The expert system profession has actually been shedding its appeal since late. Shares of Alphabet (GOOG, GOOGL), Amazon (AMZN), and Microsoft (MSFT), 3 of AI’s most significant gamers, are down over the last month, with Google moms and dad Alphabet going down 14%, Amazon off around 8%, and Microsoft dropping greater than 7% since Thursday.

The supply relocations followed the business, together with fellow hyperscaler Meta (META), validated they’ll remain to put billions of bucks right into constructing out their AI framework over the coming quarters– without giving much understanding right into when they’re mosting likely to transform every one of that investing right into profits. That, together with the current market chaos, has actually detered AI business supplies.

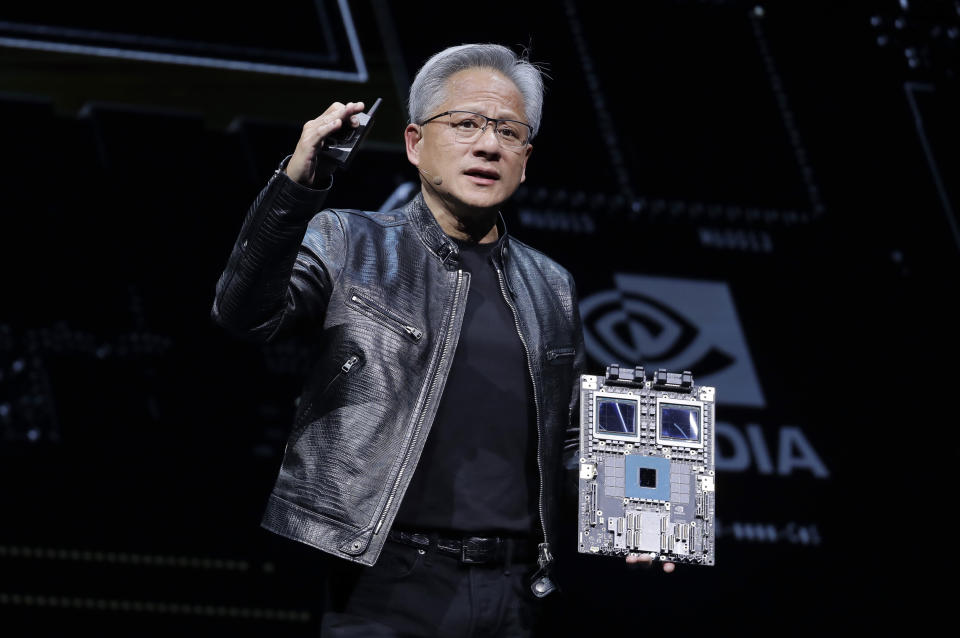

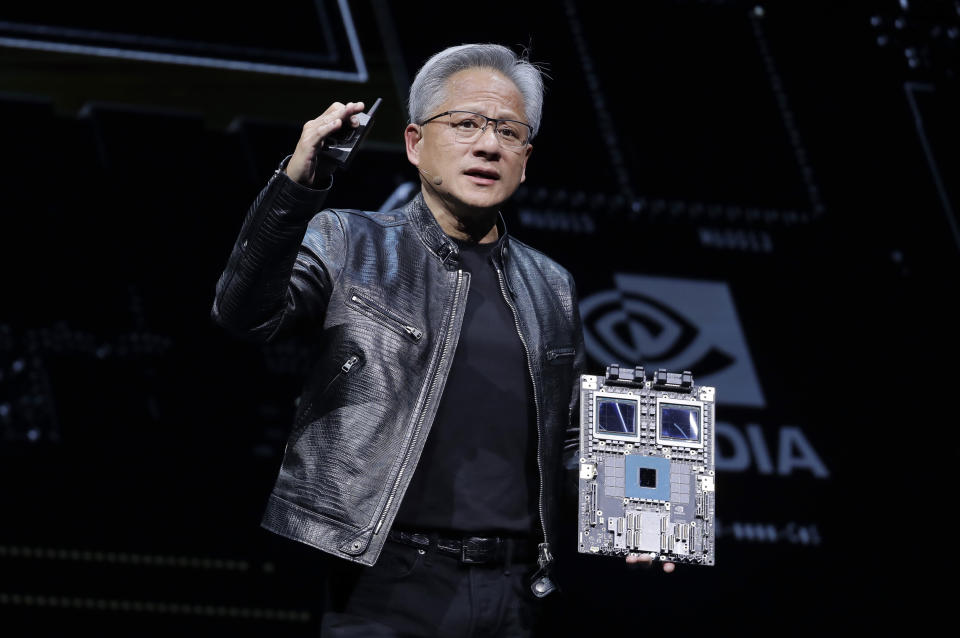

However one of the most vital element of the AI profession, Nvidia (NVDA), still needs to report its revenues. The chip business’s efficiency can reverse the AI profession greater than any type of hyperscaler. Unlike those software program companies, profits hasn’t been an issue for Nvidia. Still, if it disappoints Wall surface Road’s currently overpriced assumptions, it can bring the AI fad down with it.

Nvidia’s significant year-over-year gains will not last for life

Alphabet, Amazon, and Microsoft’s AI investing may be offering financiers stop, however it’s aiding pad Nvidia’s profits. The business’s Receptacle AI chips are one of the most popular on the marketplace, and the company is readied to start increase manufacturing of its Blackwell line later on this year.

The business regulates 80% to 95% of the marketplace for high-powered AI chips,according to Reuters That indicates whenever a firm states it’s investing in AI abilities, opportunities are it’s acquiring up, or at the very least making use of, Nvidia’s cpus.

However Nvidia’s 2nd quarter record additionally notes the begin of what will certainly be a number of quarters of hard year-over-year profits development contrasts. The business’s financial Q2 2024 revenue can be found in at $13.5 billion, up 101% year over year. Information facility profits covered $10.3 billion, up 141%.

Each succeeding quarter has actually seen ever before much more remarkable year-over-year gains for the chip titan. However that event will not last for life. In its newest quarter, Nvidia reported profits of $26 billion, a 262% boost from the $7.19 billion the business reported in the previous year.

