South Korea’s National Pension plan Solution (NPS) lately acquired $34 million well worth of MicroStrategy shares, highlighting boosted institutional self-confidence in Bitcoin (BTC) through tactical financial investments.

MicroStrategy’s hefty Bitcoin emphasis remains to increase self-confidence in the business’s lasting leads and the worth of its crypto holdings.

South Korea’s NPS Purchases MicroStrategy Shares

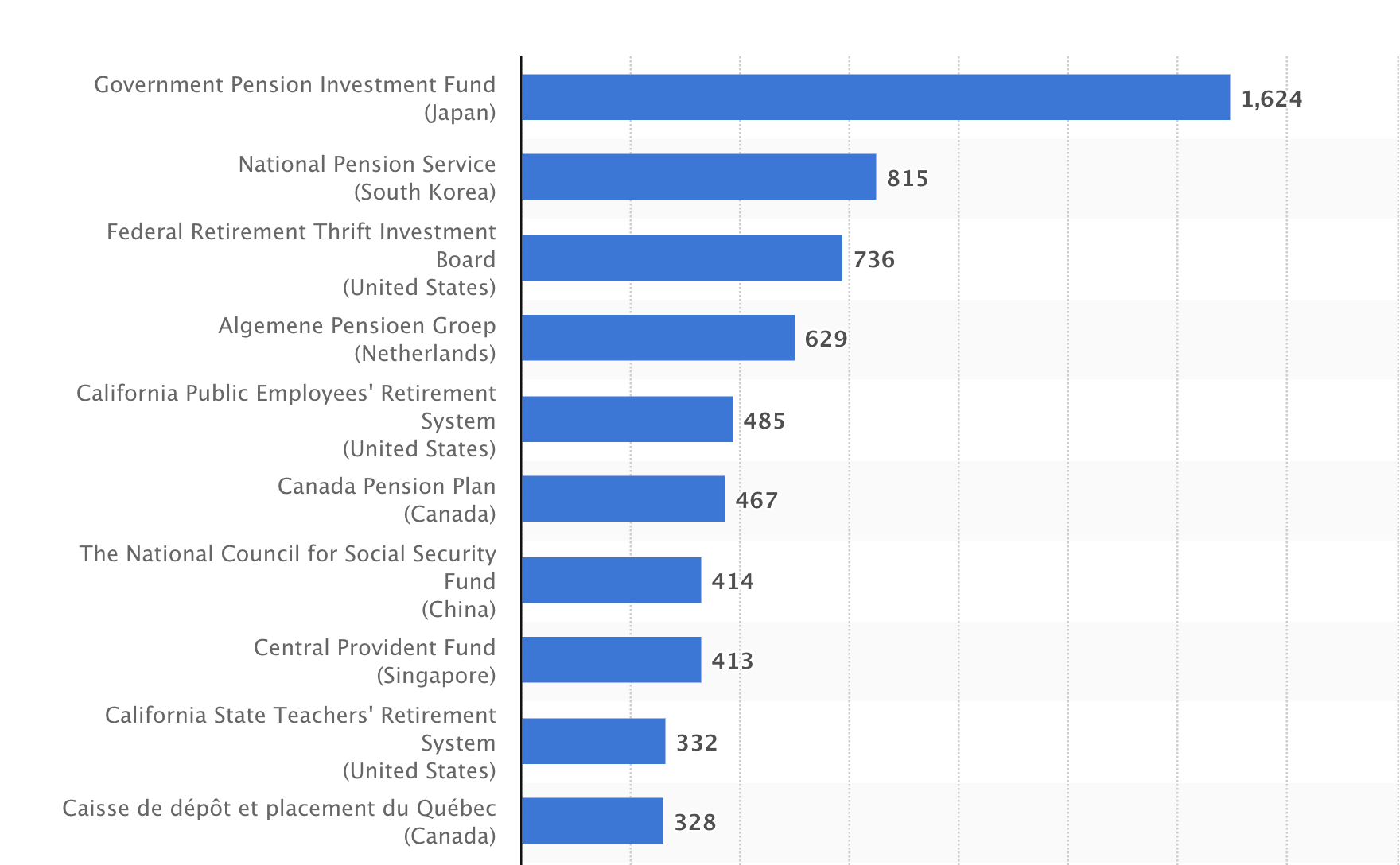

A main declaring with the United States Stocks and Exchange Compensation (SEC) validated the growth. Significantly, South Korea’s NPS, the second-largest public pension plan fund on the planet, is backing Bitcoin via its MicroStrategy financial investment. This relocation emphasizes the raising self-confidence big organizations have in Bitcoin by acquiring indirect direct exposure through MicroStrategy.

