Donald Trump’s call to exempt Social Security benefits from earnings tax obligations might supply an appealing political blurb.

Yet the relocation would certainly weaken not simply one important safeguard for elders, however 2.

Trump’s strategy is anticipated to wear down the book funds for both Social Protection and Medicare faster than prepared for, according to tax obligation plan specialists.

That would certainly saddle elders with an also larger cut in Social Protection advantages than presently approximated and toss a medical care program that covers 67 million right into mayhem. Tax Obligations on Social Protection payments assist fund Medicare’s medical facility protection.

The strategy would certainly additionally include $1.6 trillion over ten years to the nation’s deficit spending with couple of financial gains, these specialists stated.

” It’s not establishing the privileges up for success and it’s not placing our budget plan in an excellent setting,” Garrett Watson, an elderly plan expert and modeling supervisor at the detached Tax obligation Structure, informed Yahoo Financing.

The proposition has both the Tax obligation Structure and the Facility for American Progression, which usually get on contrary sides of tax obligation plan, caution of the possible repercussions.

” If wise experts left wing and wise experts on the right of the tax obligation plan do not assume it’s an excellent concept, that definitely informs you something,” Brendan Fight it out, elderly supervisor for financial plan at the left-leaning Facility for American Progression Activity Fund, informed Yahoo Financing.

” It’s possibly not an excellent concept.”

‘ Base fifty percent are losers’

Trump, the Republican governmental prospect, very first drifted the concept late last month at a rally in Harrisburg, Pa., promising that “elders must not pay tax obligations on Social Protection and they will not,” without using additional information.

On Wednesday, Trump waited a banner that checked out “No tax obligation on Social Protection” at a project rally in Asheville, N.C., calling the tax obligation a “vicious dual tax.”

As it stands currently, regarding 40% of seniors must pay federal income taxes on their Social Protection advantages. The tax obligation is dynamic, implying those with the most affordable earnings aren’t tired, while wealthier elders with significant earnings beyond their advantages are.

Sparing take advantage of earnings tax obligations would certainly offer a reliable 44% advantage rise for elders with the highest possible earnings, a 6% rise for middle-income ones, and no rise for many in the lower fifty percent, according to Marc Goldwein, an elderly plan supervisor for the Board for an Accountable Federal Budget Plan.

That’s prior to Social Protection encounters problem.

The tax obligation elders pay on their Social Protection advantages additionally goes straight right into moneying the count on fund that sustains the social program. Removing those tax obligations increases when the gets for Social Protection go out.

Presently, Social Protection’s gets are anticipated to be worn down by 2035, whereupon advantages will certainly obtain reduced by 21%. If Trump’s proposition is passed, those gets are approximated to run completely dry by 2033 and advantages would certainly be lowered by 25%.

Despite the advantages reduced, wealthier elders appear a little in advance with the tax obligation break, taking a 9% rise, per Goldwein.

That’s not the instance for lower-earning Social Protection recipients that would certainly see their advantages minimized by a quarter without any tax obligation break.

” The lower fifty percent are losers,” Watson stated.

On the whole, the strategy would certainly thin down what is taken into consideration the largest anti-poverty program in the USA.

” There is no globe where this does not raise the senior hardship price,” Fight it out stated.

‘ That’s really quite terrifying’

Trump’s strategy would certainly additionally clear out the gets that Medicare makes use of for medical facility protection– called Medicare Component A– earlier than prepared for.

Today, that fund is anticipated to go out in 2036. That goes up to 2030 under Trump’s strategy, according to Watson.

The Medicare trustees have stated the fund’s bankruptcy might initially create hold-ups in repayments to health insurance plan and suppliers of medical facility solutions. Furthermore, elders’ “accessibility to healthcare solutions might quickly be cut.”

” No one really understands what takes place when Medicare lacks cash,” Fight it out stated. “Which’s really quite terrifying.”

‘ Mechanically contribute to the deficit spending’

The effects for the government deficiency are additionally substantial.

