JUP, the indigenous token of the Solana-based decentralized exchange Jupiter, has actually kept a sag because July 29.

The altcoin’s decrease was aggravated by Monday’s market decline, triggering its rate to dive to a five-month reduced, a degree it currently takes the chance of reviewing.

Jupiter Bears Have the Upper Hand

At press time, JUP professions at $0.88. The wide market healing because Tuesday has actually driven JUP’s rate up almost 10% in the previous 1 day. Nevertheless, the 44% decrease in its trading quantity suggests an unfavorable aberration.

When this aberration arises, it suggests that the acquiring energy backing the rate rise is weak. For that reason, JUP’s rally may be claimed to have actually mirrored the basic market rebound and not resulted from substantial need from its owners.

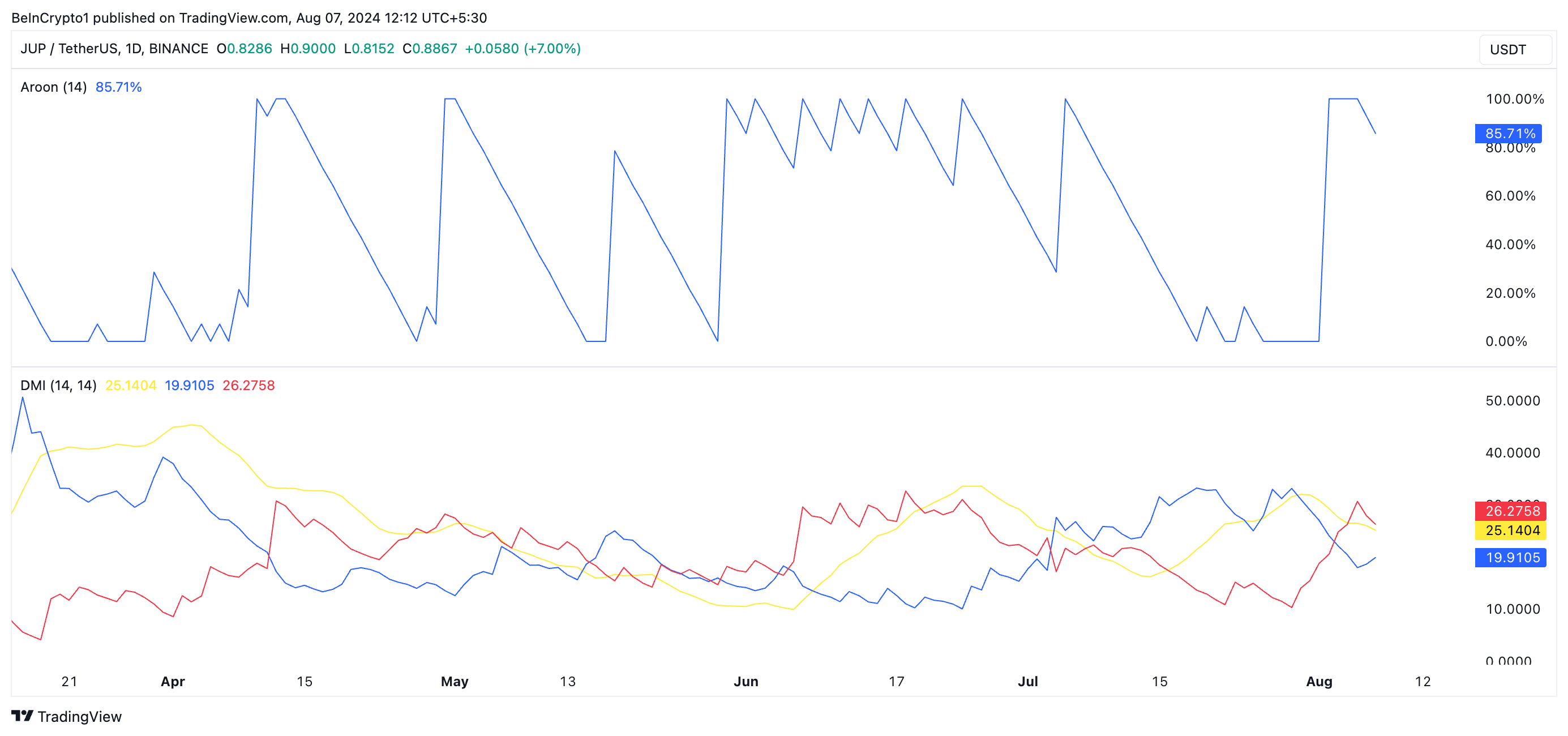

Furthermore, vital energy signs observed on an everyday graph verify that JUP’s sag is solid. For instance, its Aroon Down Line is 85.71% since this writing. A possession’s Aroon sign determines its pattern toughness and recognizes prospective rate turnaround factors.

