ORDI, a cryptocurrency operating on the Bitcoin network within the Ordinals method, is among the leading gainers in the marketplace today. This is occurring at once when BTC rate is battling to hang on the $60,000 mark.

The aberration in efficiency recommends that ORDI might be decoupling from BTC in spite of sharing a solid connection. What could be sustaining this?

No Bitcoin, No Worry for ORDI

ORDI, the initial BRC-20 token, obtained substantial interest following its launch in March 2023. Improved Bitcoin’s blockchain, ORDI’s rate has actually very closely adhered to BTC’s motions. As an example, when BTC rose to its all-time high in March 2024, ORDI additionally came to a head, getting to $96.31.

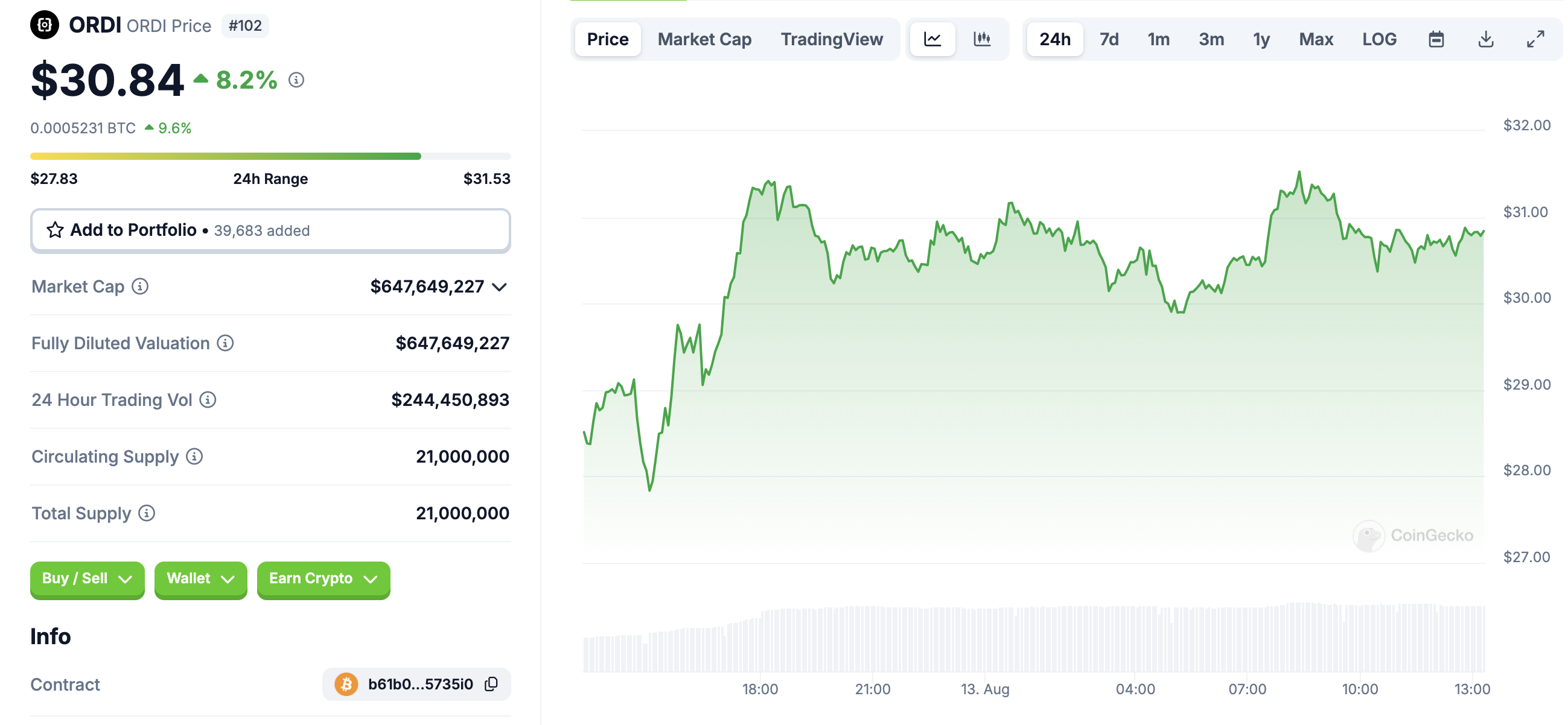

Nonetheless, ORDI isn’t the only BRC-20 token revealing this sort of efficiency; 1000SATS (SATS) is experiencing comparable fads. Currently, ORDI’s rate is $30.83, noting an 8.20% rise in the last 24-hour.