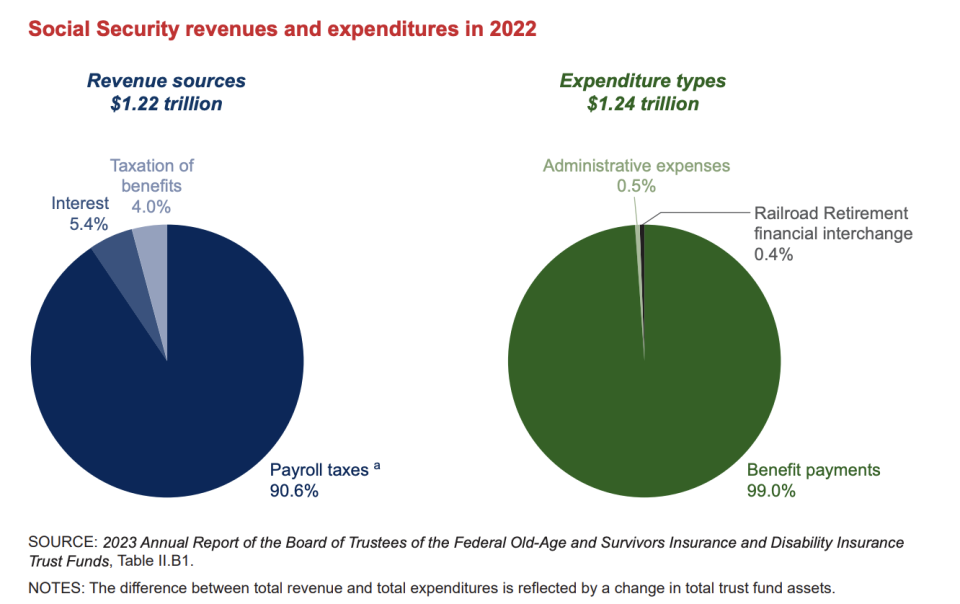

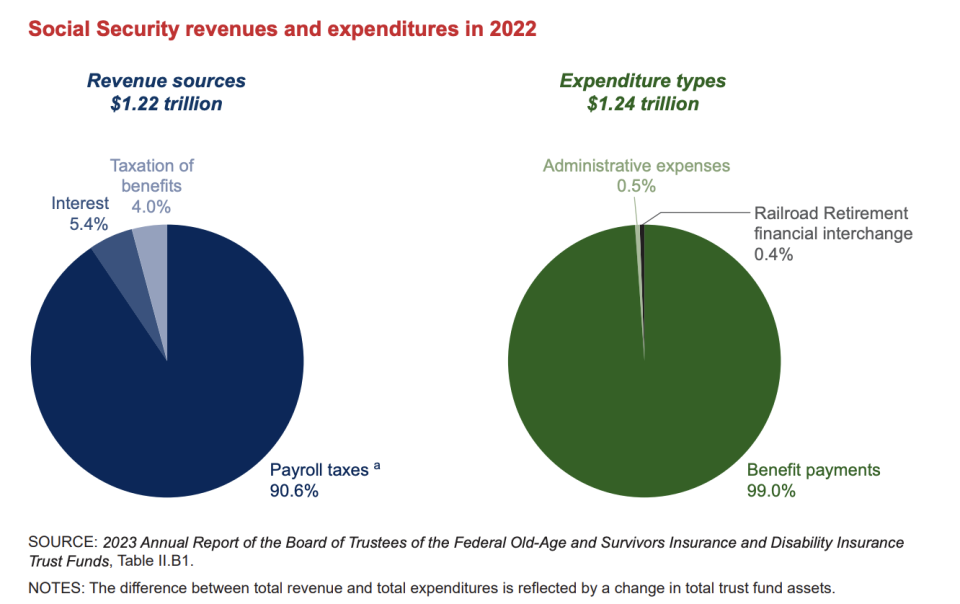

Not tiring elders’ advantages indicates $1.6 trillion in complete earnings would certainly not most likely to the trust fund funds that sustain Social Protection and Medicare from 2024 to 2033, according to computations utilizing information from one of the most current Social Protection and Medicare trustees records.

” This would mechanically contribute to the deficit spending and enter the incorrect instructions in fixing that issue,” Watson included.

There would certainly be extremely little financial return from the proposition, also, Watson located.

The nation’s long-run gdp would certainly raise by 0.1%, while the economic climate would certainly include around 64,000 full time tasks. Earnings would certainly tick up by much less than 0.05%.

” The intent [of the proposal] is attempting to safeguard elders that are operating dealt with earnings from rising cost of living and offer even more alleviation by not tiring it,” Watson stated. “Yet if it’s done without offsets, it compromises the extremely privileges they’re attempting to safeguard.”

—

Janna Herron is an Elderly Writer at Yahoo Financing. Follow her on X @JannaHerron.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.