On August 15, Hamilton Lane revealed a partnership with Securitize to make its $5.6 billion Additional Fund VI obtainable to certified financiers via a blockchain-based system.

Hamilton Lane’s Additional Fund VI, which enclosed June 2024, surpassed its first $5 billion target by elevating $5.6 billion in dedications.

Securitize and Hamilton Goal to Lower the Personal Market Obstacles for Person Capitalists

Commonly, such funds have actually been restricted to institutional financiers with high access limits. Nonetheless, via this collaboration, specific financiers can currently access the fund with a minimal financial investment of $20,000.

” By digitizing the financial investment procedure, we are eliminating obstacles and making it simpler for even more financiers to join premium exclusive market chances,” Carlos Domingo, founder and chief executive officer of Securitize, remarked.

Find Out More: What is Tokenization on Blockchain?

This fund is the most up to date in a collection of tokenized financial investment items from Hamilton Lane and Securitize. Earlier collaborations in 2023 offered specific financiers with accessibility to Hamilton Lane’s Equity Opportunities Fund V and the Elder Credit History Opportunities Fund (EXTENT).

Tom Kerr, Co-Head of Investments and Global Head of Additional Investments at Hamilton Lane, revealed his enjoyment for this brand-new campaign. He additionally recognized the expanding need for liquidity in the second market.

” Fund VI is an extension of our historical second franchise business, and we remain to concentrate on locating distinguished second chances at eye-catching inflection factors where we have knowledge and an affordable angle,” Kerr included.

Hamilton Lane has actually been energetic in the second market for over 24 years. Since June 30, 2024, the company has actually taken care of about $21.0 billion in possessions.

Find Out More: What is The Effect of Real Life Property (RWA) Tokenization?

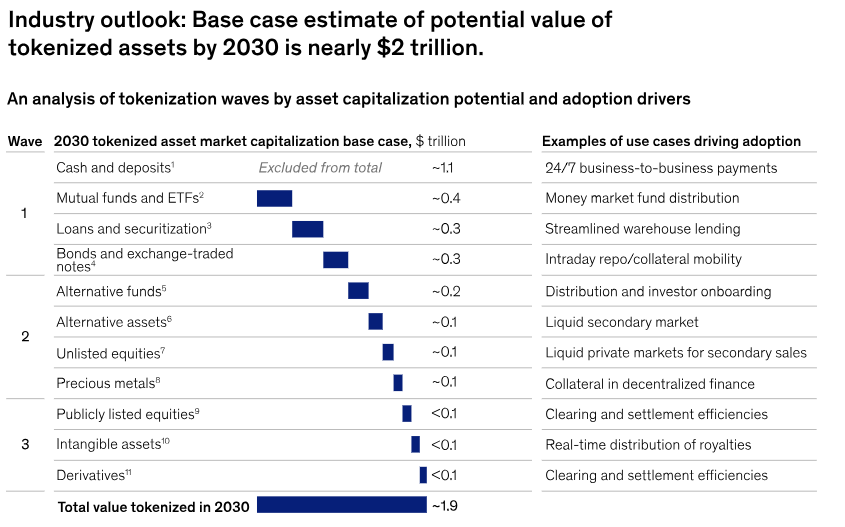

This campaign comes as the tokenization of economic possessions is getting energy. According to a record by McKinsey, the marketplace for tokenized economic possessions might get to $2 trillion by 2030. On the other hand, a different record from ADDX and BCG price quotes that the worldwide market for illiquid property tokenization might get to $16 trillion by the exact same year.

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to give exact, prompt details. Nonetheless, visitors are suggested to confirm truths separately and seek advice from an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.