This is The Takeaway from today’s Early morning Short, which you can subscribe to get in your inbox every early morning together with:

Tuesday’s gains left capitalists with 2 inquiries: “Is the marketing over?” and “When should I acquire?”

Wall surface Road believes the most awful mores than, yet to really cover our heads around what’s taking place we have to trip overseas to Japan to examine the supposed bring profession

That’s due to the fact that the Japanese yen has actually discovered itself securely associated with United States technology supplies– which have actually been powering the marketplace this year.

Money vary about each various other greatly based upon rate of interest differentials, place moves throughout times of panic, and global profession.

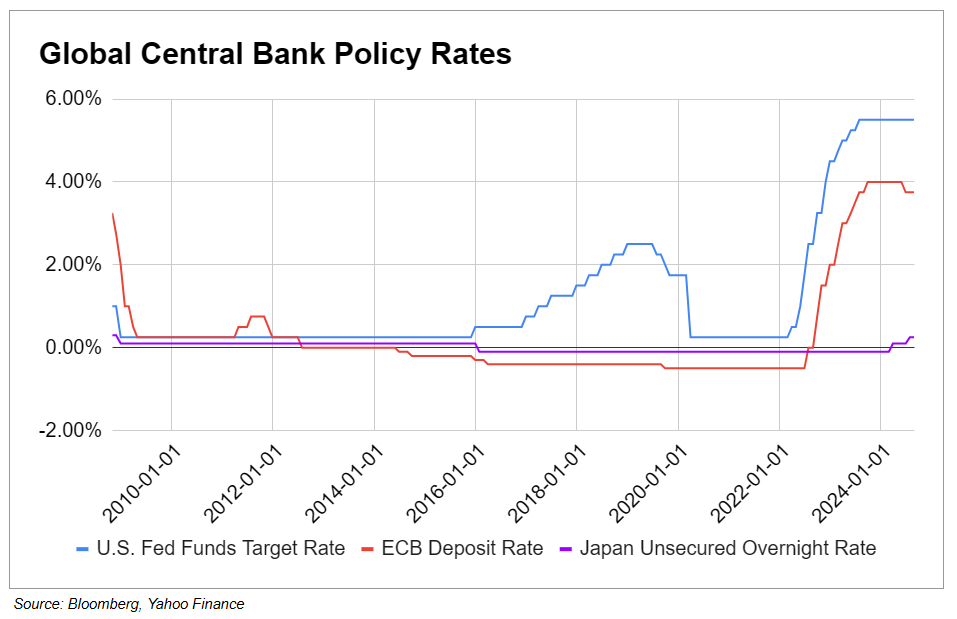

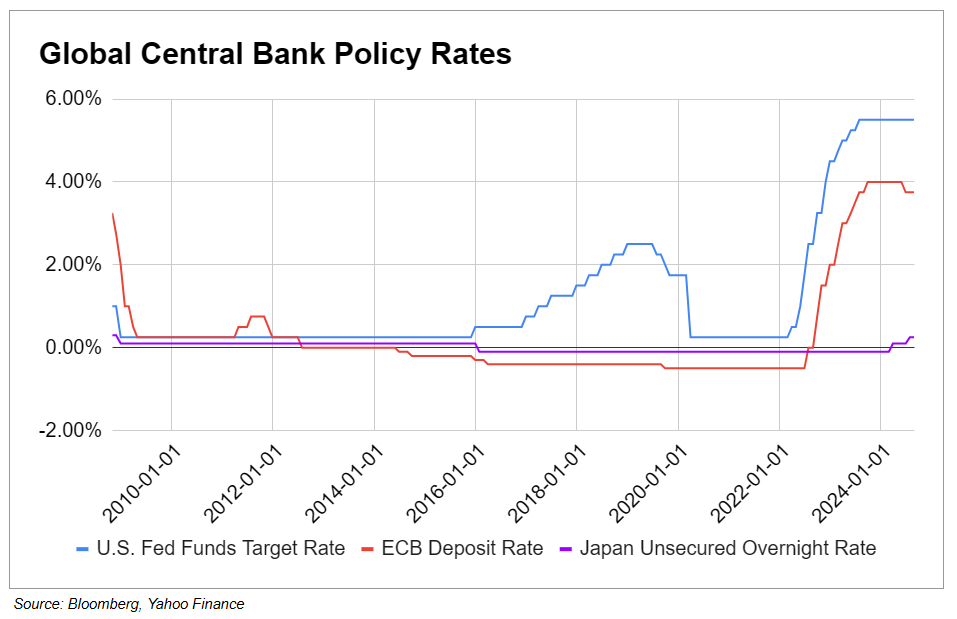

Japan has actually been bogged down in a decades-long deflationary spiral, where it is just currently climbing up out, and its prices have actually likewise floated around the absolutely no line for years. As the globe’s last holdout with unfavorable prices, it climbed up right into favorable region just this year when it treked to 0.1% in March– however recently to 0.25%.

On the other hand, prices in the United States have actually been north of 5% for a year and the European Reserve bank rests simply under 4%, having actually reduced in June.

Out of this big void, a whole home sector of capitalists arised that obtain inexpensively in Japan, after that reinvest in higher-yielding possessions in other places. It’s called the bring profession.

Ed Yardeni, head of state of Yardeni Research study, signed up with Yahoo Money’s Early morning Short program to damage down the details.

“[A] great deal of speculators went and obtained in Japan at absolutely no rate of interest,” claimed Yardeni, that discussed that the obtained yen was after that exchanged bucks and various other money.

” The yen damaged, the buck reinforced, and they took that cash and spent it in possessions worldwide,” he claimed.

Given That 2010, this relentless marketing stress on the yen, incorporated with the matching quote on the United States buck, has actually made the buck two times as useful as the yen– a stupendously big relocation for a developed-world money.

The collapsing yen also led the Financial institution of Japan to interfere sometimes, yet ultra-low prices urge resources trip. And since the BOJ is elevating prices, the engines are turning around, together with the global cash recedes right into the yen.

Take advantage of and volatility work as masochistic brother or sisters, eating each various other throughout times of quarrel– erasing pyramided settings. Activities that would typically take months happen in the period of a couple of days.

Markets made it through the preliminary of margin calls Monday and Tuesday, yet bearishness do not happen over night. When searching for hints concerning future instructions, capitalists ought to likewise take into consideration the background in United States markets.

In the back fifty percent of July, capitalist profiles had actually currently gone through a gut-wrenching turning from megacaps right into tiny caps and worth industries.

Include some economic crisis is afraid fed by softening United States financial numbers together with a Fed chair with a forefinger on the “cut” switch, and capitalists themselves fasted to push “market.”

Wall surface Road is favoring a rather fast resolution of the episode. Morgan Stanley’s sales workdesk wrote to clients, “We are more detailed throughout of the marketing than to the start.” JPMorgan’s co-head of FX approach Arindam Sandilya believes we’re 50% to 60% via the bring loosen up since Monday.

For his component, Yardeni sees completion a little bit quicker: “The loosen up ought to more than by the end of the week.”

Visit This Site for the most up to date stock exchange information and thorough evaluation, consisting of occasions that relocate supplies

Review the most up to date economic and organization information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.