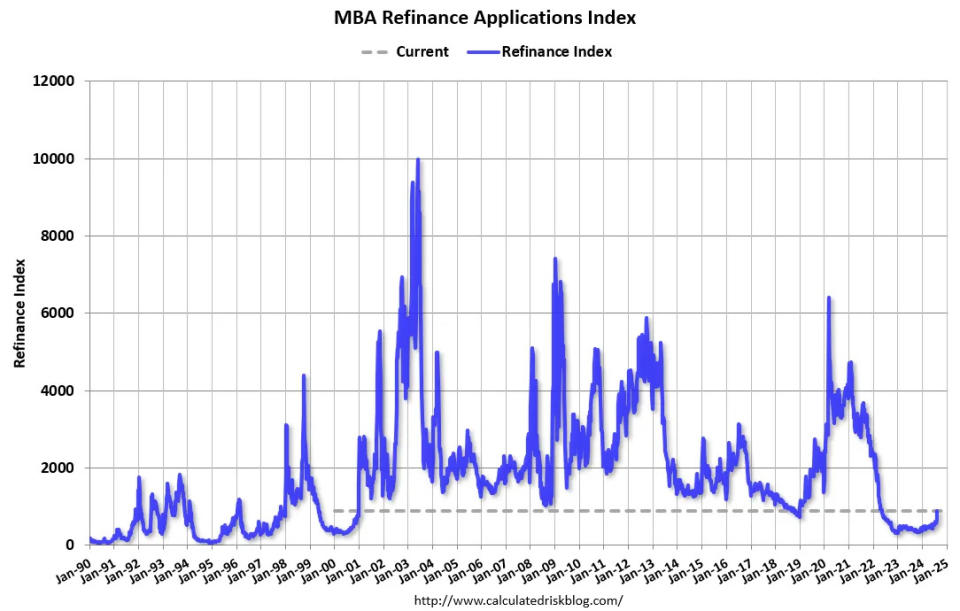

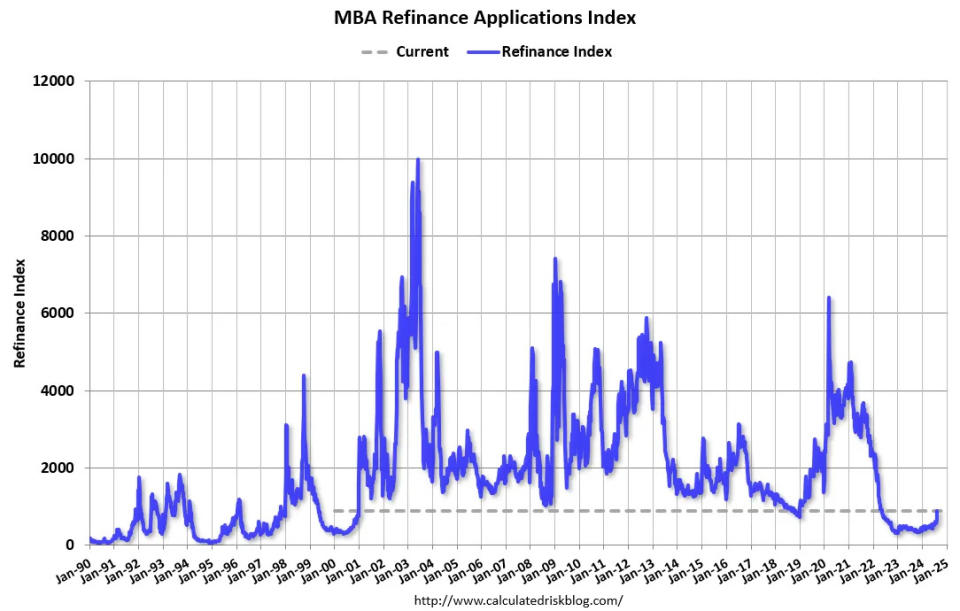

Weekly home mortgage applications climb From Mortgage Bankers Association’s Joel Kan: “General applications boosted virtually 17% to the highest degree because January 2023, driven by a 35% boost in re-finance applications. The re-finance index additionally saw its toughest week because Might 2022 and was 117% greater than a year back, driven by gains in standard, FHA, and VA applications. In addition, acquisition applications boosted by 3%, with tiny gains seen throughout the different lending kinds, showing that possible buyers are gradually reentering the marketplace.”

