Duo 9, a popular crypto teacher and expert, postured a concern nobody wishes to listen to. “Suppose altcoin period never ever comes?,” he asked, with numerous information to back his unsupported claims.

An altcoin period is a casual term defining a stage where buying altcoins offers far better returns than putting funding right into Bitcoin (BTC).

Expert Clarifies Altcoin Period Hold-up

After the 4th Bitcoin halving, the crypto market’s following significant emphasis, in addition to Ethereum ETFs (exchange-traded funds) authorizations and launches, was the expectancy of an altcoin period. A number of vital occasions normally lead up to this stage.

Initially, fresh funding goes into the cryptocurrency market, originally moving right into stablecoins, Bitcoin, or Ethereum. These possessions are focused on because of their viewed security contrasted to smaller sized market cap cryptocurrencies. Next off, this increase of funding activates a market rally.

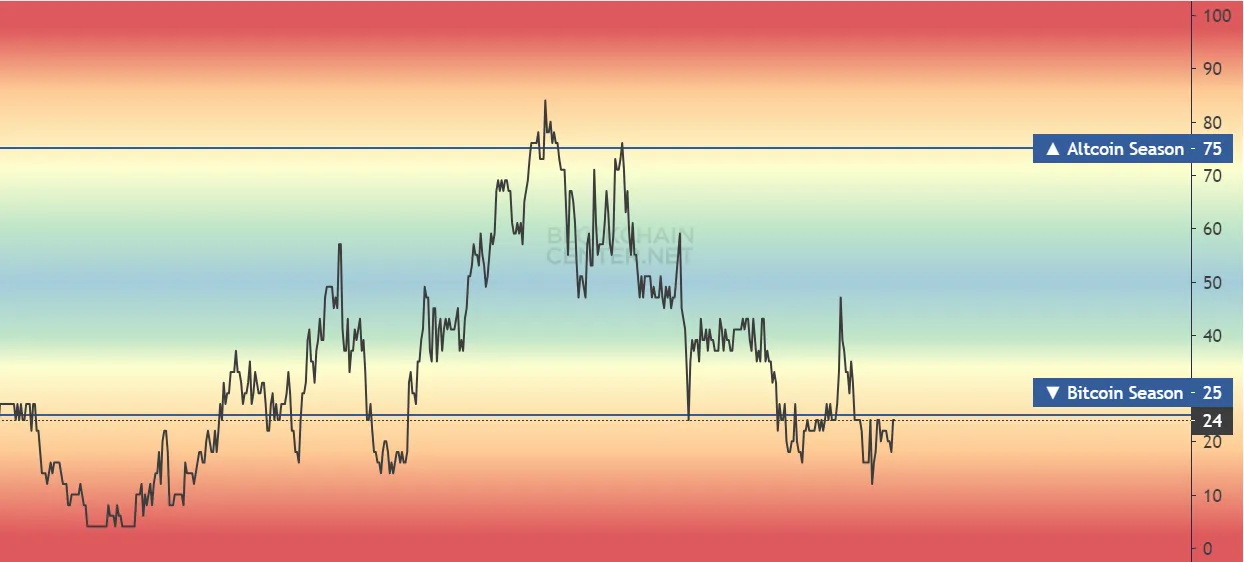

Lastly, make money from these possessions, together with extra funding, start to move right into altcoins. This funding turning is what triggers an altcoin period. According to the altcoin period index, the crypto markets are presently still in the Bitcoin period.

