Tesla’s (TSLA) court battle to bring back Elon Musk’s pay postures an uncertain concern that could reprise the policies of business legislation: Can shareholders ever before void a court?

The electrical lorry manufacturer claims the solution is indeed.

The business is asking the exact same Delaware company court judge that invalidated Musk’s $56 billion chief executive officer payment deal in January to throw out her choice and change it with the will of the business’s shareholders, that accepted the pay a 2nd time in June.

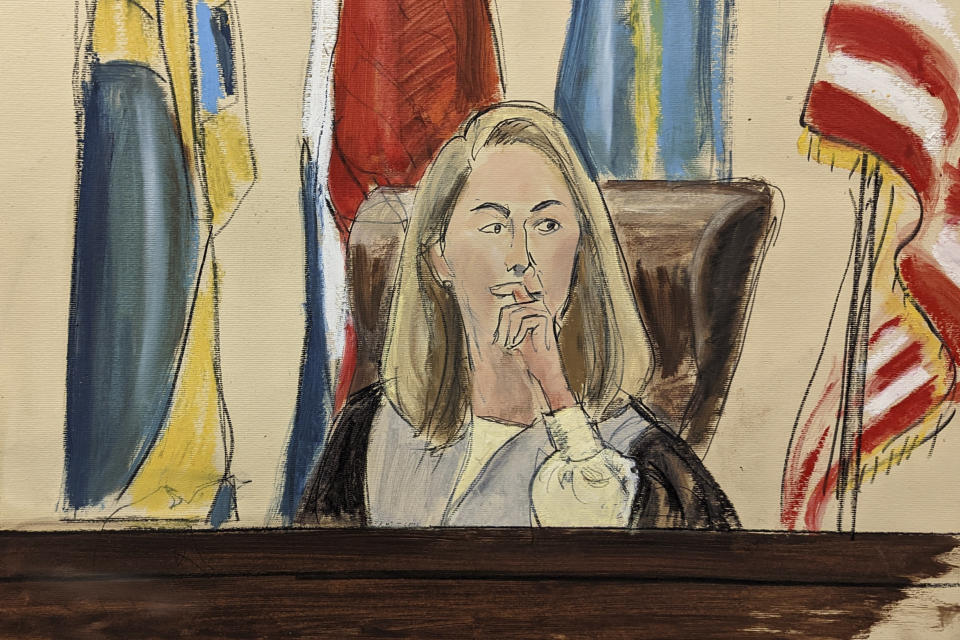

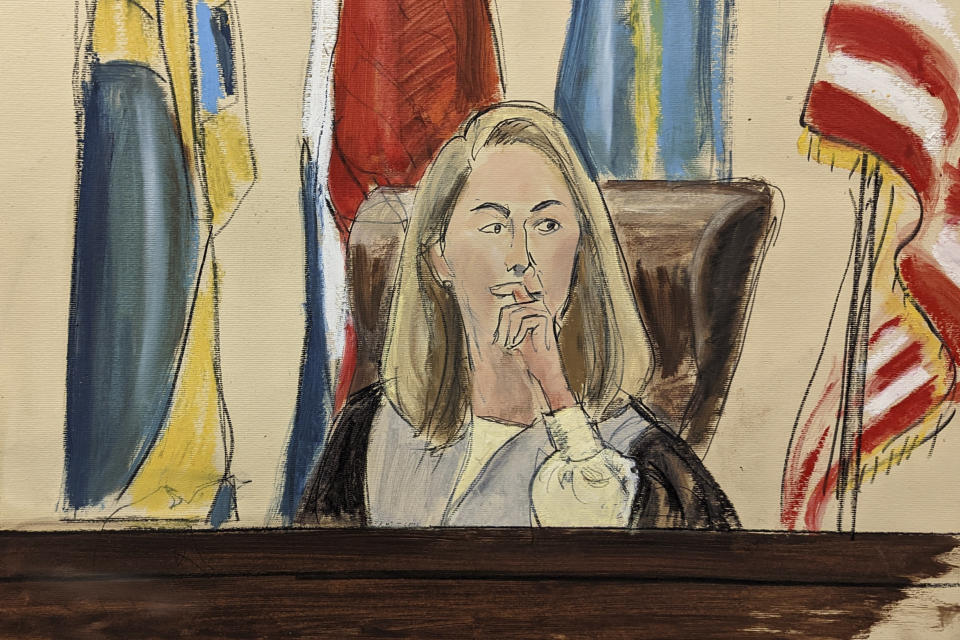

” This has actually never ever been done in the past,” the court, Chancellor Kathaleen McCormick of the Delaware Court of Chancery, claimed at a hearing previously this month.

Tesla’s attorney concurred, however suggested the brand-new investor choice need to hold last guide.

” This was investor freedom working,” he claimed.

Business legislation lawyers anticipate that pitch will not suffice to alter Chancellor McCormick’s choice.

They claim the concern at the heart of the instance can continue on allure as for the United States High Court.

A ‘cleaning’

Tesla’s disagreement is that investors, not courts, need to make a decision business deals. Or else, the broader company globe will certainly despair that they can rely upon the contracts they get to with their shareholders.

And as a basic policy, Delaware courts take investor ballots very seriously, making them likely to accept the result of those tallies.

” I do not see just how Delaware legislation can inform proprietors of a firm that they can not” established chief executive officer pay, Rudolf Koch, a legal representative for Tesla’s board, claimed throughout the August hearing prior to Chancellor McCormick.

However what can flounder Tesla is that it might have missed out on some actions that can have made the investors’ claim moot.

Lawful specialists indicate a collection of instances in the state’s company court called the M&FW line of instances that display the course Tesla can have taken– however really did not.

The choices in those instances held that also when a company purchase entailed a conflicted managing investor– as a court ruled held true with Musk and Tesla– it was feasible for a firm to “clean” the purchase with the ideal sort of investor ballot.

However right here’s the prospective trouble: Situation legislation advises that Musk has to have satisfied the cleaning problems prior to he participated in substantive arrangements with Tesla over his pay bargain and conditioned the bargain on investor authorization, according to New york city College legislation college teacher Marcel Kahan.

That will certainly be challenging for Musk to verify. No brand-new arrangements show up to have actually occurred prior to Tesla re-submitted Musk’s pay bargain to shareholders in June.

And still there’s one more trouble: Also if Court McCormick discovers Tesla’s 2nd ballot “washed” Musk’s pay bargain, she might locate Tesla just waited also lengthy prior to holding its remodel ballot.

Delaware’s Chancery Court takes timeliness and reasonableness of business activities right into account, business legislation lawyers claimed, and might not endure that Tesla waited till after the court had actually ruled versus it to look for brand-new investor authorization.

Regardless of the result, Tesla can appeal a loss to Delaware’s High court. Those courts, according to Kahan, can rule that Musk was not a managing investor and the need to problem the pay bargain on investor authorization does not use.

Lots of business, he included, do not need to bother with just how this instance ends up since a lot of abide by excellent administration plans that secure them from a court ruin their deals.

” So if I’m [JPMorgan CEO] Jamie Dimon, and I check out [McCormick’s] point of view, I am not fretted that my payment plan is mosting likely to go to threat.”

Alexis Keenan is a lawful press reporter for Yahoo Money. Comply With Alexis on X @alexiskweed.

Go here for comprehensive evaluation of the most recent securities market information and occasions relocating supply costs

Check out the most recent economic and company information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.