BeInCrypto extensive Latam Crypto Summary brings Latin America’s crucial information and patterns. With press reporters in Brazil, Mexico, Argentina, and a lot more, we cover the most up to date updates and understandings from the area’s crypto scene.

Today’s summary consists of tales on Solana ETF authorization in Brazil, Bolivia’s passion in metal-backed stablecoins, and a lot more.

Brazil Authorizes Globe’s First Area Solana-Based ETF

The Brazilian Stocks and Exchange Compensation (CVM) has actually okayed for the launch of the globe’s very first area Solana-based exchange-traded fund (ETF). This item is presently in its pre-operational stage, with last authorization pending from Brazil’s major stock market, B3.

The area Solana ETF, taken care of by QR Possession and run by Vortx, will certainly track the CME CF Solana Buck Referral Price. Theodoro Fleury, Principal Financial Investment Police Officer of QR Possession, shared excitement concerning the brand-new ETF.

” This ETF declares our dedication to using top quality and diversity to Brazilian capitalists. We are happy to be international leaders in this section, settling Brazil’s placement as a leading market for controlled financial investments in crypto properties,” Fleury said

Learn More: Solana ETF Explained: What It Is and Exactly How It Functions

The ETF launch will certainly incorporate Solana right into traditional monetary systems and note the very first Solana-based item in Brazil. Over the previous couple of years, the Latam nation has actually revealed a solid passion in introducing monetary items, with B3 playing a significant function.

The exchange has actually detailed numerous crypto ETFs, consisting of those for Bitcoin and Ethereum, in between 2021 and 2022. Most lately, in March 2024, B3 started using BlackRock’s iShares Bitcoin Trust fund (IBIT).

Peru Launches New Anti-Money Laundering Policy for Crypto Business

Beginning August 1, Peru’s cryptocurrency market gets in a brand-new governing period. The Superintendency of Financial, Insurance Policy, and AFPs (SBS) has actually presented the nation’s first official framework targeted at stopping cash laundering and terrorist funding within the field.

This guideline calls for all cryptocurrency organizations, consisting of electronic pocketbook suppliers and financial investment systems, to adhere to rigorous anti-money laundering (AML) steps. The SBS will certainly manage these entities to guarantee they carry out a “risk-based technique” to discourage immoral tasks.

A crucial element of the brand-new regulations entails confirming the identification of purchase recipients. This action intends to stop corrupt funds and various other immoral gains from penetrating the monetary system. The guideline covers all purchases, also those under $1,000, with possibility for raised analysis in the future.

Learn More: Crypto Policy: What Are the Advantages and Drawbacks?

Non-compliance with these policies can lead to serious fines. Business that stop working to fulfill the brand-new criteria might encounter large penalties, the loss of their operating licenses, or the elimination of their sites and applications.

This step lines up with Suggestion 15 of the Financial Activity Job Pressure (FATF), which advises nations to impose lawful structures for the guidance of digital property company (VASPs). Peru’s relocation adheres to comparable activities in various other Latam nations, such as Argentina, where more stringent crypto policies were applied regardless of first resistance.

Paraguay Dismisses Exodus of Miners In Spite Of Greater Electrical Power Fees

Paraguay’s National Electrical energy Management (ANDE) has dismissed concerns over an exodus of cryptocurrency mining business adhering to a walking in power prices. The rise, which increased tolls by approximately 16% for massive cryptocurrency miners, triggered worries of business running away to bordering nations like Brazil.

The Paraguayan Chamber of Mining of Digital Properties (Capamad) had actually formerly advised that lots of cryptocurrency miners were thinking about moving to Brazil as a result of the climbing prices. Capamad recommended that Paraguay can shed its charm as a positive place for Bitcoin mining.

Nonetheless, Félix Sosa, head of state of ANDE, shot down these insurance claims, insisting that no mining business had actually left Paraguay. Sosa highlighted a current agreement with a big mining procedure, which protected the supply of 6 megawatts (MW) of power, making certain the ongoing procedure of 72 mining business in the nation.