Learn More: Leading 5 BRC-20 Systems To Profession Ordinals in 2024

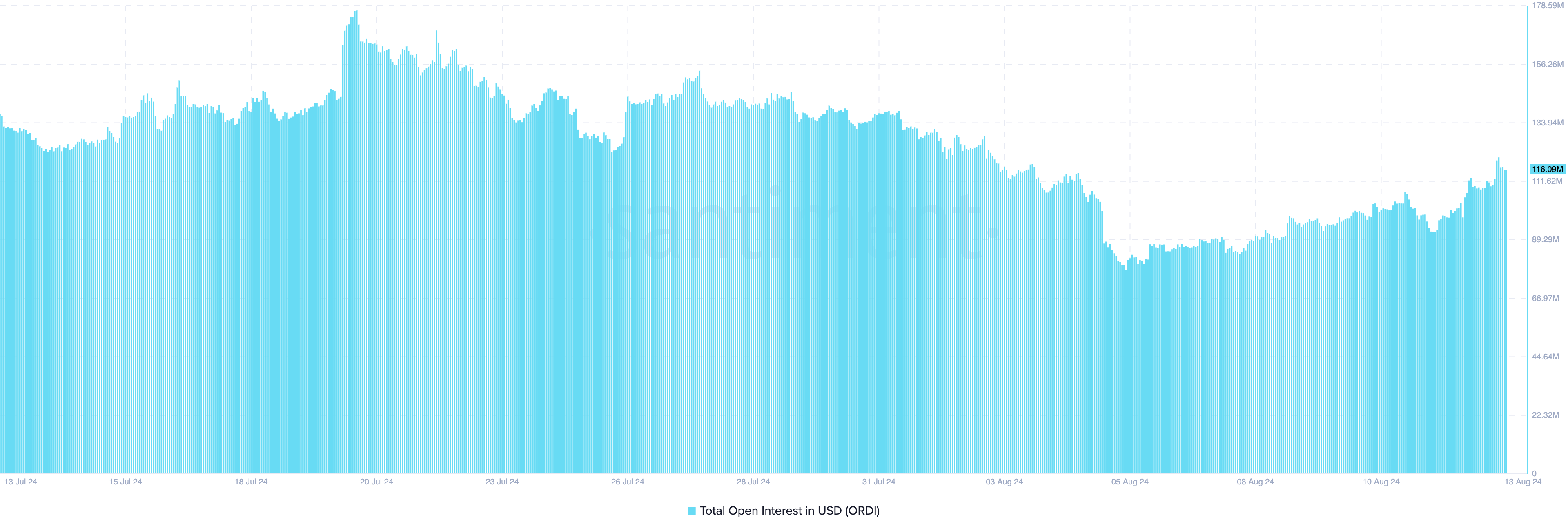

Along with the rate, Open up Passion (OI) has actually additionally increased. Open up Passion stands for the worth of impressive agreements in the acquired market. A rise in OI shows a rise in speculative task connected to the cryptocurrency, while a reduction recommends a decrease in web positioning.

From a trading point of view, if OI boosts in addition to ORDI’s rate, the higher pattern is most likely to proceed. Nonetheless, if investors begin shutting their placements, the resulting decline in OI might deteriorate the continuous pattern.

In ORDI’s instance, the Open Passion appears to be battling to preserve its current energy, recommending that the uptrend might delay unless investors remain to boost web positioning.

ORDI Cost Forecast: $36 or $26? Purchasers Will Certainly Select

In spite of the decrease in OI, the everyday graph reveals the development of a dropping wedge for the token. A dropping wedge is a favorable technological pattern, which recommends that the drop has actually shed energy. Identified by 2 descending inclines, a favorable recognition shows up when customers significantly get in the marketplace.

Nonetheless, the cash Circulation Index (MFI), in spite of its current increase, stays listed below the neutral line. This recommends that some investors are purchasing ORDI, yet the stress might not suffice to maintain the uptick.

Must the cash circulation rise, ORDI’s rate might surround the high-ranking resistance at $36.10. Nonetheless, a decrease in purchasing stress might revoke the thesis, potentially driving a decrease to $26.75.

Learn More: ORDI (ORDI) Cost Forecast 2024/2025/2030

Additionally, market individuals might require to look out for Bitcoin. If ORDI go back to associating with BTC once again, the coin’s motion might have a solid impact on the crypto’s following instructions.

Please Note

In accordance with the Count on Job standards, this rate evaluation post is for informative objectives just and must not be taken into consideration economic or financial investment guidance. BeInCrypto is devoted to precise, honest coverage, yet market problems undergo alter without notification. Constantly perform your very own study and talk to an expert prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.