Ethereum gas charges have actually plunged to their cheapest degree in numerous years, driven by raising deals on the network’s layer-2 networks.

This considerable decrease has actually made on-chain deals more affordable for individuals and triggered conversations concerning their lasting result on the network.

Ethereum’s Gas Charge Decrease Brings About Supply Rise

According to Etherscan information, the ordinary gas charge on the Ethereum mainnet dropped below 1 Gwei the other day however has because rebounded to about 2 Gwei, or about $0.06. At the same time, some deals might still bring in charges of as much as 5 Gwei, approximately $0.22.

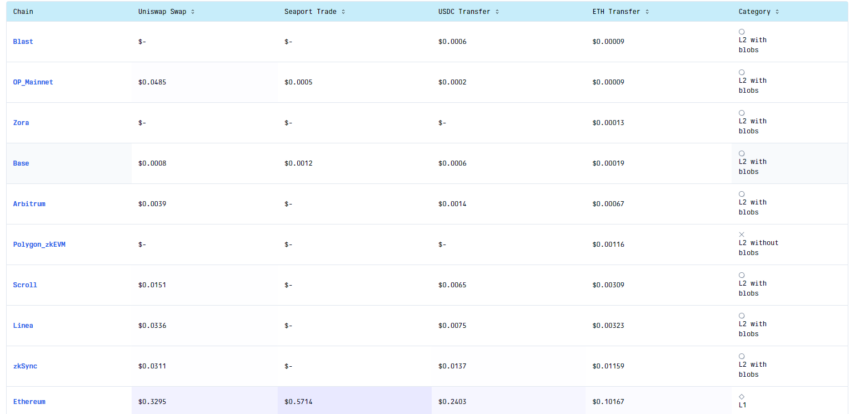

This charge decrease is likewise obvious throughout Ethereum’s Layer 2 scaling services. Information from Gasfees.io suggests that ordinary charges on Positive outlook, Base, Arbitrum, and Linea are presently listed below $0.01.

Learn More: Ethereum (ETH) Cost Forecast 2024/2025/2030

Market onlookers stated the decrease in gas charges might be connected to the intro of blob-based deals with the Dencun upgrade in March. This upgrade has actually dramatically boosted Layer 2 deal quantities as a result of the reduced charges.

For context, L2beats information reveals that famous layer-2 networks like Base and Arbitrum currently refine extra deals per 2nd than Ethereum itself. Over the previous day, Base dealt with 39.80 deals per 2nd (TPS), and Arbitrum handled 17.28 TPS. On the other hand, Ethereum refined around 12.17 TPS.

These patterns have actually led some stakeholders, such as Martin Koppelman, Founder of Gnosis, to support for boosted Layer 1 task. Koppelman recommends that increasing the gas restriction, despite reduced charges, can be a tactical relocate to increase base layer use.

” IMO Ethereum requires to obtain even more L1 task once again and also if it appears counterproductive at such reduced prices, increasing the gas restriction can be component of a technique,” he stated.

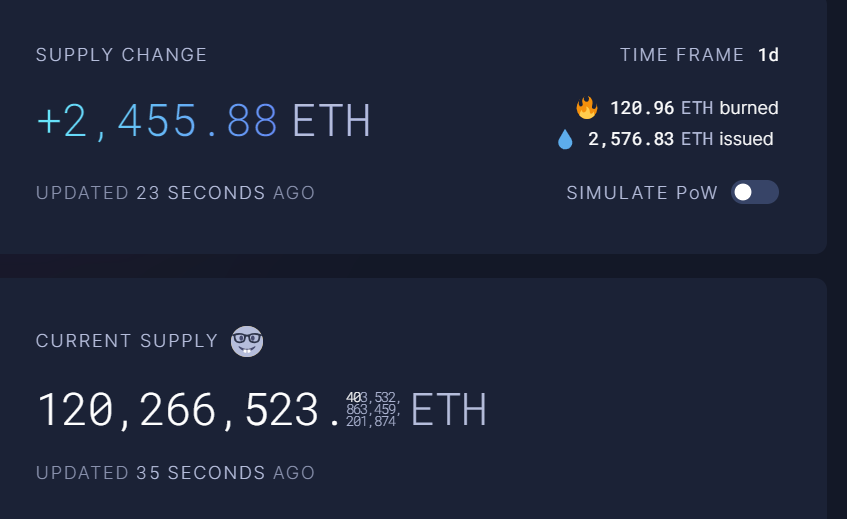

On the various other hand, the decrease in charges has actually stimulated issues concerning network rising cost of living. With less ETH being shed, the network’s supply has actually been increasing.

According to Ultrasound.money, just 120 ETH were shed in the previous day, while the supply boosted by greater than 2,500 ETH. This inequality recommends an expanding ETH supply, neutralizing the deflationary fad formerly observed.

Learn More: Exactly how to Buy Ethereum ETFs?

If this fad proceeds, Ethereum’s supply can increase by over 943,000 ETH, equal to $2.5 billion, within the following year.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to give exact, prompt details. Nevertheless, visitors are encouraged to confirm truths individually and talk to an expert prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.