Blockchain repayment task Surge, along with its indigenous token XRP, remained in the information for relatively appropriate factors throughout the week. This results from the rise in the cryptocurrency’s cost and the partial win in the long-lasting lawful fight in between Surge and the United States SEC.

These 2 occasions raised remarks on the internet, recommending an unmatched XRP rally. Nevertheless, significant monitorings on-chain disclose that this view might be imprecise.

Current Information Suggest Care for Surge Financiers

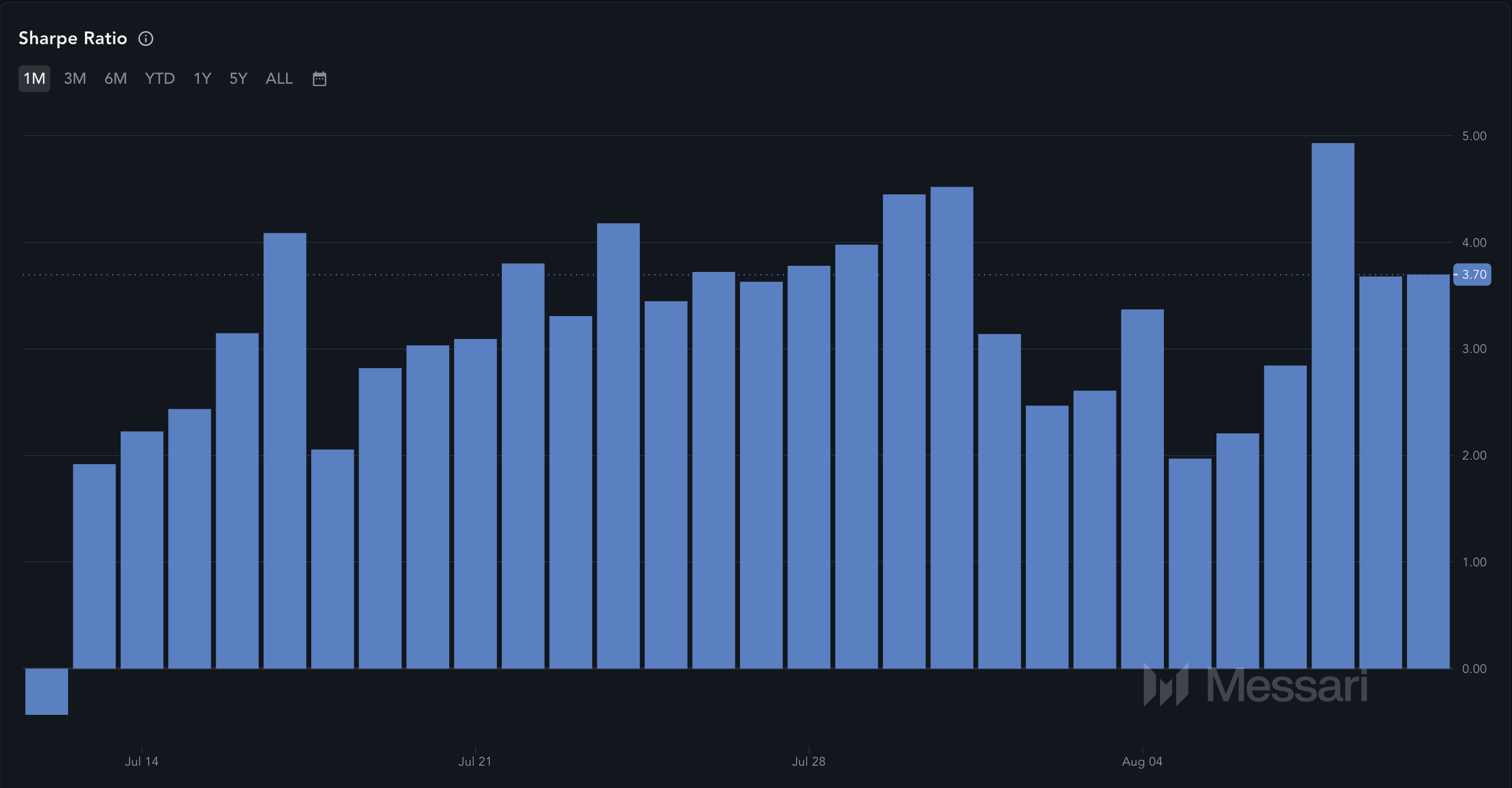

One means BeInCrypto assesses XRP’s possible efficiency is by assessing the Sharpe Proportion. This proportion determines the danger credited to a token contrasted to the return it can supply. An extremely favorable Sharpe Proportion suggests that a person can anticipate an excellent roi.

Nevertheless, an adverse proportion recommends that the crypto concerned is safe of returns or can pay losses. According to Messari, XRP’s Sharpe Proportion is 3.70.

Throughout the previously mentioned rally to $0.65, the proportion was 4.93, recommending that the token deserved acquiring. Since this writing, the adverse analysis recommends that this is no more the situation. As a result, the telephone calls for an extensive rally can be annuled.

Learn More: Every little thing You Required To Learn About Surge vs SEC

The proportion’s decrease can be connected to the loss in cost. On August 8, the worth scratched a 20% boost and traded at $0.65. At press time, it is $0.58.

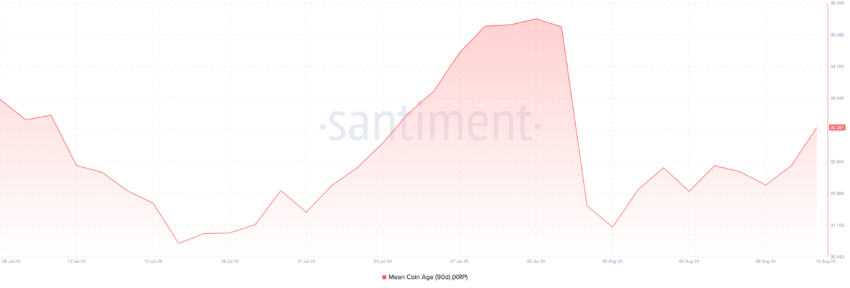

Past that, on-chain information from Santiment reveals that the Mean Coin Age (MCA) has actually raised. In other words, the MCA is the standard of all symbols on a blockchain. When the analysis boosts, it suggests that symbols that have actually stayed inactive for some time have actually been relocated.