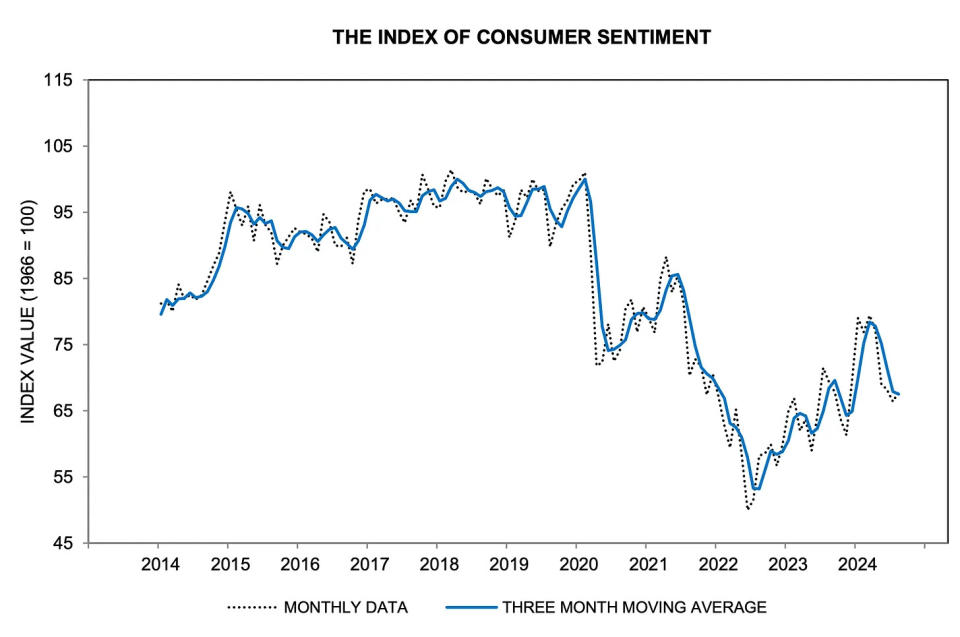

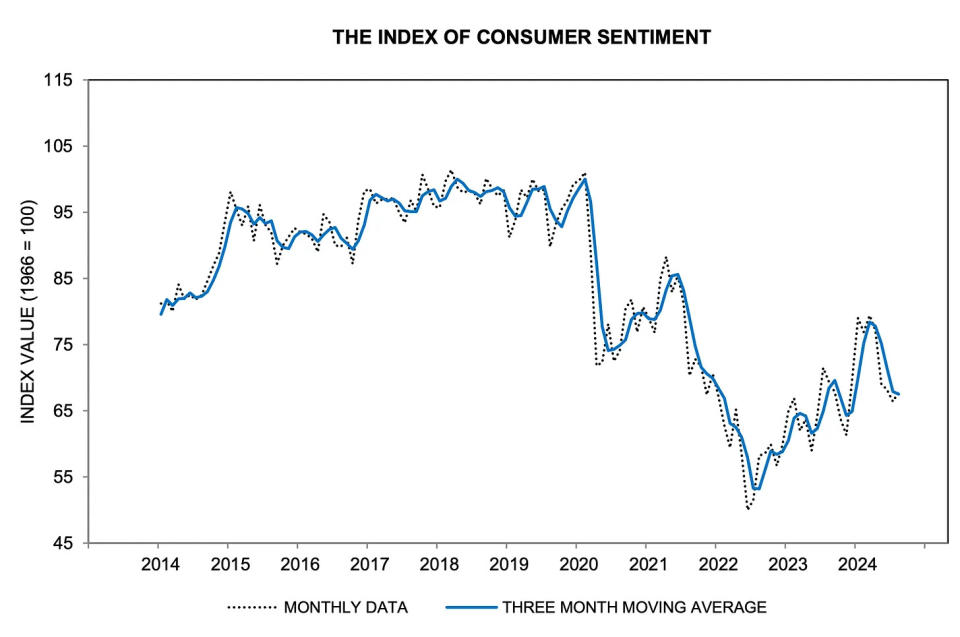

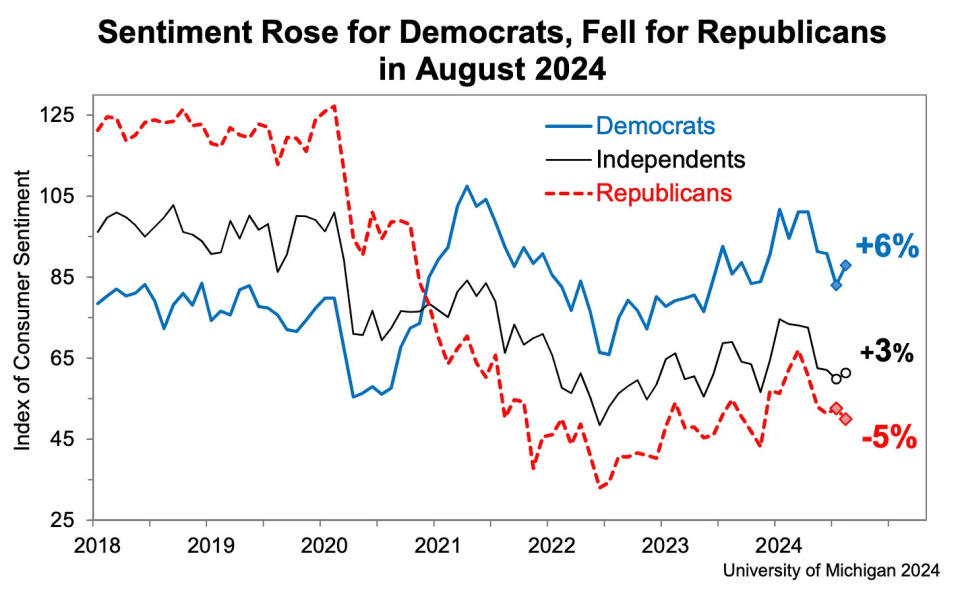

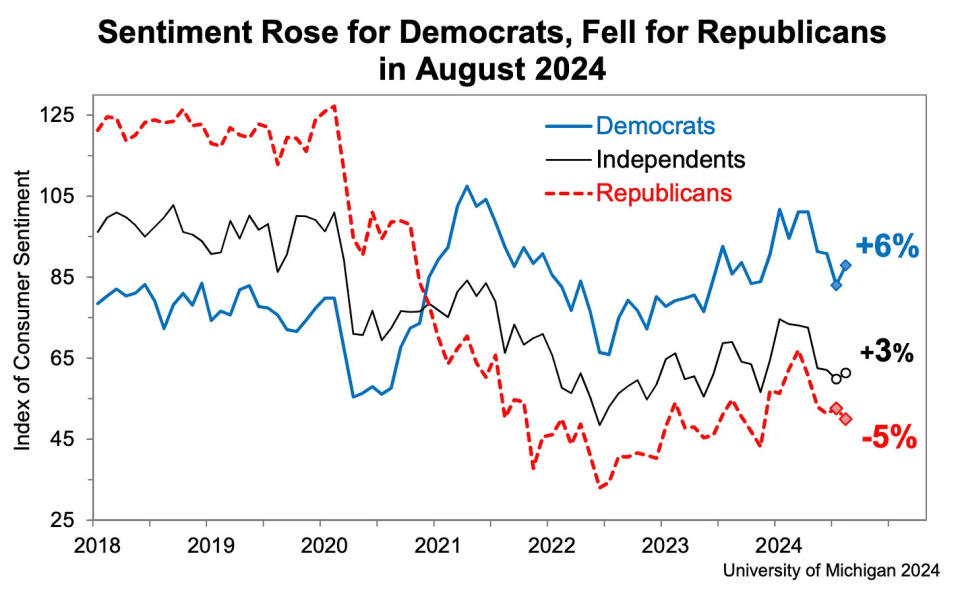

Customer belief ticks greater From the College of Michigan’s August Surveys of Consumers: “General, assumptions reinforced for both individual financial resources and the five-year financial expectation, which reached its greatest analysis in 4 months, constant with the truth that political election growths can affect future assumptions however are not likely to modify existing analyses. Study reactions usually integrate that, currently, customers anticipate the following head of state will certainly be. Some customers keep in mind that if their political election assumptions do not occur, their anticipated trajectory of the economic situation would certainly be completely various. Therefore, customer assumptions go through alter as the governmental project enters into higher emphasis, also as customers anticipate that inflation-still their leading concern-will proceed supporting.”

Extra from the study: “With political election growths controling headings this month, belief for Democrats climbed up 6% following Harris changing Biden as the Autonomous candidate for head of state. For Republicans, belief relocated the contrary instructions, dropping 5% this month. Belief of Independents, that continue to be in the center, increased 3%. The study reveals that 41% of customers think that Harris is the far better prospect for the economic situation, while 38% selected Trump.”

Weak customer belief analyses show up to oppose durable customer costs information. For a lot more on this opposition, read: What consumers do > what consumers say, We’re taking that vacation whether we like it or not, and Sentiment: Finally a vibe-spansion?

