The Sandbox (SAND) cost reached $0.27 throughout very early trading today. Nevertheless, with 98% of its owners presently in losses, the token might encounter an additional cost decline.

Year-to-date (YTD), SAND’s cost has actually dropped by 56.22%. If this decrease proceeds, the cryptocurrency might approach its cheapest cost seen throughout the 2022 bearishness.

The Sandbox Remains To Face Challenging Times

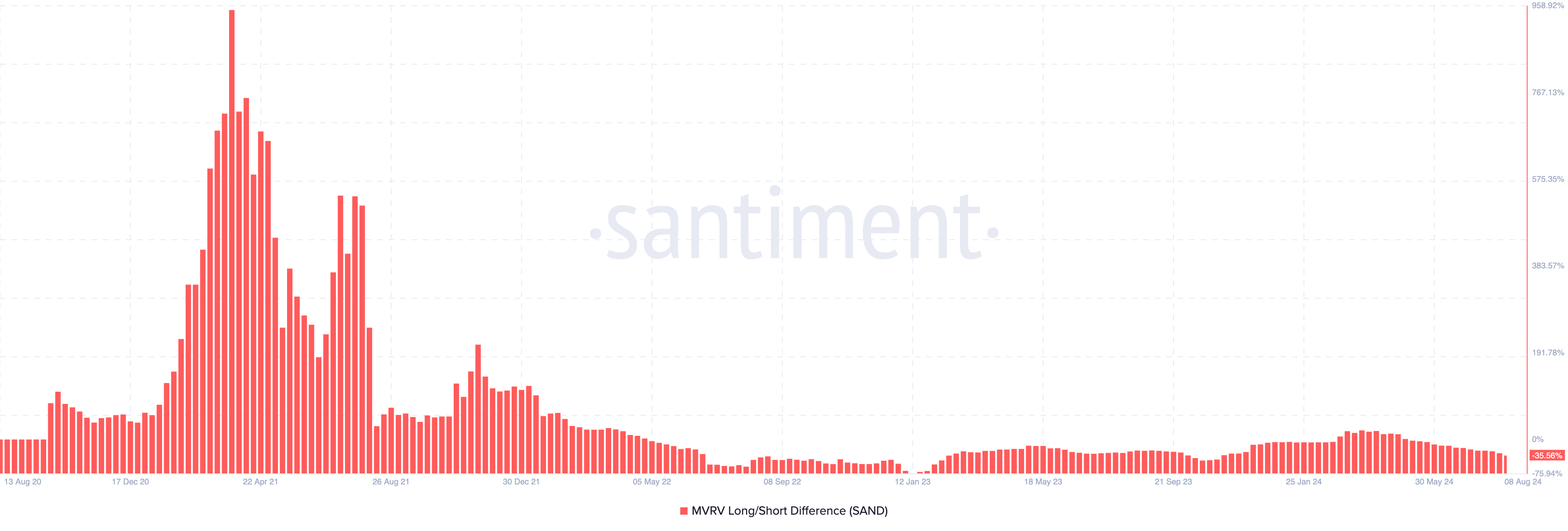

The Sandbox cost has actually increased by around 6% over the last 7 days. Nevertheless, on-chain information reveals the marketplace Worth to Recognized Worth (MVRV) Long/Short Distinction is -35.56%. This statistics, which tracks market earnings, is vital for recognizing bear and bull stages.

Adverse worths suggest that temporary owners would certainly recognize much more revenues than lasting owners if they cost the present cost. Alternatively, favorable worths recommend that lasting owners would certainly recognize much more revenues if they marketed.

Taking Into Consideration the above, the MVRV Long/Short Distinction likewise records the top of a bull run and when a cryptocurrency is heading towards a bearish market. Historically, SAND gets in a bear cycle when the statistics is in between -40.74% and -75.26%.

Learn More: What Is The Sandbox (SAND)?

This final thought is based upon the metric’s actions throughout the 2022 advancing market, which ultimately resulted in a collapse in crypto costs. If SAND’s cost stops working to make a remarkable dive, earnings will certainly reduce, possibly pressing the token right into a bear stage.

