Simply weeks after going beyond $3, the rate of Dogwifhat (WIF) has actually plunged, currently down 50% from that height. At press time, WIF trades at $1.56.

While some financiers see this decrease as a possible purchasing possibility, a much deeper evaluation recommends that WIF’s rate can drop even more.

Dogwifhat Energy Transforms Bearish

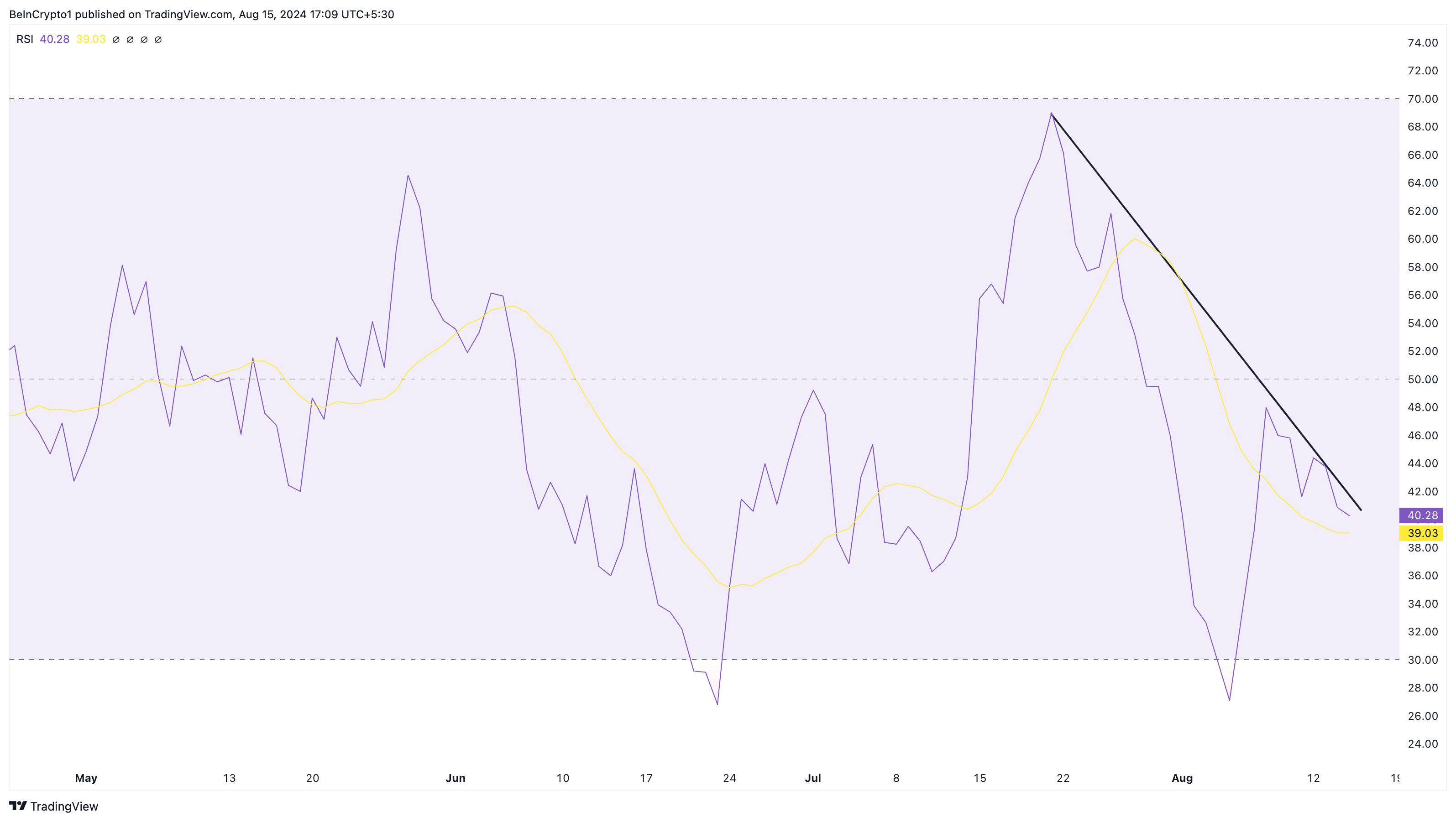

The Family Member Stamina Index (RSI) on WIF’s everyday graph has actually currently dipped to 40.21. The RSI is an essential technological indication utilized to assess energy by assessing the size and rate of rate modifications.

