While Bitcoin battles listed below $60,000, a Bybit record shown BeInCrypto recommends that the BTC rally could still have energy. The record marks bull runs retrospectively and anticipates the prospective extension of Bitcoin’s rate increase.

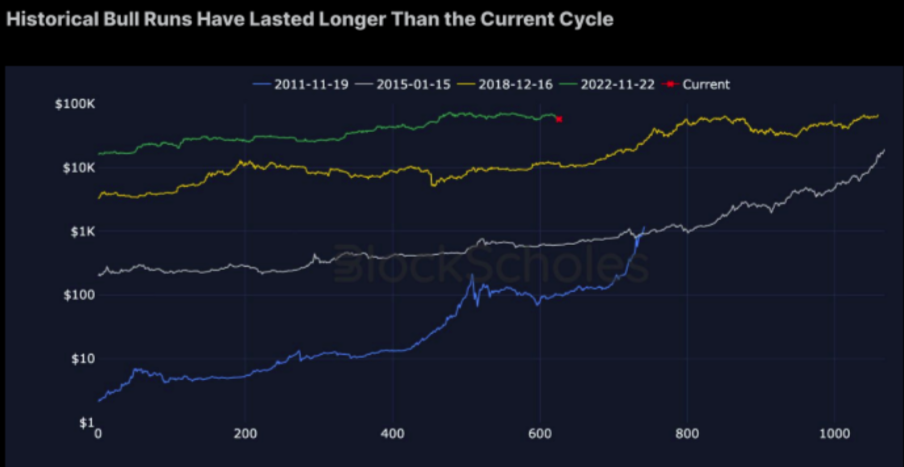

Bybit’s evaluation splits Bitcoin’s historic efficiency right into distinctive cycles, imagined on a logarithmic range to make clear lasting patterns. According to its requirements, a bull run covers from the most affordable trough to the highest possible optimal of each cycle.

The 2024 Bitcoin Bull Cycle Still Has Space For Development

Especially, 3 significant favorable stages have actually been determined: 2012-2014, 2015-2018, and 2019-2022. The present bull cycle started in late 2022 and is continuous.

This cycle began when Bitcoin recoiled from the post-FTX low of $15,800 in November 2022. To day, BTC has actually noted 624 days in this bull run, getting to a height of $73,000 in March 2024, standing for over a fourfold boost from its trough.

Although exceptional, this gain is small contrasted to the 20x boost in the previous 2019-2022 cycle. Nevertheless, the ordinary period of previous cycles– 956 days– recommends there can be about 350 days left for prospective development.

Find Out More: Bitcoin Halving Cycles and Financial Investment Methods: What To Know

Nevertheless, there is problem over the reducing returns from each succeeding bull run, which saw returns reduce from a remarkable 553x in the very first cycle to 20x in the 3rd. This pattern triggers concerns regarding the future of rapid gains in Bitcoin’s worth.

Nevertheless, a record from Glassnode shows that Bitcoin whales continue to be fully commited to holding their possessions. The Buildup Pattern Rating (ATS), which analyzes heavy equilibrium modifications throughout the marketplace, just recently accomplished its optimum worth of 1.0. As a result, this shows a change in the direction of primary build-up actions amongst financiers.

In addition, lasting owners (LTH) have actually significantly moved their technique from marketing near tops to keeping their financial investments. Over the previous 3 months, this team has actually enhanced its holdings by greater than 374,000 BTC. This change has actually brought about a stablizing and also development in the percent of network wide range managed by LTHs.

Find Out More: That Has one of the most Bitcoin in 2024?

In spite of the considerable stress to offer from these lasting financiers at the marketplace’s optimal, the quantity of wide range they maintain is traditionally high. This monitoring highlights their strength and mean the capacity for more rate recognition if market problems boost.

Furthermore, in a meeting with BeInCrypto, Juan Pellicer, Elder Scientist at IntoTheBlock, disclosed that institutional financiers are extremely thinking about gathering Bitcoin.

” If organizations see Bitcoin as a bush versus rising cost of living or as component of their diversity technique, their acquiring stress can balance out any type of sell-offs and also strengthen the self-confidence of lasting owners,” Pellicer informed BeInCrypto.

Please Note

According to the Trust fund Job standards, this rate evaluation post is for educational objectives just and need to not be taken into consideration economic or financial investment recommendations. BeInCrypto is devoted to precise, honest coverage, however market problems go through transform without notification. Constantly perform your very own research study and talk to a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.