( Bloomberg)– Gregg Abella, a cash supervisor in New Jacket, had not been anticipating the flooding of telephone call he obtained from customers this previous week. “All of a sudden individuals are claiming to us, ‘Wow, do you believe it’s a great time for us to include bonds?'”

Many Review from Bloomberg

It’s something of a vindication for Abella. He’s been, in his words, “banging the gong” for bonds– and property diversity, much more extensively– for many years. This was long an extremely out-of-favor referral. Up until, that is, supplies began to roll this month. Swiftly, need for the safety and security of financial obligation skyrocketed, driving 10-year Treasury returns at one factor early recently to the most affordable degrees given that mid-2023.

The rally has actually stunned several on Wall surface Road. The old-time connection in between equities and bonds– where fixed-income offsets losses when supplies plunge– had actually been included question in recent times. Specifically in 2022, when that relationship entirely fell down as bonds stopped working to give any kind of security in any way in the middle of the slide in supplies. (United States national debt, as a matter of fact, published its worst losses on document that year).

However whereas the selloff at that time was set off by a rising cost of living episode and the Federal Book’s shuffle to stop it by ratcheting up rates of interest, this newest equities downturn has actually been stimulated in huge component by concern the economic situation is getting on an economic crisis. Assumptions for price cuts, therefore, have actually installed quickly, and bonds do quite possibly because atmosphere.

” Lastly the factor for bonds is beaming via,” claimed Abella, whose company– Financial investment Allies Possession Monitoring– supervises concerning $250 million consisting of for affluent Americans and nonprofits.

As the S&P 500 Index shed concerning 6% throughout the very first 3 trading days of August, the Treasury market published gains of nearly 2%. That made it possible for financiers with 60% of their possessions in supplies and 40% in bonds– an as soon as classic approach for developing a varied profile with much less volatility– to surpass one that just held equities.

Bonds would ultimately eliminate much of their gains as supplies maintained over the previous couple of days, yet the more comprehensive factor– that set revenue functioned as a bush at a minute of market disorder– continues to be.

” We have actually been acquiring national debt,” claimed George Curtis, a profile supervisor at TwentyFour Possession Monitoring. Curtis in fact initially started including Treasury bonds months earlier– both as a result of the greater returns they currently supply and due to the fact that he also has actually anticipated the old stock-bond connection to return as rising cost of living declined. “It exists as a bush,” he claimed.