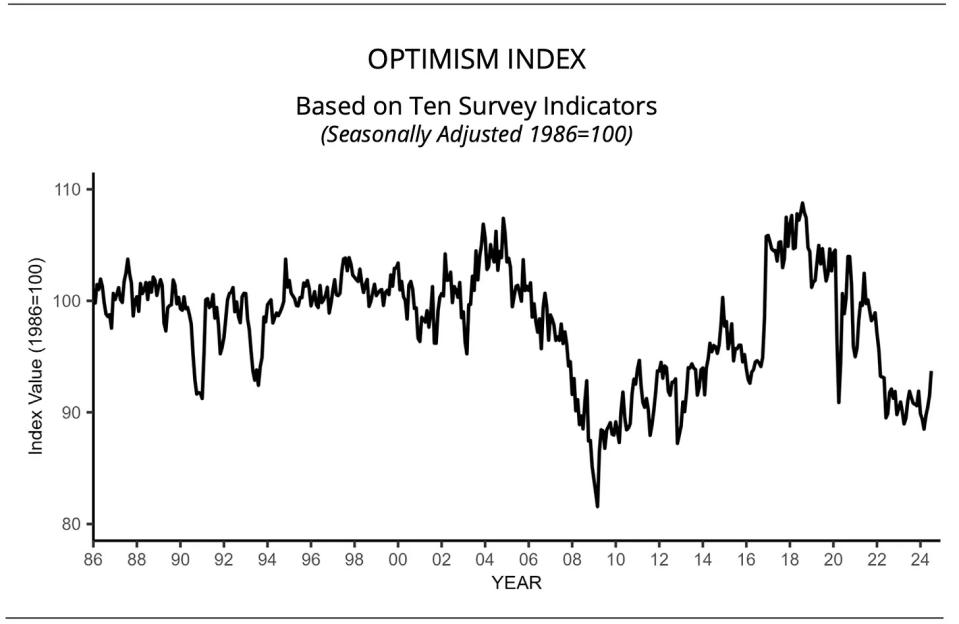

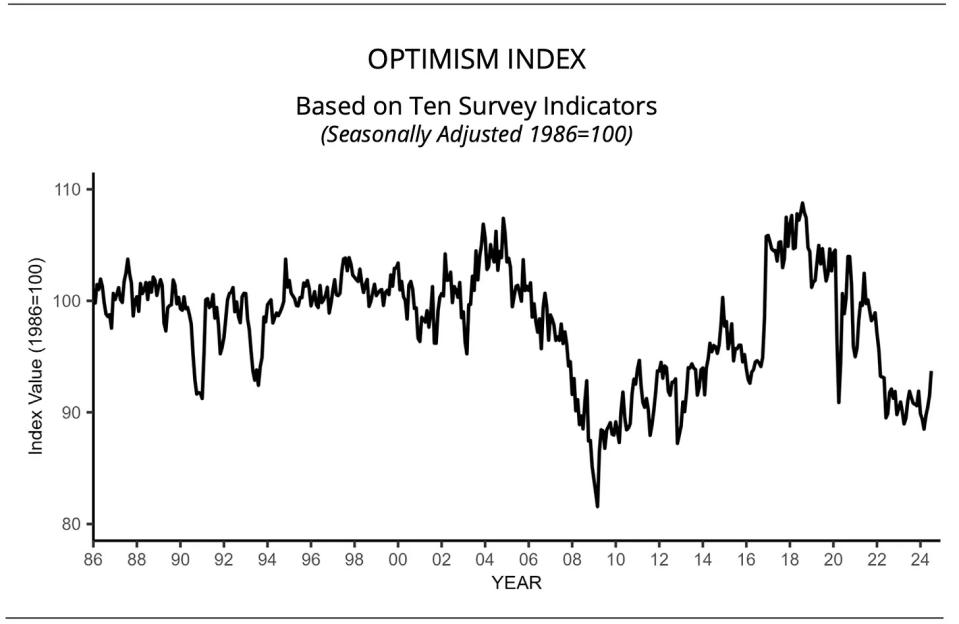

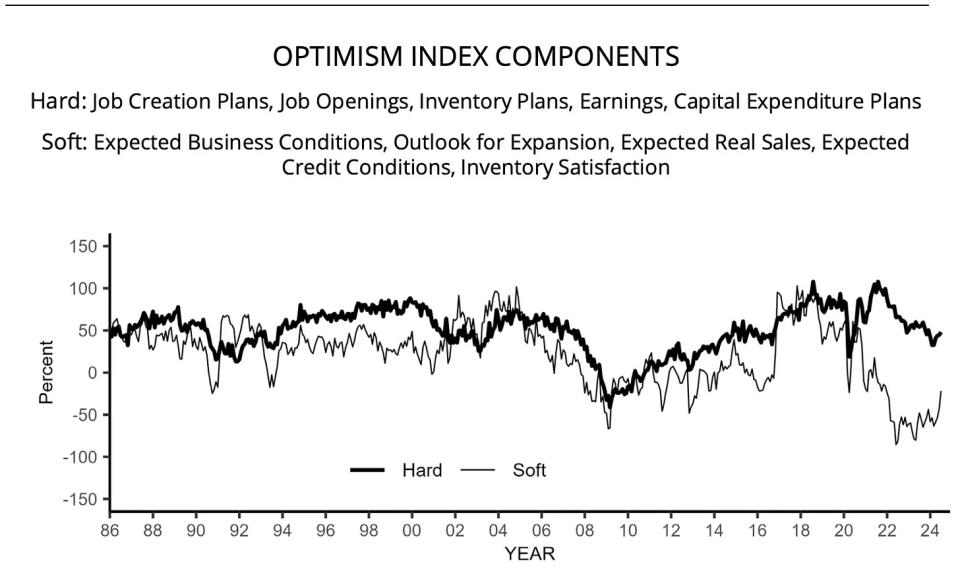

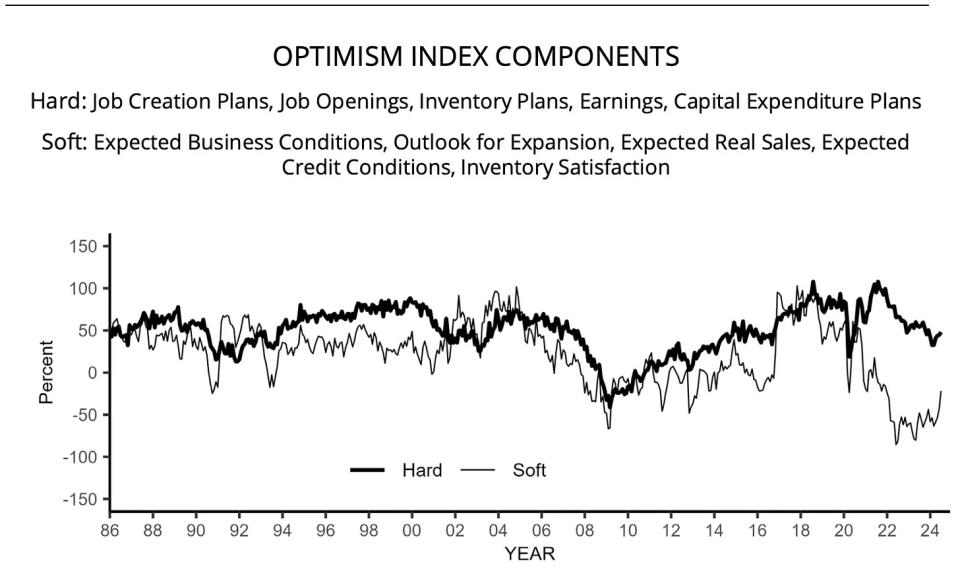

Small company positive outlook boosts The NFIB’s Small Business Optimism Index in July increased to the highest degree because February 2022.

Notably, the a lot more concrete “difficult” parts of the index remain to stand up far better than the a lot more sentiment-oriented “soft” parts.

Bear in mind that throughout times of regarded stress and anxiety, soft information has a tendency to be a lot more overstated than real difficult information.

For a lot more on this, review: What businesses do > what businesses say and Sentiment: Finally a vibe-spansion?

