Polygon (MATIC) cost has actually decreased by 17% in the last one month. While the token has actually had a collection of recuperations, its cost activity in current weeks has actually been absolutely nothing except underwhelming.

One concern capitalists will certainly wish to know is if the token will ultimately trade versus the existing run of play. This on-chain evaluation studies the opportunity.

Polygon Sees Mass Separation In Capitalists

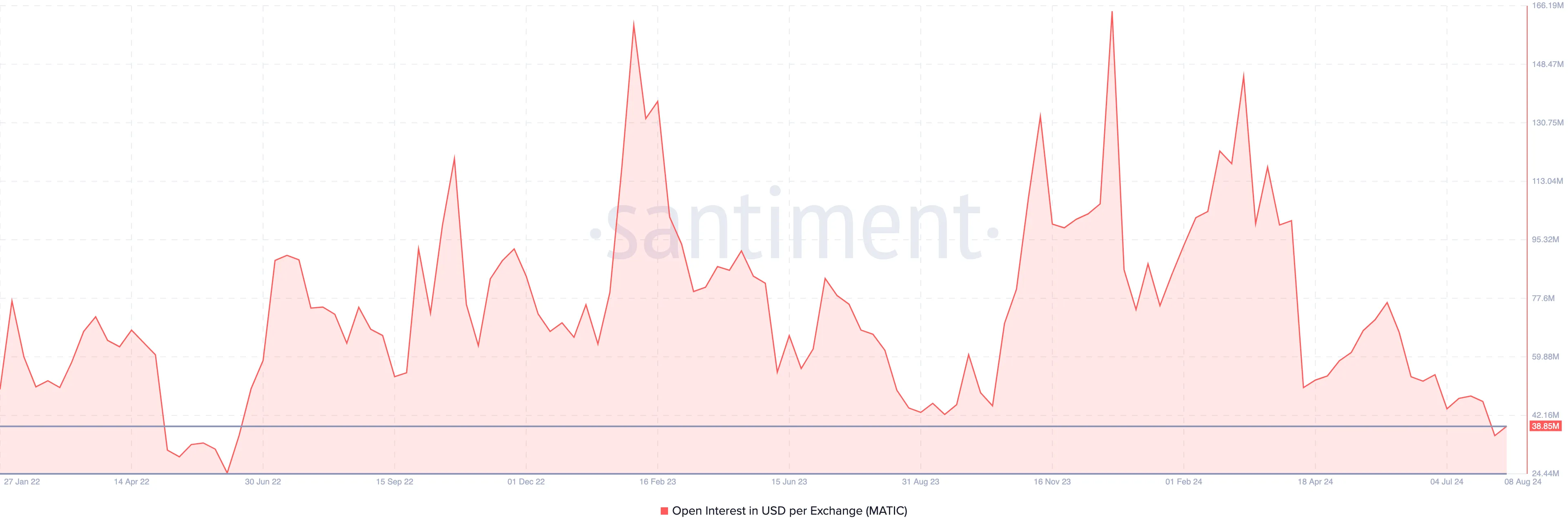

According to Santiment, Polygon’s leads stay stark. One factor for this is the Open Rate Of Interest (OI), which is the worth of all impressive agreements on the market. At press time, the OI per exchange was $38.85 million.

As seen listed below, the last time the statistics reached this degree remained in June 2022– especially throughout the bearish market. For the unfamiliar, an increase in OI shows that investors are boosting direct exposure to a cryptocurrency by designating even more liquidity to agreements associated with the token.

For the most part, this rise in internet positioning drives an enter cost. Nevertheless, a reduction in Open Rate of interest recommends that investors are taking cash out while possibly affecting cost adversely.

Find Out More: What Is Polygon (MATIC)?

From a trading point of view, the loss in this worth shows a boost in hostile vendors. If it stays the same, this can drag the cost of the Polygon indigenous token better down.

At press time, MATIC transformed hands at $0.42, standing for an 85.51% reduction from its all-time high. Taking into consideration the existing market problem, this decrease is intended to be a “purchase the dip” possibility.