” A technological assessment is made to validate where to mount, where ANDE has power accessibility for the setup of this sort of tons,” Felix Sosa explained to ABC.

Learn More: Is Crypto Mining Profitable in 2024?

Sosa additionally disclosed that these 72 business presently have 391 MW of gotten power, with an overall possibility of 821 MW. He shared that ANDE anticipates to produce $100 million in income from these agreements. In addition, 400 MW of brand-new agreements with mining business are pending authorization.

On the other hand, Jimmy Kim, supervisor of Capamad, kept in mind that the growth strategies of lots of cryptocurrency mining business currently prefer Brazil over Paraguay. He indicated an agreement authorized by Penguin Team for 400 MW in Brazil, with an additional 400 MW in the pipe.

In spite of these stress, ANDE has actually preserved its position, saying that the raised tolls will certainly help in reducing losses from prohibited mining tasks, which total up to over $185,000 yearly. The toll rise, described in Resolution 49238 provided on June 26, targets massive cryptocurrency miners especially.

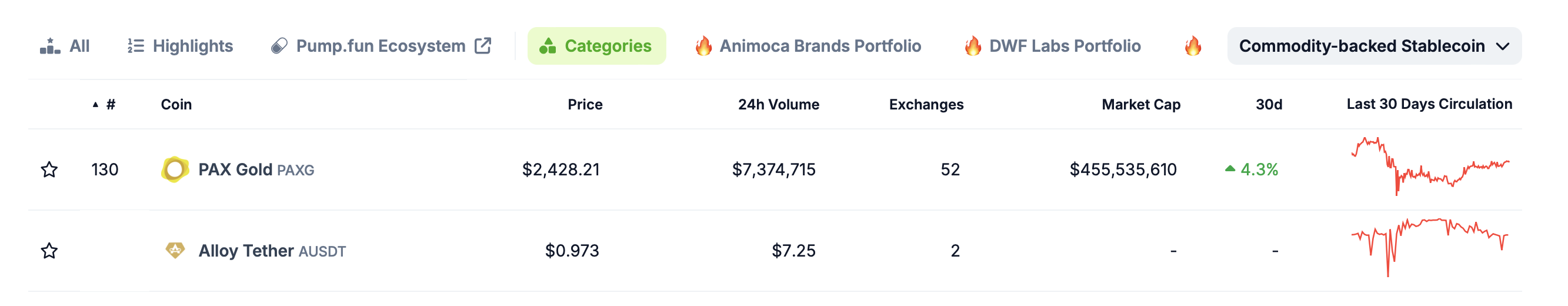

Bolivian Head Of State Luis Arce is supporting for the fostering of cryptocurrencies backed by metals, such as lithium and gold, as component of a more comprehensive method to reinforce Bolivia’s monetary system. This relocation intends to incorporate electronic properties with the nation’s bountiful mineral sources while decreasing dependence on the United States buck.

Head of state Arce highlighted that this effort would certainly advertise using metal-backed cryptocurrencies like Tether’s Alloy stablecoin (aUSDT). He kept in mind that the step is created to improve the circulation of international money right into Bolivia and reinforce the settlement system for worldwide purchases.

” The better circulation of cryptoassets backed by gold, lithium, and various other technical steels like Alloy (aUSDT) will certainly improve the inflow of international money right into the nation and grow the settlement system for worldwide acquisitions,” Arce stated.

Learn More: An Overview to the most effective Stablecoins in 2024

This press adheres to a current proposition by Congresswoman Mariela Baldivieso, that presented an expense in the Bolivian Legal Setting up to control Bitcoin. Baldivieso said that cryptocurrencies can make it possible for Bolivia to carry out purchases and get worldwide settlements without relying on standard fiat money.