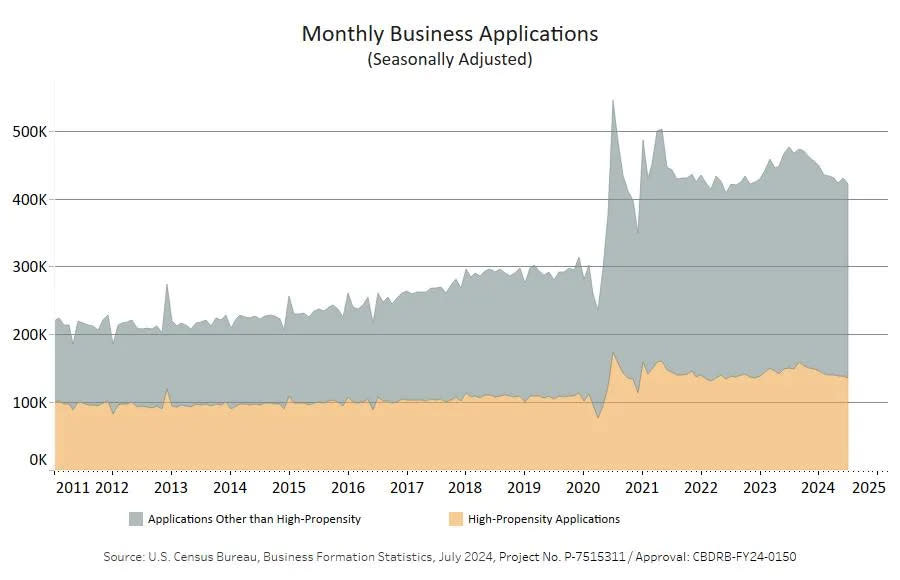

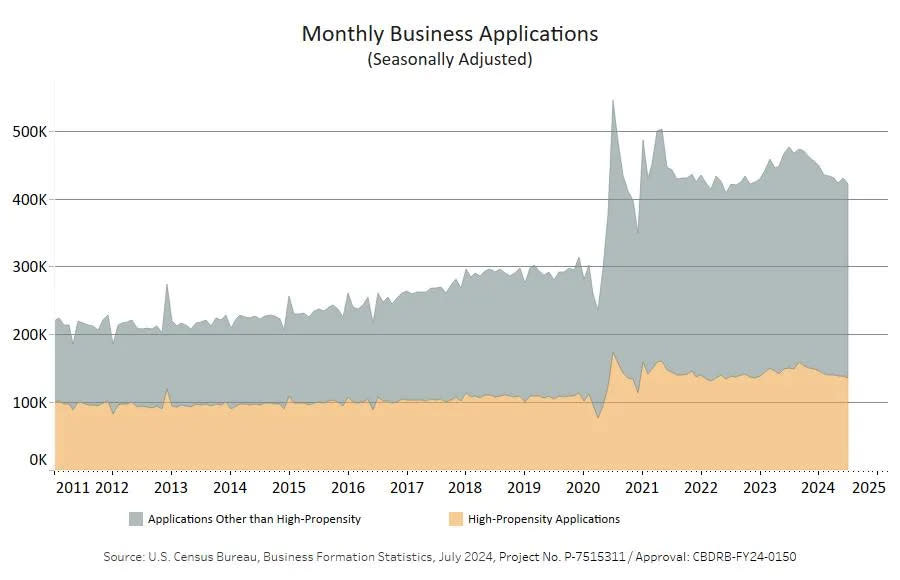

The business spirit lives Small company applications, while down a little from the previous month, continue to be well over prepandemic degrees. From the Census Bureau: “July 2024 Service Applications were 420,802, down 2.1% (seasonally changed) from June. Of those, 135,465 were High-Propensity Service Applications.”

For a lot more on what business development boom suggests, review: Promising signs for productivity