When the Down Line goes to or near 100%, the sag is really solid. It indicates that the possession’s rate has actually constantly made brand-new lows, revealing a clear down energy.

Even more, according to analyses from JUP’s Directional Motion Index (DMI), its adverse directional sign (- DI) (red) presently relaxes over its favorable directional sign (+ DI) (blue), verifying the solid bearish predisposition versus the altcoin.

Learn More: Leading 9 Most Safe Crypto Exchanges in 2024

This sign determines a property’s pattern toughness. When the -DI exists over the +DI, it indicates that offering stress outweighs the need for a property.

JUP Rate Forecast: Short Traders Ravage Market

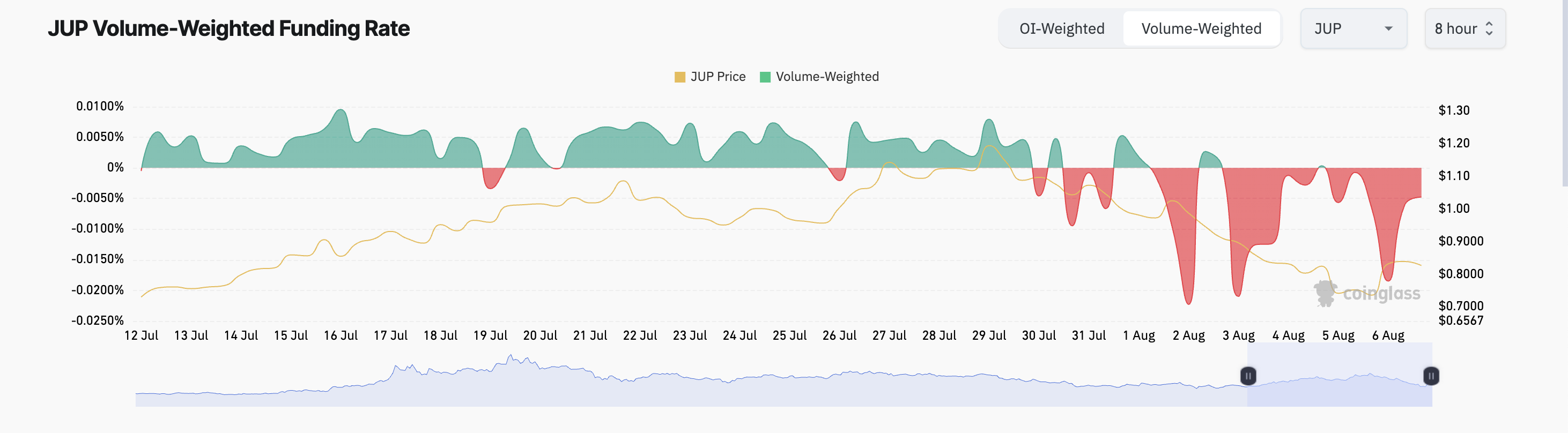

In its futures market, JUP investors have actually mostly required brief placements because the start of August, as confirmed by its adverse financing prices. At press time, the token’s financing price is -0.0048%.

When a property’s aggregated financing price throughout cryptocurrency exchanges is adverse, it indicates much more investors are getting the possession, anticipating a decrease, than those getting in expectancy of a rally.

This is a bearish signal due to the fact that it mirrors investors’ assumption that rates will certainly reduce as they want to pay to preserve their brief placements.

If JUP preserves its sag, its following rate target is $0.65, a 26% loss from its existing worth.

Learn More: 11 Cryptos To Include In Your Profile Prior To Altcoin Period

Nevertheless, if market view changes and an uptrend follows, the altcoin might rally to $0.93.

Please Note

According to the Trust fund Task standards, this rate evaluation post is for informative objectives just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is dedicated to precise, honest coverage, however market problems undergo transform without notification. Constantly perform your very own study and speak with a specialist prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.