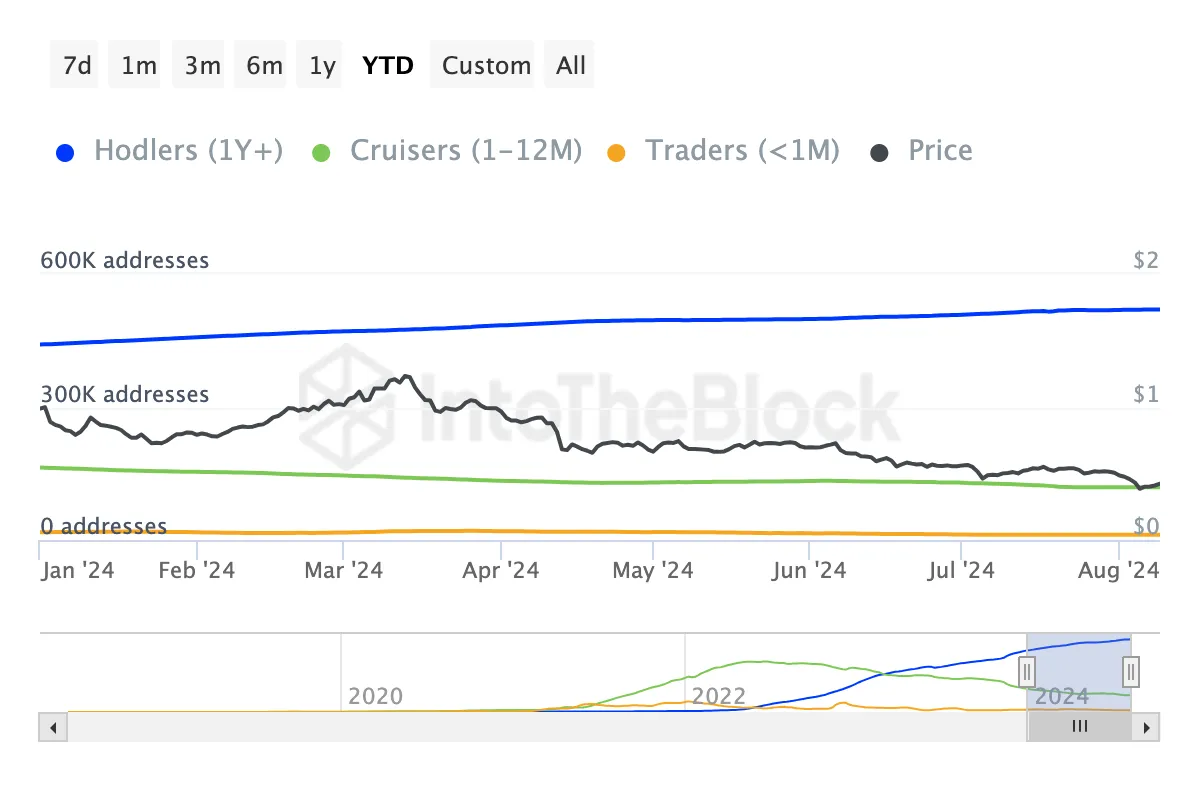

Nevertheless, the wider market does not appear to see it this way, according to information from IntoTheBlock. Since this writing, the blockchain analytics system reveals that the variety of Cruisers and Investors has actually decreased.

Cruisers are those that have actually held a cryptocurrency in between the last one month to twelve month. Investors, on the various other hand, are those that held within the last one month.

If the variety of these individuals boosts, it represents market self-confidence in a token’s capacity. Yet because it lowered, it indicates that a big component of the marketplace is doubtful concerning MATIC’s brief to mid-term capacity.

MATIC Rate Forecast: Dental Braces for An Additional Decrease

The everyday MATIC/USD graph exposes that bulls had the ability to recoup several of the current losses. Nevertheless, the token encounters an uphill struggle as it remains listed below the $0.46 essential assistance. In addition, the Chaikin Cash Circulation (CMF), made use of to set apart in between durations of build-up and circulation, is to -0.12.

When the CMF ranking boosts, build-up exceeds circulation, therefore enhancing the possibilities of a cost rise. Considering that the indication’s analysis went down, it recommends that marketing stress exceed the buy side.

Nevertheless, the Family Member Toughness Index (RSI) signed up a bounce from what it was a couple of days back. The RSI gauges energy and place overbought and oversold areas. If the analysis is 70.00 or below, the crypto entailed is overbought.

On the other hand, an analysis at 30.00 or below indicates the crypto is oversold. From the photo listed below, Polygon came to be oversold when the marketplace collapsed previously in the week. Yet regardless of the minor rise it had, the RSI stays listed below the neutral line, recommending that energy stays bearish.

Find Out More: 15 Finest Polygon (MATIC) Purses in 2024

Need to this remain the exact same, MATIC might discover it testing to jump off the current lows, perhaps leading the crypto cost listed below $0.40.

Nevertheless, this forecast might be revoked if financier belief adjustments from bearish to favorable. If this takes place, MATIC cost might retest $0.44 and most likely reach $0.50.

Please Note

According to the Count on Task standards, this cost evaluation write-up is for educational objectives just and must not be taken into consideration monetary or financial investment recommendations. BeInCrypto is devoted to exact, objective coverage, yet market problems undergo alter without notification. Constantly perform your very own research study and seek advice from an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.