Surge, the economic modern technology company behind the XRP cryptocurrency, has actually started screening of its much-anticipated stablecoin, Surge USD (RLUSD).

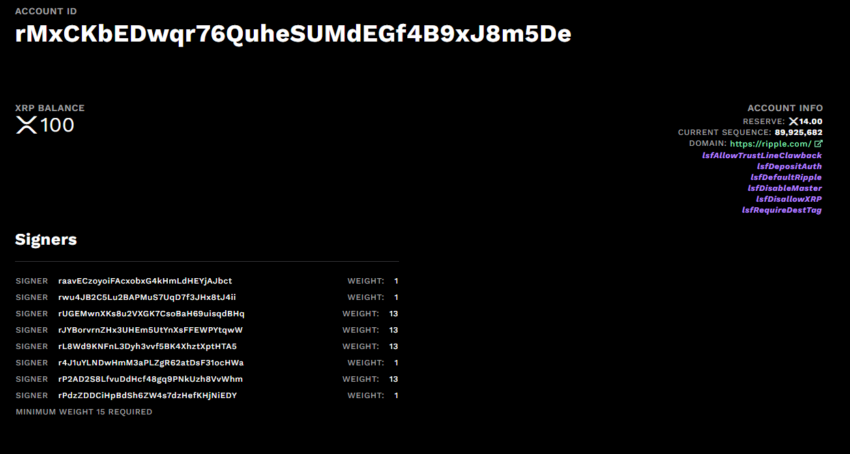

According to its main statement, the screening is presently being performed on both the XRP Journal (XRPL) and the Ethereum mainnet.

Stablecoin Risks: Surge Browses Lawful Fights and Market Need

The beta stage of Surge USD is important for making sure that the stablecoin satisfies the highest possible criteria prior to its more comprehensive launch. Surge has likewise emphasized that RLUSD is not yet offered for public acquisition or trading. It is presently going through extensive screening with choose venture companions.

” Please beware of fraudsters that assert they have or can disperse Surge USD,” the companywarned

Learn More: An Overview to the very best Stablecoins in 2024

The company better disclosed that RLUSD’s appraisal will certainly be secured 1:1 to the United States buck. Its support consists of a mix people buck down payments, temporary United States federal government treasuries, and various other money matchings.

Surge intends to fulfill the boosting need for reputable, secure electronic money by introducing RLUSD. By incorporating RLUSD with its existing cross-border settlement options, Surge looks for to supply a smooth experience for its worldwide clients. In addition, the firm prepares to boost openness and count on by supplying regular monthly attestations of its gets.

Surge disclosed its strategy to release the stablecoin in very early April. During that time, Brad Garlinghouse, Surge’s chief executive officer, highlighted the tactical relevance of the brand-new stablecoin.

” We have the years of experience, governing impact, a solid annual report, and a connect with near-global payment insurance coverage to supply the very best of crypto-enabled settlements making use of XRP and our (future) stablecoin with each other,” Garlinghouse affirmed.

Nevertheless, Surge’s passions with RLUSD may deal with obstacles, especially as a result of its lawful conflicts with the United States Stocks and Exchange Payment (SEC). BeInCrypto reported previously in Might that the SEC sent a redacted solutions respond quick versus Surge Labs and its execs, in which the firm highlighted the company’s strategies to provide a brand-new non listed crypto property. According to the exhibition area of the file, the SEC referred to Surge USD stablecoin as the property concerned.

Learn More: Every Little Thing You Required To Find Out About Surge vs SEC

Surge’s stablecoin growth complies with a current order from a government court to pay a $125 million fine for offering XRP without correct enrollment. This choice belongs to its long-lasting lawful fight with the SEC.

Regardless of safeguarding an extra beneficial result than at first anticipated, Surge still deals with prospective lawful obstacles. Records recommend that the SEC may appeal the judgment. The allure will likely concentrate on identifying XRP additional sales as safeties, and it may likewise test the court’s choice on programmatic sales and the minimized penalty Surge was purchased to pay.

Please Note

In adherence to the Count on Job standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to supply exact, prompt details. Nevertheless, visitors are recommended to validate truths individually and speak with a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.