Complying with Monday’s crypto market collision, around $2.5 billion in Bitcoin (BTC) and Ethereum (ETH) alternatives are running out today.

The expiry might affect market problems, with financiers keeping track of possible changes.

$ 2.5 Billion in Options Dealings Expiring: Will Crypto Markets Sustain Their Recuperation?

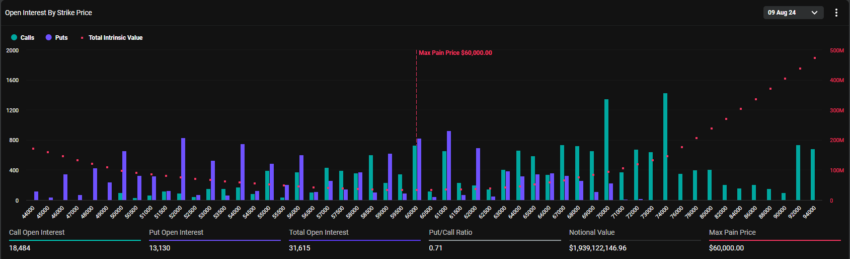

According to Deribit, $1.94 billion in Bitcoin alternatives are readied to end. The optimum discomfort factor of these agreements stands at $60,000.

These alternatives consist of 31,615 agreements, a little less than recently’s 36,732. The put-to-call proportion of 0.71 suggests a basic favorable view regardless of the current volatility.

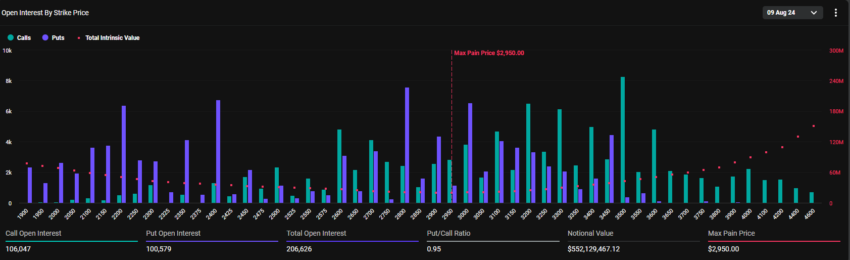

Ethereum has $552.13 million in alternatives running out, entailing 206,626 agreements. This number is a boost from the previous week’s 183,756 agreements. The optimum discomfort factor for these alternatives is $2,950, and the put-to-call proportion is 0.95.

Find Out More: An Intro to Crypto Options Trading

The optimum discomfort factor in the crypto alternatives market stands for the rate degree that brings upon one of the most monetary pain on alternative owners. At the same time, the put-to-call proportion suggests a greater frequency of acquisition alternatives (phone calls) over sales alternatives (places).

Experts from crypto alternatives trading device Greeks.live supplied understandings on today’s agreement expiry. They kept in mind that the indicated volatility (IV) of all significant terms stays high, surpassing 60%. At the same time, the present Bitcoin 7-day recognized volatility (MOTOR HOME) goes to 100%, much going beyond the IV degree.

” There is a gathering result in volatility, causing a much longer aftershock of big variations, so IV has solid assistance, and vendors can progressively construct settings,” Greeks.live’s experts commented.

BeInCrypto reported that Bitcoin and Ethereum costs went down considerably throughout Monday’s market collision. The seriousness appears in the liquidations, which went beyond $1 billion, according to Coinglass information.

Nevertheless, the really following day after the collision, the crypto market began to recoup. At the time of composing, Bitcoin has actually climbed up back over the $60,000 degree. It is currently trading at $61,494, noting an almost 10% boost in simply 24 hr.

In A Similar Way, Ethereum has actually risen virtually 12%, currently trading at $2,671 after briefly getting to the $2,700 mark.

Find Out More: 9 Ideal Crypto Options Trading Operatings Systems

Historically, alternatives agreement expiries have a tendency to trigger sharp however short-lived rate motions. The marketplace generally maintains quickly after. Eventually, investors must remain cautious, evaluating technological signs and market view to take care of possible volatility successfully.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to give exact, prompt details. Nevertheless, visitors are recommended to confirm realities separately and seek advice from a specialist prior to making any kind of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.