Inverse Again

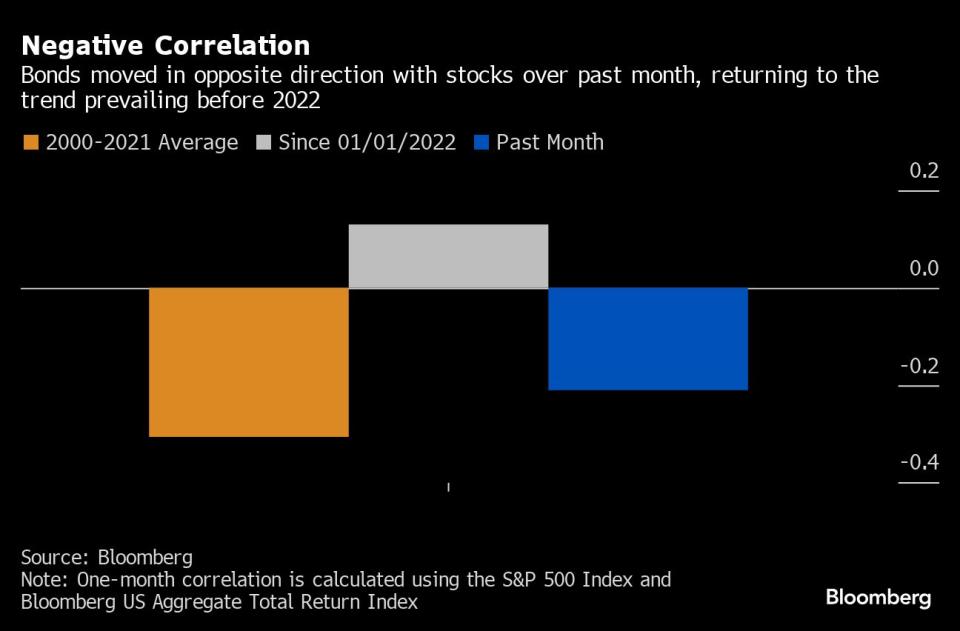

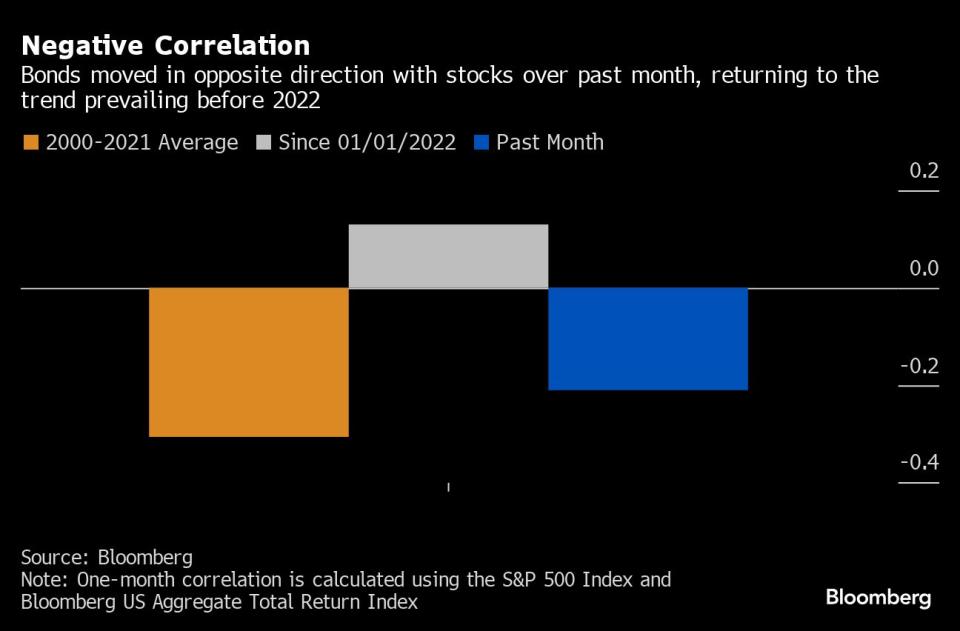

There’s an additional means to see that the conventional, inverted connection in between both property courses– which mainly held for the very first pair years of this century– is back, at the very least in the meantime.

The one-month relationship in between supplies and bonds recently got to one of the most unfavorable given that the after-effects of in 2014’s regional-bank situation. An analysis of 1 shows the possessions relocate lockstep, while minus 1 recommends they relocate the contrary instructions. A year earlier, it overshadowed 0.8, the greatest given that 1996, showing bonds were virtually ineffective as profile ballast.

The connection was switched on its head as the Fed’s hostile price walks starting in March 2022 created both markets to crater. The supposed 60/40 profile shed 17% that year, its worst efficiency given that the worldwide economic situation in 2008.

Currently the background has actually changed back for bonds, with rising cost of living much more in check and the emphasis transforming to a possible United States economic downturn each time when returns are still well over their five-year standard.

The coming week brings lots of danger for bond bulls. July records schedule out on United States manufacturer and customer costs and any kind of indicator of a revival in rising cost of living might press returns back up. They currently started ticking greater on Thursday after once a week unemployed cases– an information factor that’s unexpectedly acquiring interest as economic downturn problems swirl– remarkably dropped, solidifying signals that the labor market is damaging.

For all the enjoyment concerning bonds today, there are still great deals of individuals like Expense Eigen that are wary of leaping back right into the marketplace.

Eigen, that handles the $10 billion JPMorgan Strategic Revenue Opportunities Fund, has actually held majority of it in money– mainly in money-market funds that purchase cash-equivalent possessions such as Treasury costs—- for the previous couple of years. At simply over 5%, temporary T-bills generate at the very least a complete percent factor greater than long-lasting bonds, and Eigen’s not persuaded that rising cost of living is absolutely tame adequate neither the economic situation weak adequate to warrant the sort of Fed reducing that would certainly alter that vibrant.

” The price cuts are mosting likely to be tiny and step-by-step,” he claimed. “The most significant issue for bonds as a bush is that we still have an inflationary atmosphere.”

What Bloomberg Knowledge Claims

” The return contour has a tendency to bull steepen entering into an economic crisis. The extremely quick uninversion of the 2-year/10-year Treasury contour on Aug. 5 might presage a bull-steepening fad that we anticipate to continue as the economic situation reduces. On the other hand, we believe the equity/bond relationship might be stabilizing.”

—- Individual Retirement Account F. Jacket and Will Hoffman, BI planners

Maybe. However an expanding variety of financiers have, like Curtis, delegated rising cost of living to an additional problem. Throughout the elevation of recently’s market volatility, bond financiers sent out a short lived message that their stress over development were coming to be alarming. Returns on two-year notes quickly traded listed below those on 10-year bonds for the very first time in 2 years, a sign the marketplace was supporting for economic downturn and quick price decreases.

” With rising cost of living trending reduced and with dangers far more well balanced and even slanted in the direction of problems concerning even more considerable financial slowing down, we do believe bonds are mosting likely to display even more of their protective attributes,” claimed Daniel Ivascyn, primary financial investment police officer at Pacific Financial investment Monitoring Co.

What to Enjoy

-

Financial information:

-

Aug. 12: New York City Fed 1-year rising cost of living assumptions; month-to-month budget plan declaration

-

Aug. 13: NFIB local business positive outlook; manufacturer consumer price index

-

Aug. 14: MBA home mortgage applications; customer cost index; actual ordinary incomes

-

Aug. 15: Realm production; retail sales; Philly Fed service expectation; unemployed cases; import and export consumer price index; commercial manufacturing; ability application; production (SIC) manufacturing; service stocks; NAHB real estate market index; TIC information

-

Aug. 16: Real estate begins; structure licenses; NY Fed solutions service task; College of Michigan view

-

-

Fed schedule:

-

Aug. 13: Atlanta Fed Head Of State Raphael Bostic

-

Aug. 15: St. Louis Fed Head Of State Alberto Musalem; Philly Fed Head Of State Patrick Harker

-

Aug. 16: Chicago Fed Head Of State Austan Goolsbee

-

-

Public auction schedule:

-

Aug. 12: 13-, 26-week costs

-

Aug. 13: 42-day money administration costs

-

Aug. 14: 17-week costs

-

Aug. 15: 4-, 8-week costs

-

— With support from Michael Mackenzie.

Many Review from Bloomberg Businessweek

© 2024 Bloomberg L.P.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.