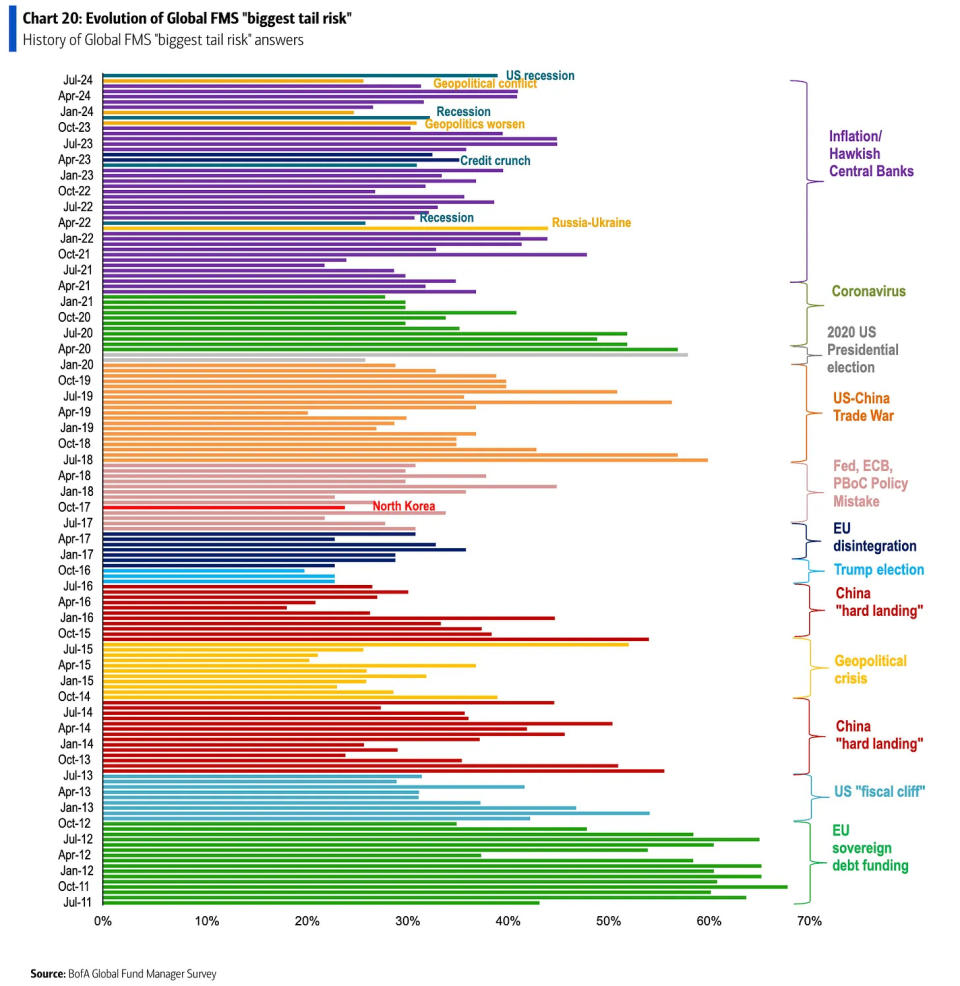

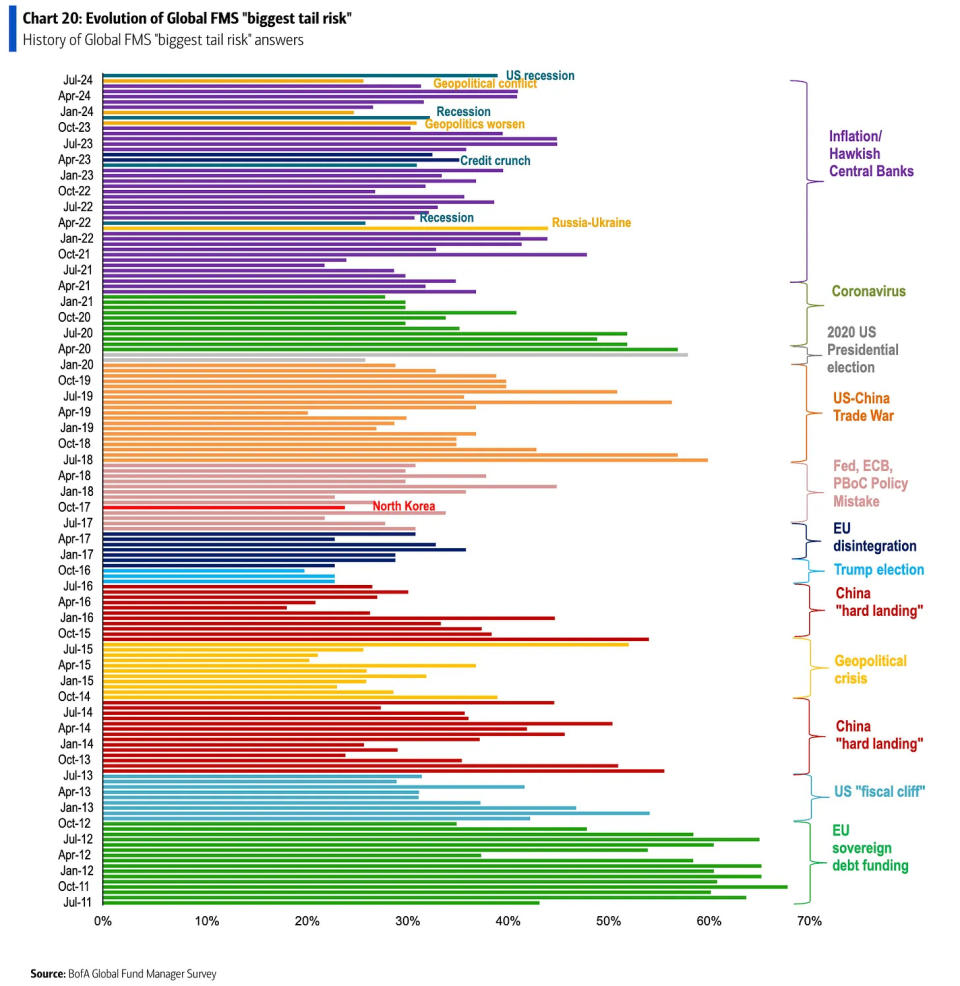

This is right stuff pros are fretted about According to BofA’s July Global Fund Supervisor Study, “united state economic downturn (39% up from 18% in July) has actually changed geopolitical dispute (25%) as the # 1 tail danger.”

The fact is we’re constantly fretted about something. That’s simply the nature of investing.

For a lot more on threats, read: Sorry, but uncertainty will always be high, Two times when uncertainty seemed low and confidence was high, and What keeps me up at night

