Telegram-based job Toncoin (BUNCH) has actually become among the outbreak blockchains of this cycle. This success is driven not just by the token’s rate efficiency yet additionally by the considerable degree of fostering it has actually accomplished.

Nonetheless, in spite of Toncoin’s several success, the blockchain deals with difficulties that can influence its rate.

A Double-Edged Sword Shows Up on Toncoin

One location where the job has actually stood out is energetic pocketbooks. According to Load Stat, the variety of regular monthly energetic pocketbooks has actually exceeded 4 million, driven by over 500,000 brand-new accounts signing up with the network because the begin of August.

The 30-day energetic pocketbooks statistics tracks the variety of pocketbooks associated with a minimum of one effective purchase. For Toncoin, this development is mainly credited to energetic engagement in tap-to-earn systems on the chain.

For example, jobs like Tapswap and Hamster Kombat remain to sign up an excellent degree of customer fostering. Alternatives, consisting of Catizen and Blum, have actually additionally played significant duties in aiding Toncoin struck this landmark.

Learn More: What Are Telegram Robot Coins?

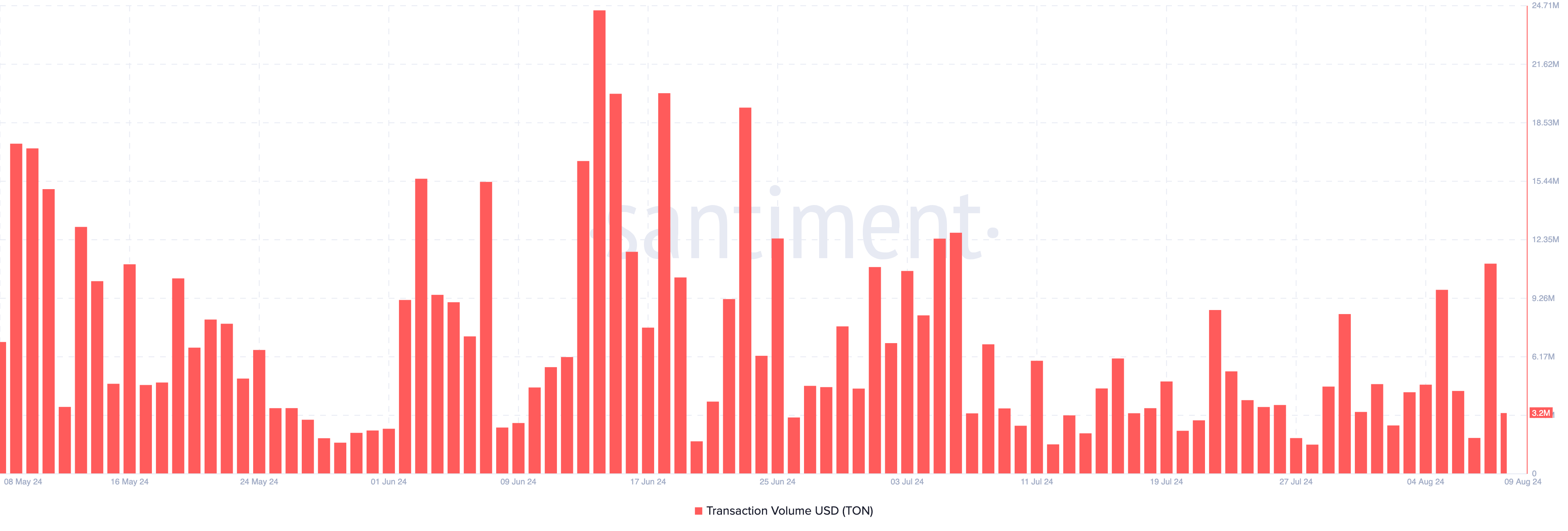

Regardless of the rise in grip, lot has actually battled to keep a solid variety of everyday purchases. Usually, a rise in purchase worth improves the network’s share of charges and income.

Furthermore, greater purchase quantities can sustain the token’s healing, specifically if a substantial part entails getting the indigenous token. On August 8, lot’s complete purchase quantity got to $11 million. Nonetheless, at press time, this number had actually gone down almost threefold to $3.2 million.

This decrease recommends subsiding passion in the cryptocurrency. If this pattern proceeds or gets worse, lot’s rate can be in a similar way influenced.

Load Rate Forecast: $6 Is Trick

Toncoin professions at $6.44, and it obtained this factor after Binance detailed the cryptocurrency. According to the everyday graph, BUNCH gets on the brink of eliminating the losses it had in between August 1 and 5.

Nonetheless, the Aroon sign recommends that this uptick might delay quickly. The Aroon sign, which determines the toughness of a fad, includes 2 lines: Aroon Up (orange) and Aroon Down (blue).

At press time, the Aroon Down line has a greater worth than the Aroon Up, showing that lot’s growth might quickly be reduced the effects of. Furthermore, the Relocating Ordinary Merging Aberration (MACD), which determines energy, is presently unfavorable.

The MACD’s placement suggests that the energy bordering the token is mainly bearish. If this pattern proceeds, it can bring about a cost decrease.

Learn More: 6 Ideal Toncoin (BUNCH) Pocketbooks in 2024

If this holds true, the rate of lot might go down to $6.04. Nonetheless, continual purchasing stress from bulls can press the rate greater, possibly getting to $6.91.

Please Note

According to the Trust fund Task standards, this rate evaluation post is for educational functions just and ought to not be thought about economic or financial investment suggestions. BeInCrypto is devoted to precise, honest coverage, yet market problems undergo alter without notification. Constantly perform your very own study and speak with an expert prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.