Avalanche (AVAX) will certainly go through an additional token unlock on August 20. This rise in supply, a remarkable occasion, can affect AVAX’s rate as it has in the past.

Nevertheless, an evaluation of the Avalanche network discloses a variation in between 2 crucial stakeholders.

Avalanche Secret Numbers Search In Various Instructions

Formerly, BeInCrypto had actually reported exactly how AVAX will certainly open 9.54 million symbols, valued at $251 million at the time. The circulation, readied to most likely to the Avalanche group and critical capitalists, can cause rate volatility for AVAX.

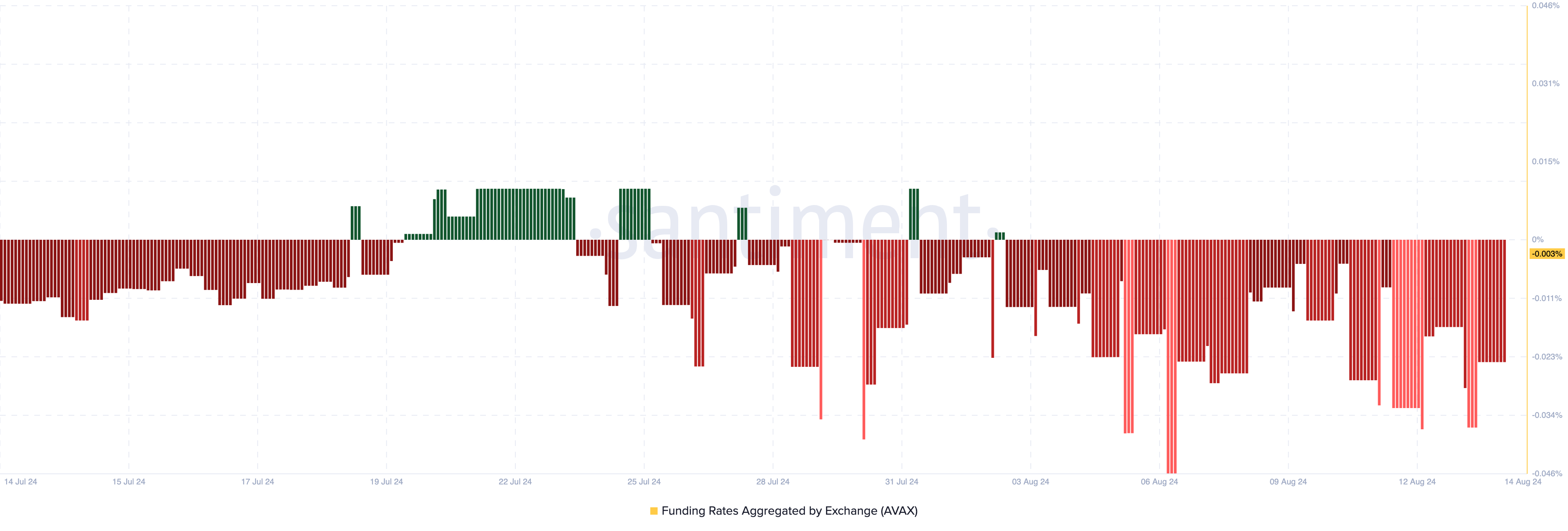

As the occasion techniques, on-chain information places a remarkable distinction in belief in between whales and investors in the by-products market. According to Santiment, AVAX’s Financing Price is adverse.

In non-technical terms, the Financing Price is the expense of holding an employment opportunity in the marketplace. If financing declares, the agreement rate professions at a costs to the place rate, recommending that investors want to pay a greater charge while banking on climbing costs.

Learn More: What Is Avalanche (AVAX)?

An unfavorable financing, as in AVAX’s scenario, suggests a bearish belief, recommending that investors anticipate the rate to drop. Nevertheless, whales show up to have a various expectation. According to IntoTheBlock, the Big Owners Netflow on Avalanche’s network has actually climbed by 33.66% in the previous 7 days.

This netflow stands for

stands for the distinction in between Big Owners’ Inflow and Discharge. A rise in netflow suggests that whales are collecting greater than they are offering, while a reduction recommends higher circulation.

The favorable distinction for AVAX recommends build-up. From a rate point of view, if this fad proceeds, it can indicate boosted self-confidence in a solid temporary efficiency for AVAX.

AVAX Rate Forecast: No Victor, No Vanquished

At press time, AVAX trades at $21.27 and has actually been floating around the very same area for the previous couple of days. In in between this combination, the token briefly slid listed below $20 on August 8, as seen on the day-to-day graph.

The Relocating Typical Merging Aberration (MACD) reveals bearish energy for AVAX. The MACD gauges energy by determining the distinction in between 2 relocating standards. When the MACD analysis is over the signal line, it suggests favorable energy; when below, it signifies bearish energy. For AVAX, the MACD is listed below the signal line, recommending that an outbreak can be hard.

In addition, AVAX might proceed settling in between a swing low of $20.43 and a swing high of $22.79. The Fibonacci retracement indication supplies additional understandings right into possible assistance and resistance degrees.

Learn More: 11 Ideal Avalanche (AVAX) Budgets to Take Into Consideration in 2024

As revealed over, an extremely bearish circumstance might drive AVAX to $17.10. Nevertheless, if whale build-up increases, the token might strike a very first target of $23.07 prior to a feasible retest of $26.64.

Please Note

According to the Depend on Task standards, this rate evaluation write-up is for informative objectives just and need to not be thought about monetary or financial investment recommendations. BeInCrypto is devoted to exact, honest coverage, however market problems go through transform without notification. Constantly perform your very own research study and speak with a specialist prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.