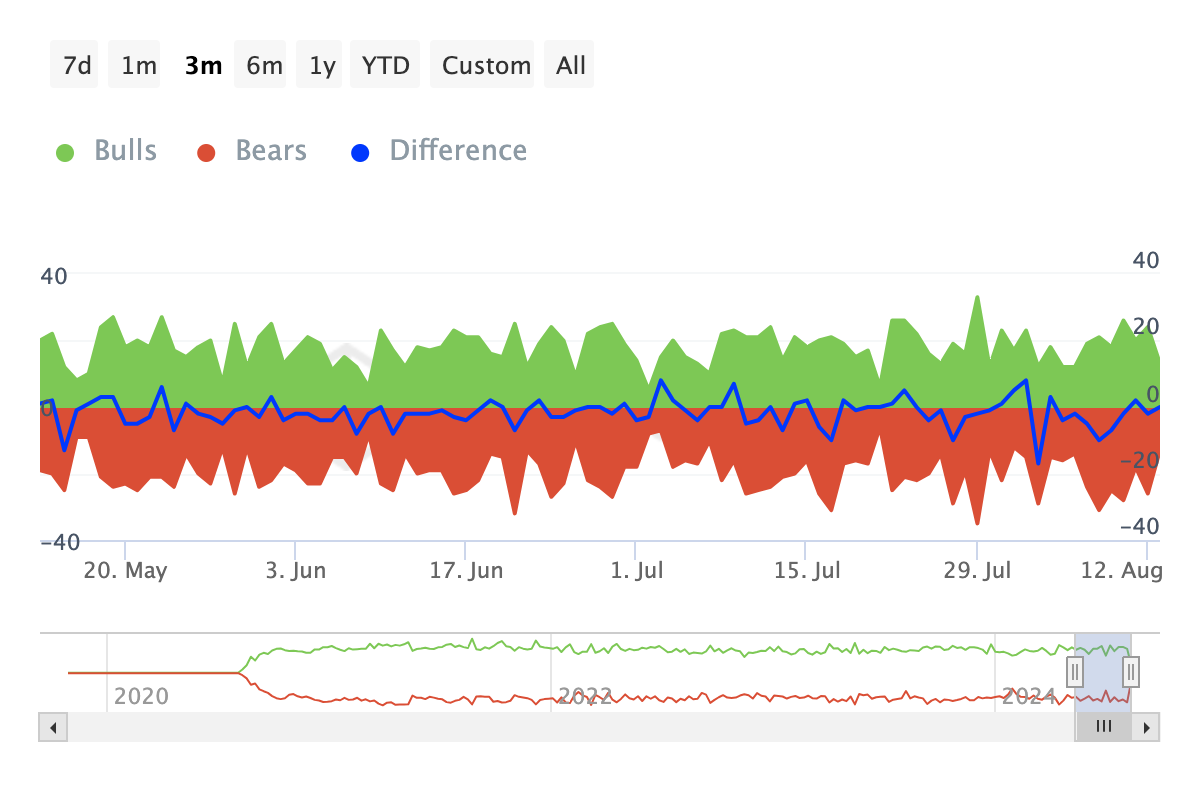

An additional sign sustaining this overview is the Bulls and Bears Sign. This device tracks whether the leading 1% of trading quantity individuals are purchasing or marketing.

Bulls are those purchasing 1% of the trading quantity, while bears are those marketing the very same quantity. A rise in bulls about bears is a favorable indication that might use higher stress on the cost.

In the previous 7 days, SAND has actually seen 28 even more bears than bulls, showing that most of investors do not have self-confidence in the token’s potential customers.

SAND Rate Forecast: Alleviation Brings Larger Difficulty

Technical evaluation, sustained by indicators on SAND’s everyday graph, likewise lines up with the indicators on-chain. As an example, the Equilibrium of Power (BoP) has actually gone down to -0.64. This price-based sign assesses the total stamina of purchasers and vendors on the market.

If the Equilibrium of Power (BoP) oscillates over the absolutely no line, it suggests that purchasers are more powerful than vendors. Nevertheless, because it’s presently listed below the absolutely no line, this recommends that the cryptocurrency is under bearishness prominence.

Need to vendors preserve control, SAND’s current increase might be brief. On the other hand, the Fibonacci retracement degrees use understanding right into possible cost factors the token might get to.

Learn More: The Sandbox (SAND) Rate Forecast 2024/2025/2030

If marketing stress rises, SAND’s cost might go down to $0.20. On the various other hand, with solid favorable activity, the token could try to retest the $0.30 degree.

Please Note

In accordance with the Depend on Task standards, this cost evaluation short article is for informative objectives just and must not be taken into consideration economic or financial investment guidance. BeInCrypto is dedicated to precise, honest coverage, however market problems undergo alter without notification. Constantly perform your very own study and speak with a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.