Bitcoin’s (BTC) cost seems in a perilous circumstance as significant stakeholders, typically described as crypto whales, have actually supposedly stopped their acquiring tasks.

This stop in acquisitions has actually triggered worries regarding Bitcoin’s future assessment, specifically as technological patterns show a bearish pattern. Historically, such patterns have actually been related to extended drop-offs or durations of debt consolidation.

Crypto Whales Go Back as Bitcoin Transforms Bearish

Current information from Lookonchain recommends that organizations have actually gone back from Bitcoin acquisitions, accompanying a 1.44% decrease in Bitcoin’s worth over the previous 1 day. Presently, Bitcoin is trading about $58,300, a decline from last Monday’s high over $61,900.

The current cost decrease listed below the $60,000 mark appears to have actually influenced organizations’ passion in Bitcoin.

” Organizations appear to have briefly quit acquiring, and the cost of BTC went down 4.5% today! We discovered that organizations quit getting USDT from Tether’s Treasury and moving it to exchanges 2 days back,” Lookonchain stated.

Furthermore, stablecoin down payments to Secure’s Treasury have actually decreased, and a discharge of 1.3 billion USDT has actually been made to exchanges because the August 5 crypto market collision, suggesting minimized acquiring stress and an extra mindful strategy from financiers.

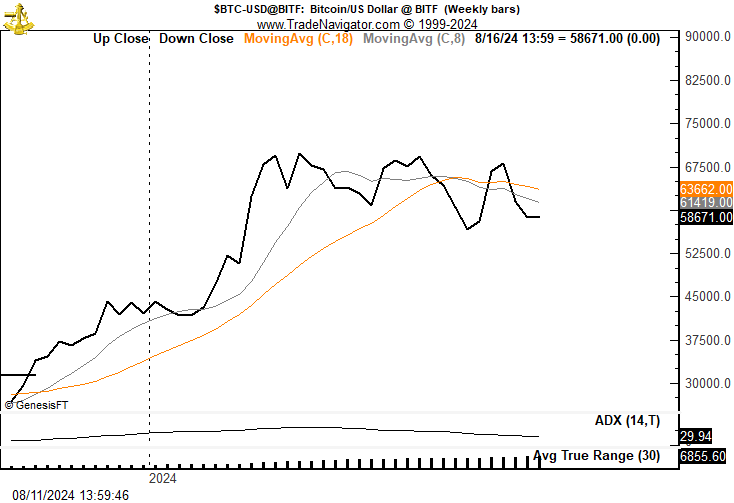

Amidst these worries, trading expert Peter Brandt pointed out that Bitcoin can have observed a pattern turnaround from favorable to bearish. The expert identified a “fatality cross” on the once a week graph in between the 8 and 19 basic relocating standards (SMA).

Although this is not constantly a reputable forecaster of future cost, it recommends the start of a sag.

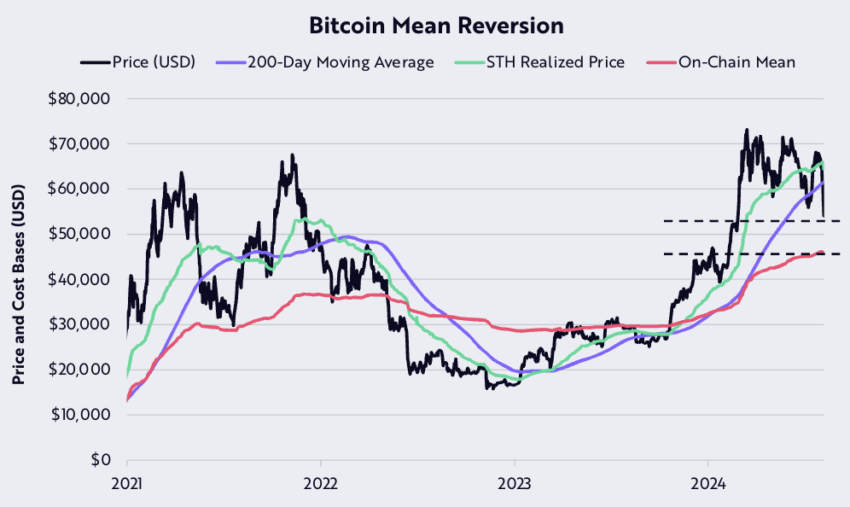

Remarkably, David Puell, a Study Partner at ARK Invest, provided understandings right into Bitcoin’s vital assistance degrees in case of a rate modification.

” Bitcoin’s crucial cost assistances go to $52,000 and $46,000, the last validated by its on-chain mean, the red line on the graph,” Puell clarified.

Find Out More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

In recap, Bitcoin’s present technological problems, noted by the time out in institutional acquiring and the development of a fatality cross, recommend a mindful expectation in the short-term. With vital assistance degrees recognized and market belief leaning in the direction of threat off, the coming weeks will certainly be essential in identifying whether Bitcoin can support or if additional decreases are on the perspective.

Please Note

In accordance with the Trust fund Task standards, this cost evaluation short article is for educational objectives just and need to not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to precise, honest coverage, however market problems go through alter without notification. Constantly perform your very own study and seek advice from a specialist prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.