The XRP rate encounters noteworthy down stress as even more financiers pick to squander their revenues. Presently trading at $0.56, the token has actually gone down virtually 10% over the previous week.

The success of current day-to-day deals has actually triggered several XRP owners to market, adding to the continuous decrease.

Surge Investors Secure Their Gains

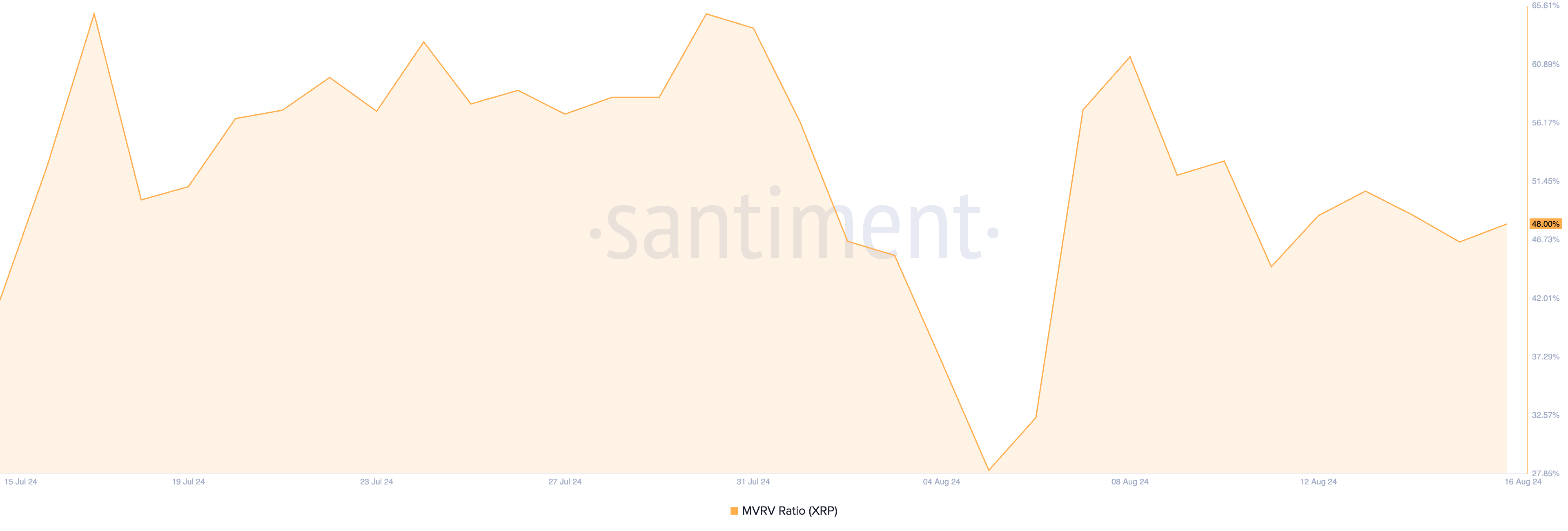

Analyses from XRP’s market price to understood worth (MVRV) proportion reveal that the altcoin is presently miscalculated. Since this writing, the token’s MVRV proportion is 48%.

The MVRV proportion determines the distinction in between a possession’s present market value and the ordinary purchase expense of its flowing supply. A worth over one suggests the property trades more than its ordinary acquisition rate, frequently leading owners to cost revenue when it’s considered miscalculated.

With XRP’s MVRV proportion at 48%, a big part of owners remain in revenue, driving the present wave of token circulation.