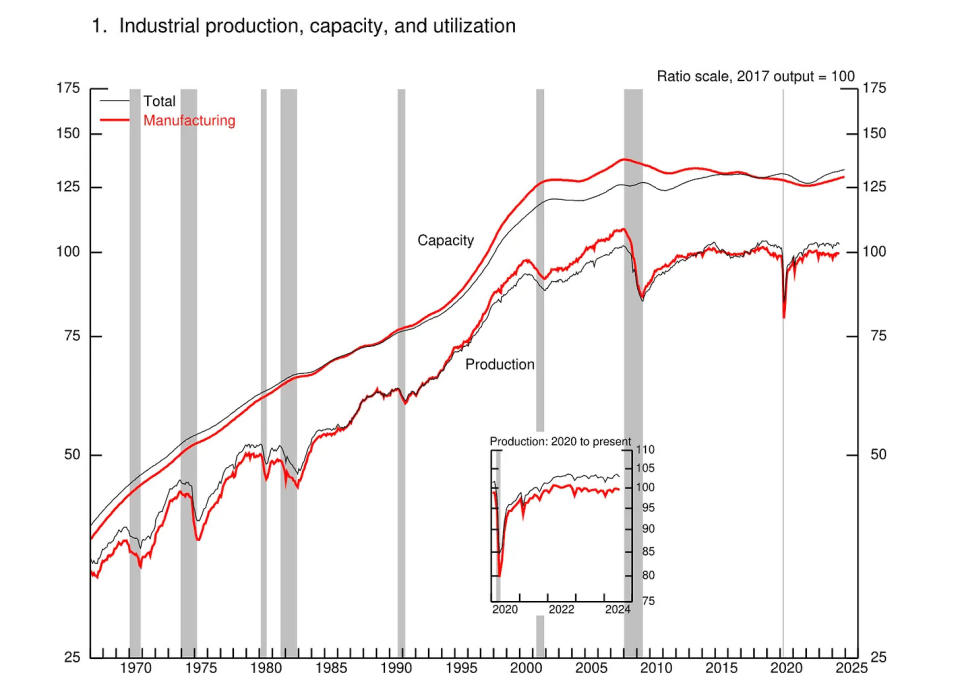

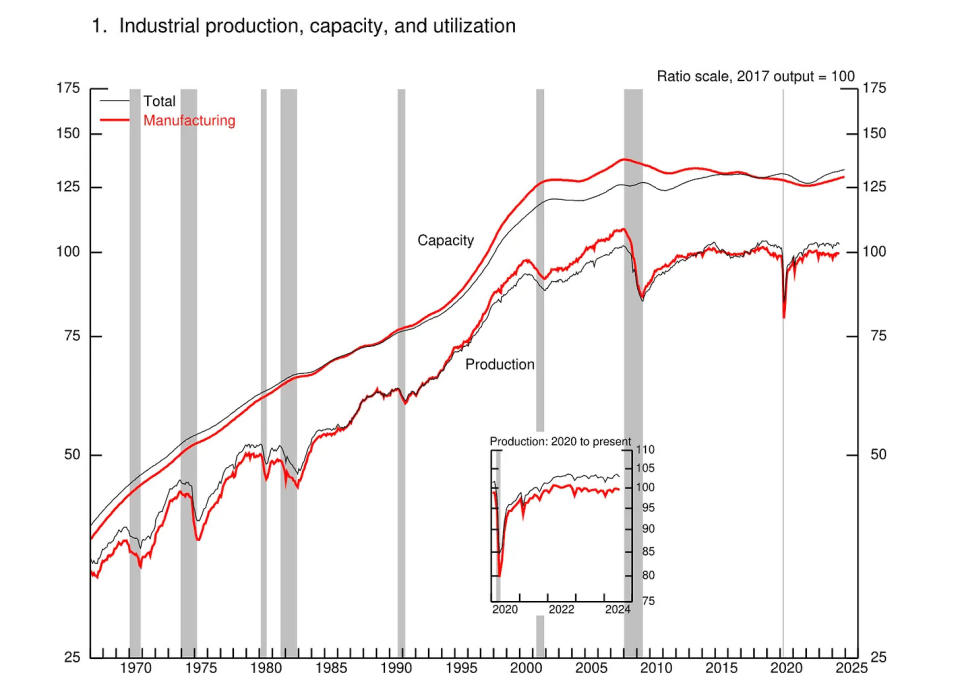

Commercial task ticks reduced. Industrial production activity in July dropped 0.6% from the previous month. Production result dropped 0.3%. From the Federal Book: “Very early July closures focused in the petrochemical and relevant sectors because of Storm Beryl held back the development of commercial manufacturing by an approximated 0.3 portion factor.”

For a lot more on task supporting as rising cost of living cools down, review: The bullish ‘goldilocks’ soft landing scenario that everyone wants