For its upcoming 2nd quarter record, Wall surface Road experts are preparing for profits of $28.6 billion, a 112% year-over-year dive. And while that still stands for a massive boost in profits, it’s not as incredible as the development the business has actually seen in its previous quarters. Which can switch off some financiers.

Nvidia is still the AI profession’s intense area

That’s not to state Nvidia isn’t anticipated to proceed generating money, or that Wall surface Road is down on the business. Since Thursday, 66 experts had Buy scores on Nvidia’s supply. Simply 7 had Hold scores and just one had an Offer score.

It’s secure to state Wall surface Road believes in the business’s expectation. Nevertheless, as UBS expert Timothy Arcuri explained in a current financier note, semiconductor maker TSMC, which generates Nvidia’s chips, uploaded solid quarter-over-quarter cause its high-performance computer sector. That ought to show an additional possibly excellent quarter for Nvidia is in the murder.

Nvidia, unlike software program business, additionally take advantage of the reality that its items have a genuine substantial advantage for its clients currently. Hyperscalers are placing the business’s chips to function as quickly as they can to establish and power AI designs. However AI-powered software program is still in an unclear type of screening stage. Firms are carrying out AI venture software program, however it’s not as though its effect on their workers’ efficiency will certainly escalate over night.

What’s even more, professionals state it’ll still take years for AI-powered software program like Microsoft’s Copilot or Google’s Gemini to really settle for company clients. And while those business are active repeating on their items, Nvidia will certainly keep offering them its equipment.

So, while the AI profession might have taken a hit over the last month, its most significant victor will certainly proceed powering ahead.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

For the most up to date revenues records and evaluation, revenues murmurs and assumptions, and business revenues information, go here

Check out the most up to date monetary and company information from Yahoo Fin ance.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.