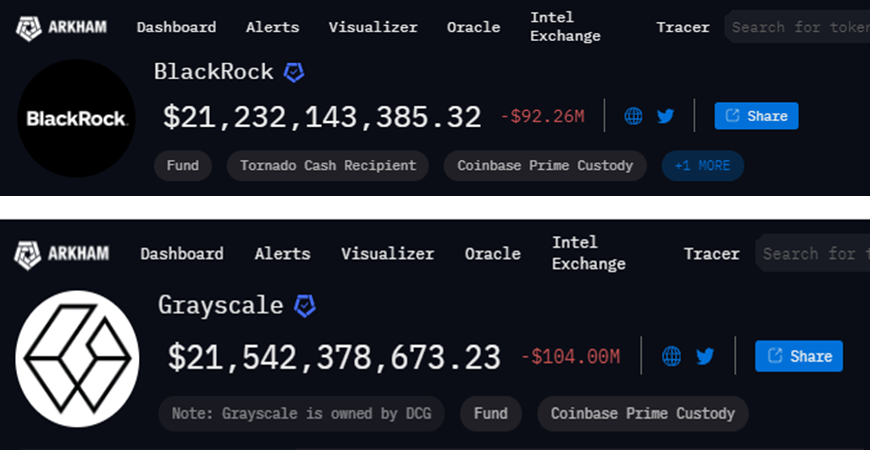

Since Friday, BlackRock’s ETF (exchange-traded fund) ended up being the biggest cumulative owner out there, exceeding Grayscale for the very first time in on-chain holdings.

The increasing passion in Bitcoin (BTC) and Ethereum (ETH) remains to sustain institutional need adhering to the authorizations of ETFs. This change highlights the expanding self-confidence in these electronic possessions amongst significant financiers.

BlackRock Dethrones Grayscale in ETF Holdings

Arkham Knowledge reported that BlackRock ETF holdings, IBIT and ETHA, rose to $21,217,107,987 on Friday. The rise saw the monetary tools properly defeated Grayscale’s GBTC, BTC Mini, ETHE, and ETH Mini, valued at $21,202,480,698 since the moment of the record.

Significantly, Grayscale still preserves a greater total equilibrium than BlackRock, mainly because of its GDLC fund, which holds about $460 million in possessions under monitoring (AUM). Unlike BlackRock’s offerings, GDLC is not an ETF, permitting Grayscale to keep a bigger share of the marketplace.

Learn More: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Bitcoin ETFs started trading on January 11, and within simply 7 months, BlackRock has actually ended up being the third-largest owner of BTC. Bloomberg ETF expert Eric Balchunas forecasts that IBIT might exceed Satoshi Nakamoto’s Bitcoin holdings by 2025, gave the existing development speed proceeds.

” Really did not understand United States ETFs get on track to pass Satoshi in bitcoin kept in October. BlackRock alone is currently # 3 and on speed to be # 1 late following year,” Balchunas said.

Recently, electronic possession financial investment items saw inflows completing $176 million, with BlackRock videotaping $408 million in inflows. On the other hand, Grayscale ETFs experienced approximately $552 million in discharges, signifying a change in financier choice.

Learn More: Who Owns the Most Bitcoin in 2024?

The current growths are unsurprising, considered that BlackRock’s Bitcoin ETF has actually seen just one day of discharges because its launch. Current filings reveal that significant banks like Capula Monitoring, Goldman Sachs, DRW Funding, and numerous financial investment and retired life boards have actually been obtaining BlackRock’s IBIT.

On the other hand, Grayscale is battling with consumer redemptions. Customers have actually been offering their holdings because Bitcoin and Ethereum place ETFs acquired authorization. Grayscale’s high charges of 2.5%, contrasted to the sector standard of 0.25%, are the major factor.

Charges can affect long-lasting efficiency, expanding symmetrical as the marketplace increases. In reaction to these problems, Grayscale presented its brand-new Mini ETH ETF with reduced charges to attend to discharges from its major ETHE fund. This pattern mirrors the company’s Bitcoin Trust fund, which likewise encountered significant discharges after its conversion in January.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to supply precise, prompt details. Nevertheless, viewers are suggested to confirm truths separately and seek advice from an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.