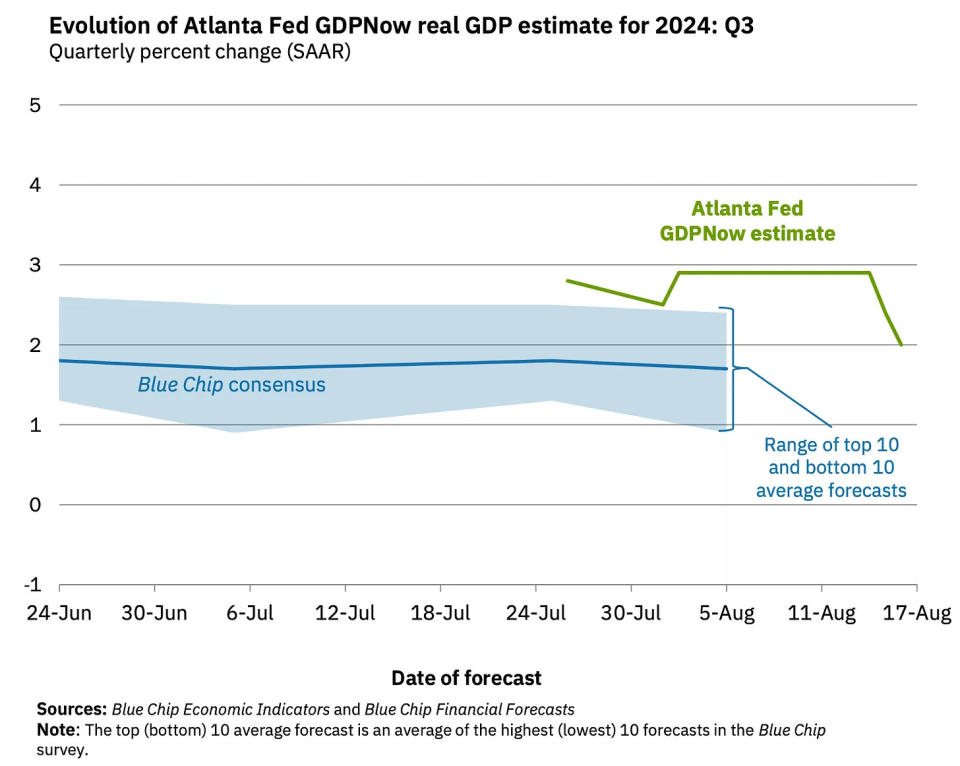

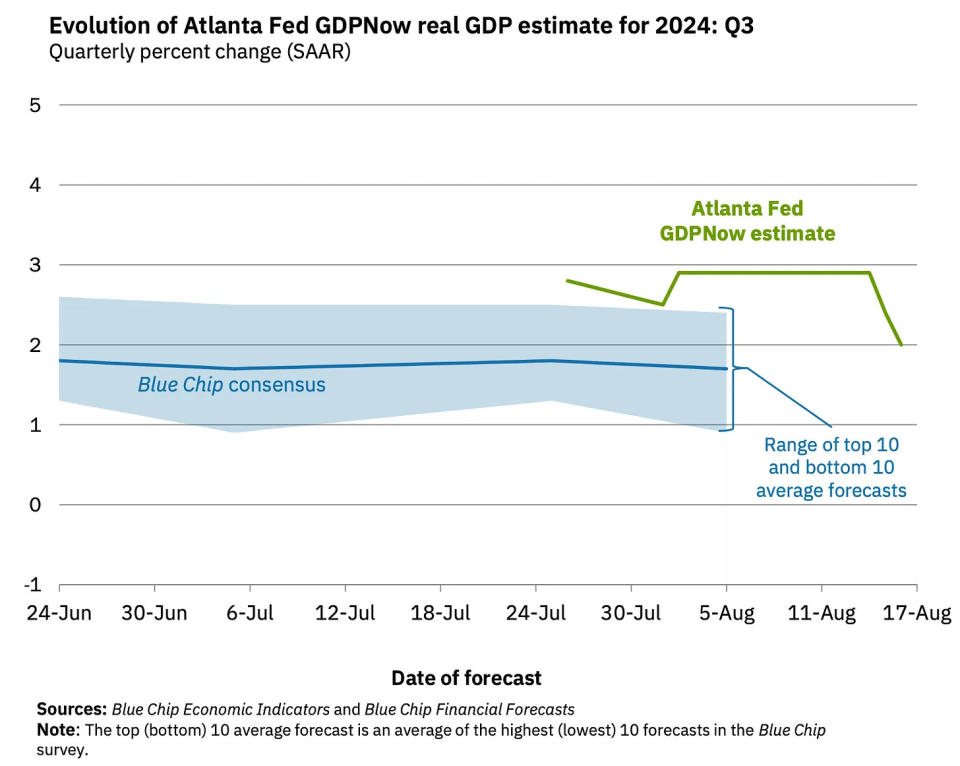

Near-term GDP development approximates continue to be favorable The Atlanta Fed’s GDPNow model sees actual GDP development climbing up at a 2.0% price in Q3.

Placing all of it with each other

We remain to obtain proof that we are experiencing a bullish “Goldilocks” soft landing scenario where rising cost of living cools down to convenient degrees without the economy having to sink into recession.

This comes as the Federal Book remains to use really limited financial plan in itsongoing effort to get inflation under control While it holds true that the Fed has actually taken a much less hawkish tone in 2023 and 2024 than in 2022, which a lot of financial experts concur that the last rate of interest walk of the cycle has actually taken place, rising cost of living still needs to stay cool for a little while prior to the reserve bank fits with rate security.

So we must expect the central bank to keep monetary policy tight, which suggests we must be gotten ready for reasonably limited monetary problems (e.g., greater rate of interest, tighter loaning requirements, and reduced supply appraisals) to stick around. All this suggests monetary policy will be unfriendly to markets for the time being, and the danger the economy slips right into an economic downturn will certainly be reasonably raised.

At the very same time, we additionally recognize that supplies are marking down devices– suggesting that prices will have bottomed before the Fed signals a major dovish turn in monetary policy.

Additionally, it is very important to bear in mind that while economic downturn threats might rise,consumers are coming from a very strong financial position Unemployed individuals are getting jobs, and those with work are obtaining increases.

In A Similar Way, business finances are healthy as lots of companieslocked in low interest rates on their debt in recent years Also as the risk of greater financial obligation maintenance prices impends, elevated profit margins offer companies area to take in greater prices.

At this moment, any type of downturn is unlikely to turn into economic calamity considered that the financial health of consumers and businesses remains very strong.

And as constantly, long-term investors must keep in mind that recessions and bear markets are simply part of the deal when you get in the securities market with the objective of creating lasting returns. While markets have recently had some bumpy years, the long-run expectation for supplies remains positive.

For a lot more on just how the macro tale is progressing, take a look at the the previous TKer macro crosscurrents »

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.