2 significant U.S.-based crypto exchanges, Gemini and Coinbase, have actually tested the United States Commodities Futures Trading Compensation’s (CFTC) recommended regulation to restrict forecast markets like Polymarkets.

The CFTC’s proposition, introduced in Might, looks for to limit specific occasion agreements, specifically those pertaining to political occasions. This relocation has actually gathered support from United States legislators such as Legislator Elizabeth Warren, that has actually articulated issues concerning the dangers related to election-related gaming.

Gemini, Coinbase Advises CFTC to Take Out Proposition

In an August 8 letter, Gemini suggested that the recommended regulation problems with the Asset Exchange Act (CEA), as meant by Congress. The exchange asserts the regulation might threaten public passion and misunderstand the CEA’s objectives.

Gemini competes that the proposition misunderstands the CEA by extensively classifying all occasion agreements, possibly negating Congress’s intent for the CFTC to evaluate private agreement accreditations. The exchange likewise slammed the proposition for doing not have concrete proof of injury from forecast markets, calling it a “service looking for an issue.”

” The Notification of Proposed Rulemaking, 89 FR 48968, (Notification) does not offer any kind of sensible basis for wrapping up that forecast markets connecting to political elections or various other unidentified occasions remain in any kind of means an issue, or that any person has actually been hurt by the presence of such markets,” the letter stated.

Find Out More: Just How Can Blockchain Be Made Use Of for Ballot in 2024?

Cameron Winklevoss, founder of Gemini, highlighted that decentralized forecast markets are a vital advancement with real utility. These markets use useful understandings right into future occasions backed by economic liability. Unlike surveys or specialist viewpoints, individuals in forecast markets have a monetary risk, including stability to the details.

” There is absolutely nothing thoughtful concerning a covering restriction on markets that have actually been used for years in one type or an additional and have actually verified incredibly reputable devices for projecting future occasions. Much more lately, the development of these markets improved top of crypto procedures guarantees higher gain access to, liquidity, and gathering of the knowledge of the group for all,” Winklevoss added.

Gemini wrapped up that the regulation might deal with considerable lawful obstacles if established by the Compensation.

Especially, Coinbase resembled Gemini’s require the CFTC to take out the proposition in its very own letter. Paul Grewal, Coinbase’s Principal Legal Police officer, slammed the proposition for its unclear interpretation of “video gaming.” In addition, he contested the CFTC’s insurance claim that such markets protest public passion.

” We prompt the CFTC to withdraw this proposition and job along with scholastic, market, and plan stakeholders to establish a much more well balanced strategy that advertises advancement while shielding the general public passion,” Grewal remarked.

Find Out More: Crypto Guideline: What Are the Advantages and Drawbacks?

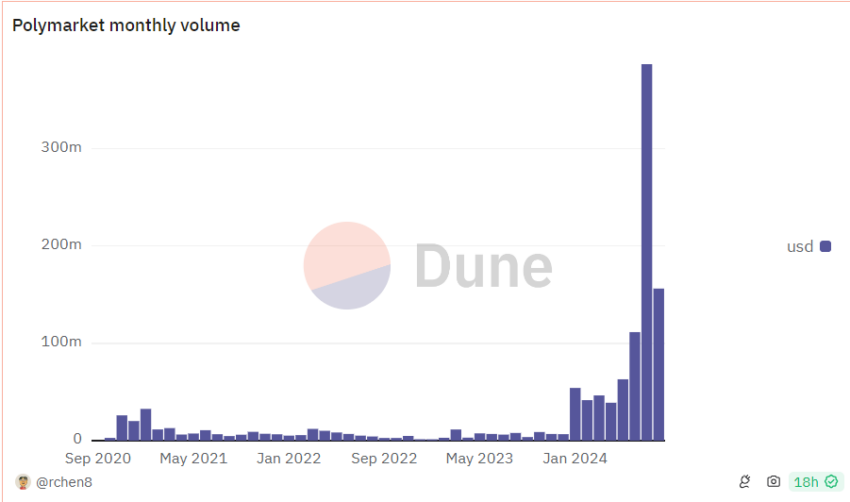

In the previous year, forecast systems have actually risen in appeal, specifically for banking on occasions like the 2024 United States governmental political election. For context, Polymarket has actually experienced a substantial rise in task. The decentralized system saw over $387 million in quantity last month, according to a Dune Analytics control panel.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to offer exact, prompt details. Nonetheless, visitors are recommended to validate truths separately and seek advice from an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.