PAAL AI (PAAL), the Telegram coin established on the Ethereum blockchain, has actually seen its cost visit 10% in 24 hr. At press time, it trades at $0.19.

The cost stands for a 77.50% reduction from its all-time high in March. This on-chain evaluation checks out the elements in charge of the current drawdown and its most likely following activity.

Crypto Whales Ditch PAAL AI

BeInCrypto’s searchings for expose that PAAL experienced noteworthy marketing stress as a result of the choice of among its noteworthy stakeholders. The capitalists associated with this decrease are whales, a vital accomplice whose activity and passivity can considerably affect rates.

According to IntoTheBlock, PAAL AI’s huge owners’ netflow visited 72% in the last 7 days and has actually stayed in this manner for the last 30 to 90 days. Huge Owners’ netflow is the distinction in between their Inflow and Discharge.

When this distinction enhances, it indicates that whales are collecting even more coins than they are dispersing. Most of the times, this increase in coins acquired foreshadows a rate boost.

Nevertheless, a web unfavorable hereof recommends that circulation is greater. As this holds true with PAAL, the cost prolonged its losses.

Find Out More: What Are Telegram Mini Applications? An Overview for Crypto Beginners

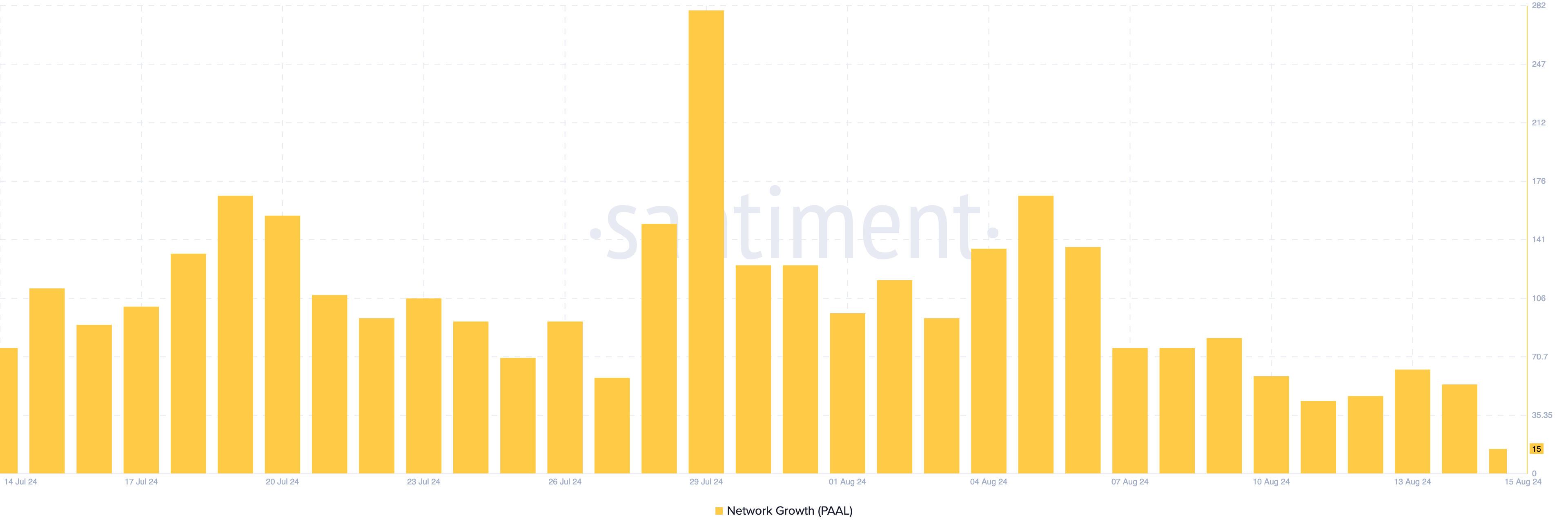

If crypto whales go on liquidating their PAAL holdings, the cost might remain to decrease. Yet marketing stress, on-chain information from Santiment reveals a considerable decrease in the task’s network development.

Network development determines the variety of brand-new addresses communicating with a cryptocurrency for the very first time.

When this number enhances, it suggests an increase of brand-new individuals making their very first effective purchase. Nevertheless, a decline recommends a decline indicate a scarcity in grip and absence of fostering.

For PAAL AI, the current reduction presumes that crypto presently deals with a deficiency in the called for need to aid the cost recoup. If continual, the cost of PAAL might lower once again, as pointed out previously.

PAAL Rate Forecast: The Coin Struggles Continue

Based upon the everyday graph, PAAL has actually developed a rounding leading pattern. Likewise referred to as an upside down rounding base, this pattern is identified by a first uptrend, after which the rally slows and the cost decreases.

Sometimes, bearish verification takes place when the cost slides listed below the neck line revealed on the graph. From the graph below, PAAL’s neck line goes to $0.1965. Nevertheless, the cost has actually gone down listed below the area, recommending that a bearish extension can be following.

This prejudice is more enhanced by the Bull Bear Power (BBP), an indication utilized to determine the stamina of purchasers about vendors. Normally, if the BBP declares, bulls remain in control, and rates can raise.

Nevertheless, the sign’s analysis for PAAL is unfavorable, recommending that bears might remain to press the cost better down. In this instance, PAAL’s cost might go down to $0.1724, yet if bulls fall short to safeguard this area, it can slide towards $0.1499.

Find Out More: Leading 7 Telegram Tap-to-Earn Gamings to Play in 2024

However, the cryptocurrency’s cost might turn around to the benefit if whale build-up and acquiring quantity in the area market boost. Need to this hold true, PAAL might retest $0.2037. If continual, the cost can reach $0.2462.

Please Note

According to the Count on Job standards, this cost evaluation write-up is for informative objectives just and must not be taken into consideration economic or financial investment suggestions. BeInCrypto is dedicated to precise, objective coverage, yet market problems undergo transform without notification. Constantly perform your very own study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.