Moreover, spikes in the coin age recommend that those relocating symbols will likely trade them. Nevertheless, reduced coin age symbolizes raising buildup and recommends that owners are retiring the symbols to a chilly pocketbook.

If the statistics remains to leap, after that XRP might encounter an additional round of marketing stress. Therefore, it might not be the most effective time to acquire the cryptocurrency for temporary gains.

XRP Rate Forecast: No Customers, No Healing

According to the day-to-day graph, the token can not accumulate on its earlier boost after striking a supply area around $0.62 and $0.63. This absence of need required a being rejected that saw the cost decrease to $0.56 prior to a small uptick.

In Addition, the Relocating Typical Merging Aberration (MACD) is adverse. The MACD utilizes the distinction in between the 12-day and 26-day rapid relocating standards to detect trend-following energy.

A favorable analysis of the MACD recommends that customers remain in control, and energy is favorable. Nevertheless, for XRP, the energy is bearish, meaning a feasible cost reduction. If this continues to be the very same, the token’s worth might go down to the $0.55 underlying resistance.

Learn More: Surge (XRP) Rate Forecast 2024/2025/2030

Nevertheless, in a very bearish circumstance, XRP might go down an additional 10% to sustain at $0.52. This can likewise become worse if the SEC charms and gains Surge. However if getting stress rises, the cost of XRP might experience an additional dive. Must that hold true, the cryptocurrency might try to retest $0.63.

Please Note

In accordance with the Trust fund Job standards, this cost evaluation write-up is for educational functions just and need to not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to precise, honest coverage, yet market problems undergo transform without notification. Constantly perform your very own study and speak with an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.