Unfavorable Circulations for Ethereum ETFs

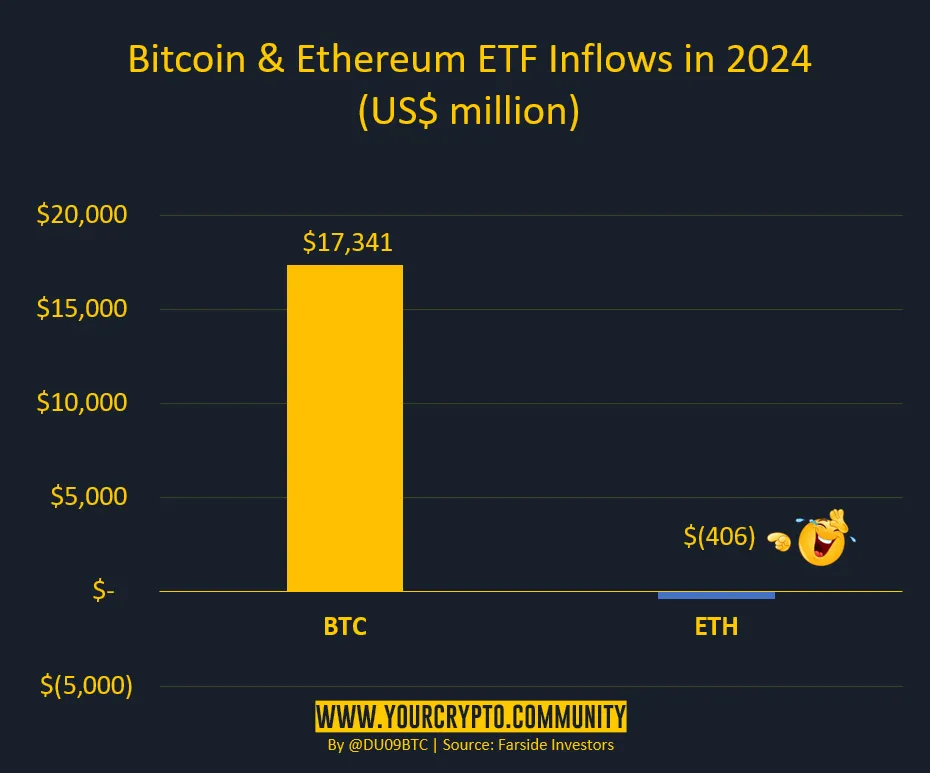

Duo 9 lays out a circumstance where the series causing an altcoin period hasn’t completely appeared. He recommends that spending totally in altcoins could be bothersome, indicating adverse circulations for Ethereum ETFs as a worrying indication.

” Because January 2024, the Bitcoin ETFs handled to draw in over $17 billion in web financial investments after Grayscale sales. Ethereum’s ETF went reside in July. Web equilibrium on that particular? -$ 406 million,” the expert wrote.

Learn More: What Is Altcoin Period? A Comprehensive Overview

The adverse circulations for Ethereum ETFs come amidst recurring Grayscale consumer redemptions complying with the conversion of its depend ETFs. Prior to the authorization of area ETFs, the Grayscale Bitcoin Count On (GBTC) was enabling financiers to retrieve shares for worth in United States bucks. Currently, with BTC and ETH ETFs readily available, consumers are choosing to retrieve their shares by offering Bitcoin and Ethereum, adding to the adverse circulations.

Per the expert, while Grayscale’s consumers marketed $2.3 billion in ETH considering that July, ETF acquire stress has actually not sufficed to counter this sell-off. Duo 9 sees no distinction for an altcoin period if a Solana ETF launches.

Nonetheless, it is very important to acknowledge that the ETH ETF market is still in its beginning. Provided this context, it’s important to comprehend that while the temporary expectation for area Ethereum ETFs might be bearish, the mid- and lasting potential customers continue to be favorable.

In knowledge, it took a while prior to Bitcoin rallied complying with area BTC ETF launches on January 11. The leader crypto sliced flat for somewhat over a month prior to prolonging north.

” The factor that capitalist acquiring of the brand-new Bitcoin ETFs isn’t rising the rate of Bitcoin is that the discharges from GBTC plus marketing of BTC surpass the consolidated inflows right into every one of the various other 10 Bitcoin ETFs. As soon as the first ETF need winds down, I anticipate a larger rate decrease,” financial expert Peter Schiff said at the time.

Considering that the launch of Ethereum ETFs on July 23, hardly a month has actually passed, leaving ETH with adequate time for rate exploration. As soon as Grayscale consumer redemptions convenience, ETH ETF moves can maintain in the favorable, with funding inflows right into Ethereum turning right into altcoins.

Bitcoin Supremacy Outbreak

The expert likewise bases his ‘no altcoin period’ thesis on the outbreak seen in the Bitcoin supremacy graph. This suggests BTC outshines altcoins, recommending an uncertainty in the last. Based upon CoinGecko information, BTC supremacy presently rests at 53.8%.

This turnover is most likely credited dominating market unpredictability amidst international geopolitical stress, political craze in the United States, and economic crisis worries, to name a few volatility-inducing stories. These timely financiers to rally behind Bitcoin, a trip to security, as BTC is taken into consideration a much better place than altcoins.

Nonetheless, some financiers watch high Bitcoin supremacy as a possibility to build up altcoins at reduced costs. When Bitcoin’s supremacy is high, altcoins might be underestimated about Bitcoin, offering an acquiring chance for those that rely on the lasting possibility of certain altcoins.

Learn More: 11 Cryptos To Contribute To Your Profile Prior To Altcoin Period

Based upon the graph above, while Bitcoin supremacy remains to increase, it comes close to essential resistance, which can see altcoins progress. Nonetheless, amidst the suspicion for an altcoin period, some say also if it does come, it might stop working to be as extensive as that of 2017 and 2020.

” This story comes every cycle by Bitcoin maxis and never ever functioned. Ultimately, a part of the bitcoin supply moves right into ALTs when the supremacy begins plunging. There comes a time when supremacy goes listed below 45% and it would certainly occur this cycle too,” one more X customer added.

Altcoin period hold-ups regardless of, experts are currently viewing some altcoins this month, with some reviving hope that hold-up might not always indicate complete lack.

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to supply exact, prompt info. Nonetheless, viewers are recommended to validate realities individually and seek advice from a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.