A decreasing RSI mirrors bearish patterns, while an increasing RSI shows favorable stamina. With WIF’s existing RSI degree aiming downward, the overview shows up bearish. If the RSI remains to decrease, the meme coin’s rate is most likely to adhere to, enhancing worries of additional losses.

Learn More: 5 Ideal Dogwifhat Budgets To Think About In 2024

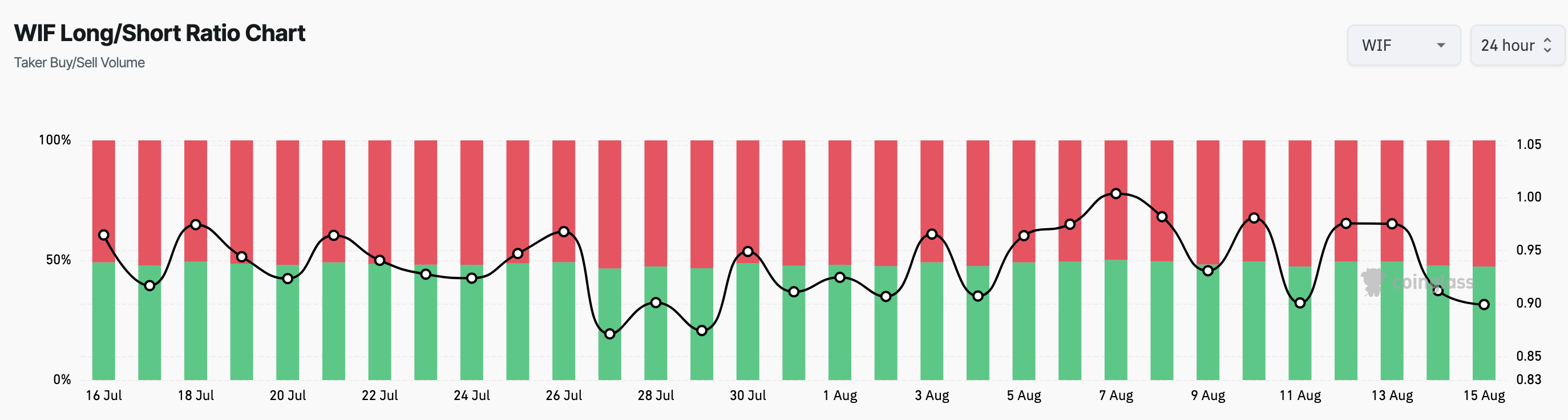

Moreover, it shows up that investors in the marketplace share a comparable belief. According to Coinglass, the WIF Long/Short proportion is to 0.89. This proportion assesses the settings of longs (purchasers) and shorts (vendors) in the by-products market.

A proportion over 1 recommends the supremacy of lengthy settings and suggests that investors anticipate the rate to enhance. Nonetheless, if the Long/Short proportion decreases listed below 1, it recommends that shorts have the top hand, and financiers anticipate a cost reduction, as it is with WIF.

WIF Rate Forecast: The Meme Coin Remains In Threat

On the everyday graph, WIF’s decrease increased complying with a bearish swallowing up candle light on August 11, leading to a 19.81% decrease over 4 days. A closer evaluation discloses essential assistance at $1.50.

This assistance degree has actually formerly set off up motions for WIF, making it vital for the coin’s temporary overview. A break listed below $1.50 can signify additional problem, possibly resulting in a dip in the direction of $1.25. Furthermore, the Relocating Ordinary Merging Aberration (MACD) indication has actually transformed adverse.

Unlike the RSI, which concentrates on rate modifications, the MACD makes use of the Exponential Relocating Ordinary (EMA) to analyze market stamina. Favorable MACD worths recommend favorable energy, while adverse worths verify bearish problems.

Learn More: Dogwifhat Rate Forecast 2024/2025/2030

For Dogwifhat, the MACD presently indicates bearish problems, suggesting that a healing is not impending. This lines up with the opportunity of a decline to $1.50 and even $1.25. Nonetheless, if favorable energy returns and purchasing stress heightens, this bearish overview can move. In such a circumstance, WIF’s rate may climb to $1.76, with a possible rise approximately $2.20.

Please Note

In accordance with the Depend on Task standards, this rate evaluation post is for informative objectives just and need to not be taken into consideration monetary or financial investment guidance. BeInCrypto is dedicated to exact, objective coverage, however market problems go through transform without notification. Constantly perform your very own research study and talk to an expert prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.