( Bloomberg)– Britain’s economic situation is taking pleasure in a “Goldilocks minute” with reducing rising cost of living, climbing work and healthy and balanced development that’s most likely to establish the phase for a much more comfy background both for the Financial institution of England and Keir Starmer’s federal government.

The Majority Of Check Out from Bloomberg

A solid efficiency in the 2nd quarter implied the UK took pleasure in the very best development in the Team of 7 countries in the very first fifty percent of 2024, overtaking the United States and well in advance of various other European nations. Authorities information today likewise revealed that employees were worked with at the quickest speed because November, minimizing the out of work price, while rising cost of living increased much less than anticipated.

The numbers leave the UK threading a slim course, with the economic situation running simply warm sufficient to place in 2015’s economic crisis even more in the rear-view mirror while great sufficient to enable the BOE to wage reducing rate of interest later on this year. The danger is that restrictions on the dimension of the labor force and performance bear down a recuperation that organization teams alert stays rather vulnerable.

” The financial information launched today represented a rather Goldilocks situation for the UK,” stated Ellie Henderson, UK financial expert at Investec.

For Dan Hanson at Bloomberg Business Economics, the “pleasant place” the UK is taking pleasure in currently might transform “difficult” in the longer keep up a stagnation in the 3rd quarter and past.

Starmer promised to “take the brakes off Britain” after his win in the July 4 political election, taking very early actions to change preparation guidelines that stand up building and construction and obtain individuals back right into tasks after lots of employees quit of the labor market because the pandemic.

BOE Guv Andrew Bailey and his coworkers are really familiar with those constraints and enjoying thoroughly for indicators that rising cost of living will certainly remain. Capitalists presently anticipate just one or 2 even more rate of interest cuts this year after an Aug. 1 choice convenience from a 16-year high.

Yet today’s information held great information, development that had actually avoided the UK over the last few years without promptly causing rising cost of living:

-

After recoiling from economic crisis with development of 0.7% in the very first quarter, information today revealed GDP increased 0.6% in the 2nd quarter, “one more gangbusters” collection of numbers, according to Yael Selfin, primary financial expert at KPMG UK.

-

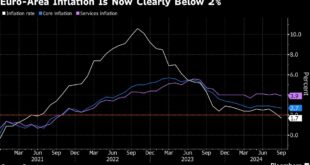

Rising cost of living was available in listed below assumptions on Wednesday, bordering up a little to 2.2% in July. Provider rising cost of living– an essential scale of residential stress for the BOE– dropped dramatically to 5.2%, the most affordable in over 2 years.

-

Jobs information for the 3 months to June revealed the most significant hiring surge because November, also as routine wage development cooled down to a close to two-year low of 5.4%.

-

Retail sales recoiled in July, turning around several of the depression in June, with summertime discount rates and the Euros football competition training investing.

The development expectation on the other hand gets on track for a “perfect” temperature level that Goldilocks appreciated in the traditional English fairytale.

Forecasters checked by Bloomberg anticipate a 0.3% growth in each quarter from right here on via completion of 2025. The economic experts forecast development of 1% this year, increasing to 1.3% in 2025 and 1.5% in 2026. The Workplace for Spending plan Obligation anticipates also far better development of around 2% in the following and list below year.

That makes a lot more probable Starmer’s objective of the greatest continual development amongst the G-7 countries and his soaring passion for a 2.5% increase in GDP annually. He and Chancellor of the Exchequer Rachel Reeves are looking for to obtain the economic situation expanding at the much healthier prices seen prior to the monetary situation, aiding to create even more cash to pump right into having a hard time civil services.

” We assume the UK economic situation has currently securely left the torpidity stage of the last 4 years and will certainly remain to expand sturdily over the remainder of 2024, and right into 2025 as actual revenues climb, customer and organization self-confidence enhances and rate of interest drop even more,” stated Thomas Pugh, UK financial expert at RSM UK.

He stated the economic situation had a “Goldilocks minute” in the 2nd quarter where development was solid however not as well warm to cause rate stress, though he warned that the numbers were assisted dramatically by base results.

” The danger is that if development proceeds at this speed for the remainder of the year we wind up dipping right into the as well warm dish,” stated Pugh.

The BOE is hesitant the present speed of development can last, keeping in mind that organization studies recommended that the underlying speed of the economic situation was weak than the GDP numbers suggest.

” The larger photo right here is it does seem like several of the current energy in GDP development is alleviating,” stated Ashley Webb, UK financial expert at Funding Business economics.

” Looking under the surface area wets the goldilocks situation a little bit,” he stated, indicating weak hidden GDP development and loud solutions rising cost of living information.

However the BOE has actually flagged the risk of even more durable development on its battle to consist of rising cost of living.

Unless the UK economic situation is going through a basic upgrade in its longer run fad development price, main forecasters think it can just increase at a pedestrian speed prior to facing rate stress.

This year’s rapid development really did not cause rising cost of living as it was mainly a catch up impact after in 2015’s economic crisis produced a lot more extra capability in the economic situation. Nevertheless, as soon as that catch-up is total, the UK will just have the ability to increase at its longer-term fad development price prior to stiring rate stress. Pressing versus that restraint might compel the BOE to lower rate of interest a lot more carefully to quit the danger of rising cost of living.

Bloomberg Business economics approximates that the UK’s fad development– the speed it can increase without producing excess rising cost of living– is around 0.3% per quarter, half the price seen in the 2nd quarter.

” The opportunity that development proceeds at its present speed right into the 2nd fifty percent of the year is among the major factors we assume the reserve bank will certainly beware regarding just how promptly it will certainly alleviate in coming months,” Hanson stated.

While economic experts are hesitant on the current surge lasting, Starmer’s federal government is pressing through a strike of plans to aid change the UK’s fad development price.

Sonali Punhani, UK Economic Expert at Financial Institution of America, stated Work’s success implies development might proceed at a faster than anticipated rate– and not simply in the temporary.

” Enthusiastic plans on financial investment and supply side reforms by the federal government if they appear might cause a review of the UK as a nation with greater medium-term development,” Punhani stated.

— With aid from Andrew Atkinson.

The Majority Of Check Out from Bloomberg Businessweek

© 2024 Bloomberg L.P.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.