Zcash (ZEC) cost proceeded where it quit recently, getting to a brand-new annual high up on Monday prior to its current pullback. On the discussed day, the personal privacy coin struck $45.45.

This cost notes not just ZEC’s highest degree this year yet additionally its height because March 2023.

Zcash Strategies Proof-of-Stake Relocate, Desires Flowing Supply Decreased

Zcash (ZEC) has actually risen virtually 45% in the previous 1 month, making it among the top-performing altcoins in very early August. On July 15, ZEC traded at $28.54, yet it has actually because experienced significant development.

According to BeInCrypto, this increase isn’t entirely driven by acquiring stress or basic market passion. A crucial aspect behind the rise is conjecture around Zcash’s feasible change from Proof-of-Work (PoW) to Proof-of-Stake (PoS). ZEC has actually generally depended on the PoW formula, comparable to Bitcoin (BTC).

Nonetheless, on August 10, Zooko Wilcox, the task’s owner, meant a shift to PoS. Wilcox kept in mind that the development of brand-new ZEC via PoW has actually added to descending cost stress throughout the years, which the current uptrend is starting to turn around.

Wilcox, in a statement via Medium, suggested that the transfer to PoS will certainly reduce descending stress on ZEC cost as it intends to minimize brand-new coin development. Describing exactly how PoS will favorably affect the cryptocurrency’s worth, the owner shared that:

” It will certainly enable individuals to lay their ZEC, hence boosting need for ZEC. It will certainly additionally minimize the supply of ZEC by securing laid ZEC.”

Sustaining the owner’s issue concerning boosted supply, information from Messari discloses that Zcash’s brand-new issuance has actually climbed to 157,000 coins since this writing. On July 1, this number was listed below 70,000, highlighting a sharp rise in distributing coins.

Find Out More: Exactly how to Purchase Your Initial Zcash

It is necessary to keep in mind that the shift to Proof-of-Stake, if executed, will just be partial. When finished, a section of ZEC’s supply will be laid, lowering brand-new issuance and possibly producing higher stress on the cost.

ZEC Rate Forecast: One More Peak Is Close

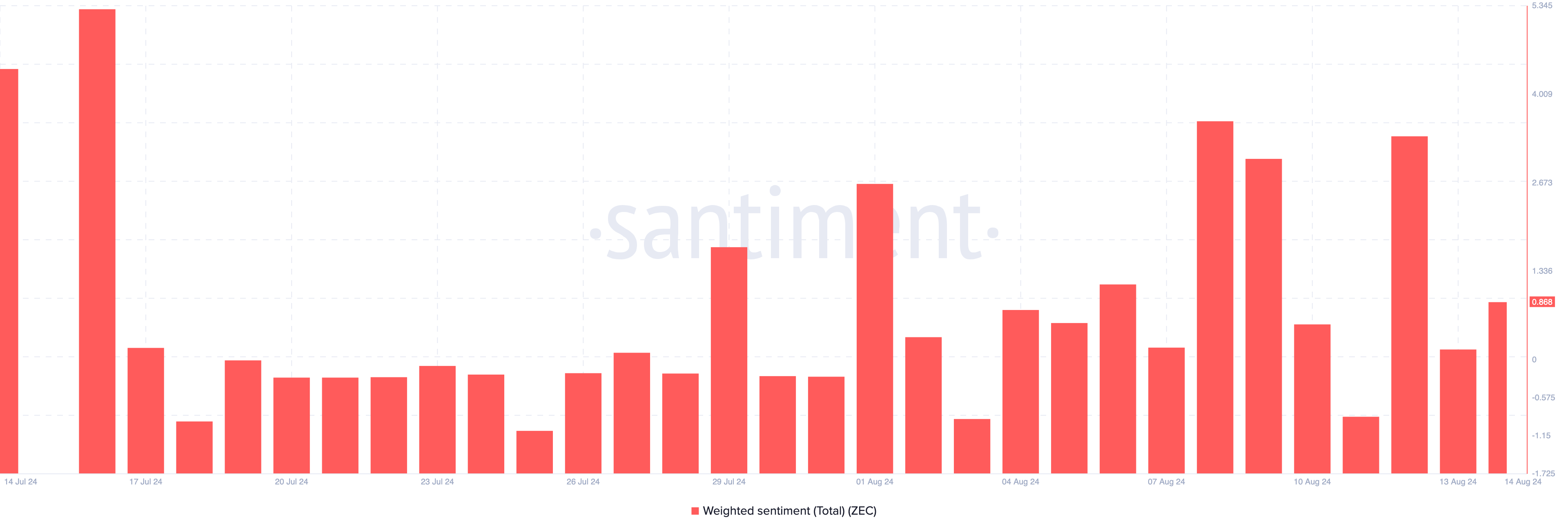

From an on-chain viewpoint, Santiment information reveal that Weighted View around ZEC has actually boosted. This statistics usages social quantity to evaluate the assumption bordering a task on the market.

If the Weighted View analysis declares, after that most remarks are favorable. Nonetheless, an unfavorable score indicates that a huge component of conversations turn towards the bearish end. For ZEC, the analysis had actually originally gone down on August 13.

Nonetheless, at press time, it has actually boosted, recommending that market individuals are certain in Zcash’s temporary cost efficiency. If this stays the instance, need for ZEC might boost, as might the worth.

On the technological side, the everyday graph discloses that ZEC’s cost has actually been creating Reduced Highs (LH) because July. This development suggests solid assistance practically each time the cost has actually boosted.

On top of that, the Exponential Relocating Ordinary (EMA) offers more understanding right into ZEC’s fad. The EMA is a technological indication made use of to evaluate fad instructions. When the much shorter EMA is placed over the longer EMA, it suggests a favorable fad, while the reverse signals a bearish fad.

On July 14, the 20-day EMA (blue) went across over the 50-day EMA (yellow), creating a gold cross. This pattern usually verifies a favorable overview, strengthening ZEC’s higher energy.

Find Out More: Zcash (ZEC) Rate Forecast 2024/2025/2030

The much shorter EMA remains to exceed the longer one, suggesting prospective for more gains. If this fad holds, ZEC’s cost might get to $46 in the short-term.

Nonetheless, a bearish crossover might interrupt this overview. If profit-taking magnifies, ZEC’s worth may decrease to around $36.74.

Please Note

In accordance with the Depend on Job standards, this cost evaluation short article is for informative functions just and ought to not be taken into consideration economic or financial investment recommendations. BeInCrypto is devoted to exact, honest coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and seek advice from a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.