In June, Bolivia raised its restriction on cryptocurrencies, permitting the usage of “digital properties” via Digital Repayment Instruments (EPI). The news by Edwin Rojas, head of state of the Reserve bank of Bolivia, noted a change in the nation’s monetary plans.

Uruguay Sees Climbing Rate Of Interest in Property Deals Utilizing Bitcoin

Uruguay is observing a climbing fad in property purchases carried out with Bitcoin, signifying a change in just how residential or commercial properties are dealt. Lately, a residential or commercial property was bought for $500,000 in Bitcoin, helped with by Banque Heritage as an intermediary.

This occasion is showcasing Bitcoin’s potential as a legal tender in property. Cryptocurrencies, recognized for tough standard monetary systems, provide a choice to standard money by making it possible for fast, indeterminate transfers without the requirement for financial institutions or various other middlemans.

Regional experts highlight numerous benefits of making use of Bitcoin genuine estate purchases, consisting of much faster procedures and decreased prices. By eliminating monetary middlemans, purchase costs reduce, and the international market ends up being a lot more obtainable, devoid of the intricacies of money conversions.

Learn More: Exactly How To Buy Real-World Crypto Properties (RWA)?

Uruguay has promptly welcomed using cryptocurrencies in property. Since October 1, 2022, a brand-new regulation permits purchasing and marketing residential or commercial property with electronic money. This adjustment made what was when thought about a swap right into a totally lawful sale, identifying cryptocurrencies as legitimate settlement.

The General Tax Obligation Directorate, which formerly really did not approve cryptocurrencies genuine estate purchases, has actually currently invited this brand-new technique. This settings Uruguay as a leader in bringing electronic properties right into the property market. On July 17, 2023, this was plainly shown when a residential or commercial property was marketed making use of Bitcoin, with Banque Heritage and Cryptotrust handling the purchase.

Binance VP for Latam to Talk at RIW 2024 on BeInCrypto Phase

As Rio Advancement Week 2024 techniques, Guilherme Nazar, Vice Head Of State for Latin America at Binance, has actually been verified as an audio speaker on the BeInCrypto phase. Nazar will certainly deal with the existing state of the market, future leads, and the course to getting to the following billion individuals.

Nazar will certainly additionally go over the relevance of client emphasis, education and learning, and safety and security ahead of time crypto fostering, especially in Latam. He kept in mind that Brazil is greatly buying Web3 remedies, placing it as an international leader in this field.

” Latin America is a market with fantastic leads for the electronic property ecological community, home to 3 of the leading 20 nations in fostering, and there are countless chances to establish the neighborhood market, fulfill individuals’ demands and enlighten culture. We are identified to function together with policymakers to specify policies that permit advancement to advancement and safeguard individuals’ funds,” he claimed on taking control of administration of the area.

Learn More: A Schedule of the Leading Blockchain and Cryptocurrency Occasions in 2024

Alena Afanaseva, Chief Executive Officer of BeInCrypto, and Fabrício Tota, Supervisor of New Organization at Mercado Bitcoin, will certainly sign up with Nazar on phase. Afanaseva has actually transformed BeInCrypto right into an international crypto information center with 8 million regular monthly site visitors. Tota, on the other hand, is a vital number in Brazil’s crypto market.

The BeInCrypto phase at Rio Advancement Week will certainly include names like Agrotoken, B3, and Comissão de Valores Mobiliários (CVM). Various other individuals consist of Itaú Unibanco, Bradesco, BTG Pactual, Banco do Brasil, and Microsoft. TecBan, ABCripto, Bitso, Trexx, MIBR, Plataforma Effect, and the Ethereum Brasil neighborhood will certainly additionally exist.

As the Latam crypto scene expands, these tales highlight the area’s enhancing impact in the international market. Keep tuned for even more updates and understandings in following week’s summary.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to give precise, prompt details. Nonetheless, viewers are encouraged to validate truths individually and talk to a specialist prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.