MicroStrategy’s supply (MSTR) has properly come to be a proxy for Bitcoin as a result of its hostile BTC financial investment method. This unexpected assumption attracts capitalists looking for leveraged direct exposure to Bitcoin without straight holding the cryptocurrency.

While South Korea’s National Pension plan Fund acquires indirect Bitcoin direct exposure via proxies, others are taking advantage of the lately accepted place Bitcoin ETFs. Noteworthy instances consist of New England’s Retired life Preparation Business, which spent $249,429 in Grayscale’s Bitcoin Count on (GBTC), getting 4,685 shares, as revealed in its most recent type 13F declaring with the SEC.

Furthermore, the State of Wisconsin acquired $99 million well worth of BlackRock’s Bitcoin ETFs, iShares Bitcoin Count on (IBIT), while the State of Michigan Retired life System spent $66 million in the ARK 21Shares ARKB place Bitcoin ETF. Jacket City Mayor Steven Fulop likewise introduced comparable financial investment strategies.

Past pension plan funds, Wall surface Road titans like Morgan Stanley, Goldman Sachs, and DRW Funding have actually revealed placements in Bitcoin ETFs. These advancements signal expanding institutional self-confidence in Bitcoin and its raising assimilation right into mainstream financing.

Find Out More: Exactly how To Profession a Bitcoin ETF: A Step-by-Step Method

This expanding attraction of Bitcoin amongst typical financing (TradFi) gamers was prompted by the authorization and launch of place Bitcoin ETFs in January, which supplied BTC to Wall surface Road. South Korea Pension plan Fund’s relocation, consequently, lines up with a wider fad where TradFi embraces Bitcoin within financial investment approaches.

MicroStrategy’s Bitcoin Financial investment Approach

The Virginia-based company MicroStrategy has actually gained a credibility as a leading Bitcoin maximalist, driven by its chief executive officer, Michael Saylor, a popular BTC supporter and financier.

” Bitcoin is a capital expense you can hold for years that a firm, rival, counterparty, or nation can not eliminate from you. It will certainly produce generational wide range for your household, company, or nation,” Saylor shared lately.

MicroStrategy’s Bitcoin financial investment method remains to strengthen its location in the crypto sector, transforming heads with every growth. As BeInCrypto reported, the United States SEC accepted ETF company Defiance’s MSTX, coming up with MicroStrategy’s first-ever leveraged single-stock ETF.

The company proceeds increasing its Bitcoin holdings in spite of market difficulties, preserving its setting as the general public business with the biggest BTC book. As an example, in Q2 2024, MicroStrategy obtained 12,222 Bitcoin, bringing its complete holdings to 226,500 BTC, also after publishing a quarterly loss. Previously this month, the business introduced strategies to offer up to $2 billion in shares for more Bitcoin financial investments and various other company functions.

Find Out More: That Possesses one of the most Bitcoin in 2024?

In spite of its strong Bitcoin position and tactical steps, MicroStrategy is not unsusceptible to market recessions. For example, its Bitcoin profile took a hit in July when the United States federal government introduced strategies to offer $2 billion well worth of confiscated BTC, bring about a decrease in Bitcoin’s worth and affecting the company’s holdings.

Nonetheless, MicroStrategy’s Bitcoin position and tactical financial investment acumen do not discharge it from taking impacts whenever the marketplace containers. For example, its Bitcoin profile took a hit in July when the United States federal government introduced a $2 billion sell-off from confiscated BTC holdings. The decrease was more sustained by the Federal Book’s choice to stop briefly rate of interest on July 31 and a weaker-than-expected United States work report on August 2.

Please Note

In adherence to the Count on Job standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to offer exact, prompt info. Nonetheless, visitors are suggested to validate realities separately and talk to an expert prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.