( Bloomberg)– UBS Team AG (UBS) will certainly sell off a front runner property fund in the most recent indication of the chaos triggered by financiers drawing cash out of plunging business property markets.

Many Review from Bloomberg

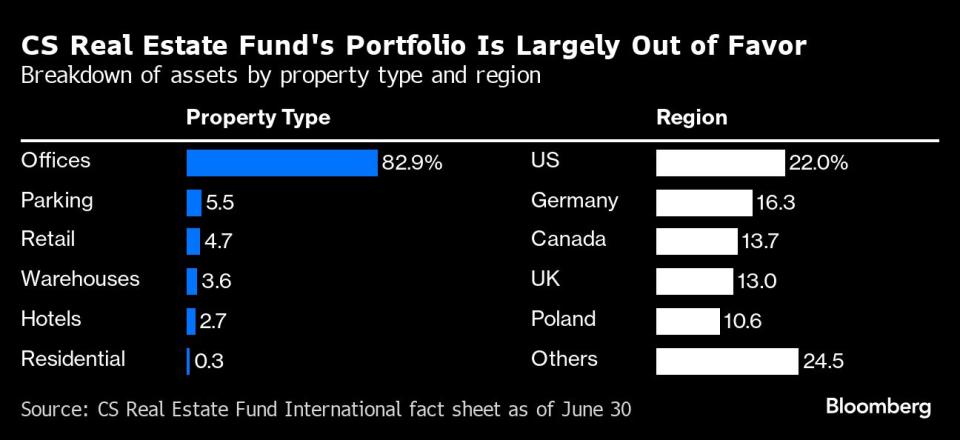

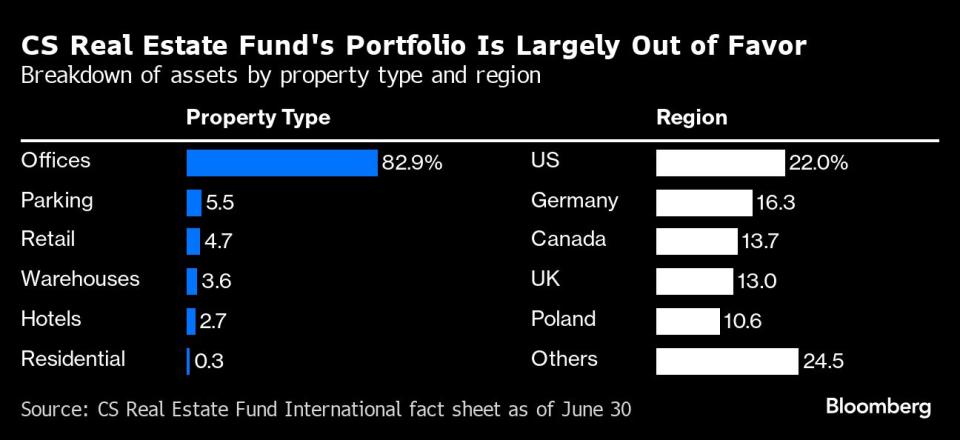

The fund, which was acquired in the requisition of Credit score Suisse, was extremely revealed to a few of the weakest industries. It had more than 80% of its 1.9 billion Swiss francs ($ 2.2 billion) in possessions in workplace buildings, and the United States and Germany were its greatest markets, according to UBS.

The Swiss financial institution made a decision to close the fund since exceptional redemption demands implied that it would certainly need to market one of the most fluid possessions listed below their lasting inherent worths, UBS claimed in a declaration on Thursday.

Such worries have actually brushed up via property funds. As financiers require cash back, fund supervisors are compelled to market their finest possessions at inexpensive rates and damaging their profiles at the same time.

In the initial 6 months, the marketplace worth of the fund’s possessions reduced 12%. CS Property Fund International had actually currently shed 31% of its worth in 2023 contrasted to the previous year.

Work-from-home fads have actually sapped need for workplace, while greater rate of interest have actually overthrown the estimations that materialized estate a winner throughout the cheap-money period. The adjustment has actually triggered Blackstone Inc.’s gigantic property depend look for to restrict redemptions, which completed $806 million in June.

The CS fund paid 2022 redemptions in April of this year and the procedure to elevate that money showed “the restricted deepness of property markets,” UBS claimed, warranting the choice to sell off.

For staying financiers, it will certainly take a while to obtain their cash back, or what remains of it. Provided the slow rate of deals, settlements of earnings from selling the profile will certainly be transformed a number of years, the financial institution claimed, without defining a timespan.

Many Review from Bloomberg Businessweek

© 2024 Bloomberg L.P.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.