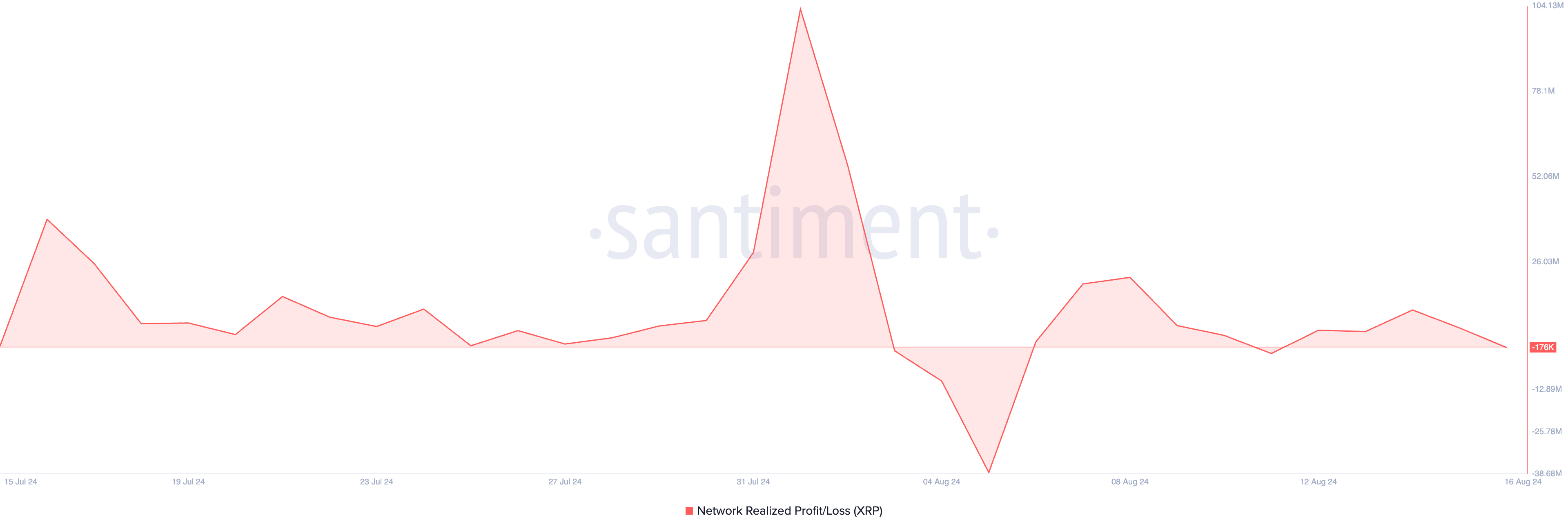

In Addition, given that the beginning of the month, XRP’s Network Understood Profit/Loss (NPL) statistics has actually constantly revealed favorable worths, verifying that the majority of XRP investors are offering their holdings at a revenue.

Find Out More: Just How To Acquire XRP and Every Little Thing You Required To Know

tracks the general revenue or loss understood by investors or owners within a particular timespan. Favorable NPL worths suggest that, generally, investors are shutting their placements with gains, while adverse worths recommend losses.

It’s widely known that a spike in profit-taking task develops down stress on a possession’s rate. When market orders rise without a coordinating boost in buy orders, a supply-demand inequality takes place, bring about a rate decrease.

XRP Cost Forecast: Liquidity Departure Equates To Dropping Rates

The liquidity leave from the XRP market is shown in its adverse Chaikin Cash Circulation (CMF). Since this writing, the sign relaxes listed below the absolutely no line and has actually been so located given that August 11.

A property’s CMF actions just how cash streams right into and out of its market. An unfavorable CMF suggests market weak point. When gone along with by a rate loss, it indicates a possible expansion of the decrease.

Find Out More: Surge (XRP) Cost Forecast 2024/2025/2030

If XRP does not see a noteworthy spike in brand-new need to respond to the rising selloffs, its rate might go down to $0.52. Nonetheless, it might redeem the $0.60 rate degree and exchange hands over it if this takes place.

Please Note

According to the Depend on Task standards, this rate evaluation write-up is for educational objectives just and need to not be thought about economic or financial investment recommendations. BeInCrypto is dedicated to exact, honest coverage, yet market problems undergo alter without notification. Constantly perform your very own research study and speak with a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.