BlackRock lately submitted a proposition for choices trading and listing on its area Ethereum (ETH) exchange-traded fund (ETF), iShares Ethereum Depend on (ETHA).

The proposition was sent to the United States Stocks Exchange and Compensation (SEC) on August 6 through the Nasdaq International Stocks Exchange.

Nasdaq and BlackRock Take Advantage Of Experience with Asset ETFs for Crypto

According to the filing, the recently suggested iShares Ethereum Depend on possessions will certainly be composed only of ETH, which Coinbase will certainly hold. On the other hand, the Financial Institution of New york city Mellon will certainly hold the cash money possessions. Moreover, the file verified that the trust fund will certainly stay non-engaged in Ethereum betting to gain added earnings.

Learn More: An Intro to Crypto Options Trading

Nasdaq detailed that this step intends to expand the variety of financial investment devices for Ethereum and make crypto financial investments extra obtainable within standard monetary markets. Although these shares do not correspond to a straight financial investment in ETH, they make it possible for capitalists to obtain direct exposure to Ethereum. This is due to the fact that the strategy occurs via the general public safeties market, which may be extra acquainted to standard capitalists.

The choices market enables investors to purchase or market a property, like a supply or an ETF, at a defined rate prior to a particular day. They commonly utilize choices to safeguard versus possible losses or to hypothesize on a property’s future rate. Unlike futures, choices offer adaptability given that the investor can determine whether to implement the profession.

Both Nasdaq and BlackRock have significant experience in noting choices on various other product ETFs structured as depends on. These consist of iShares COMEX Gold Depend on and iShares Silver Depend on. For this reason, this transfer to include choices to the area crypto ETF notes a considerable advancement in this context.

James Seyffart, an ETF expert at Bloomberg Knowledge, talked about Nasdaq and BlackRock’s declaring to include choices on Ethereum ETFs. He kept in mind that the SEC’s decision will likely be around April 9, 2025.

” SEC is not the only choice manufacturer on including choices below. Likewise require signoff from Options Cleaning Company (OCC) and Asset Futures Trading Compensation (CFTC),” Seyffart added.

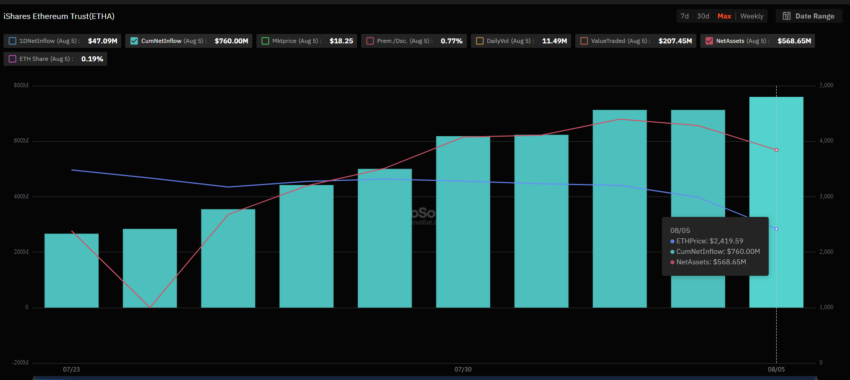

BlackRock is a famous company of area Bitcoin and Ethereum ETFs in the United States. According to SoSo Worth information, BlackRock’s iShares Bitcoin Depend on (IBIT) had internet possessions of $18.28 billion since August 5, making it the biggest area Bitcoin ETF.

Learn More: Ethereum ETF Clarified: What It Is and Exactly How It Functions

The information additionally revealed that BlackRock’s iShares Ethereum Depend on (ETHA) had internet possessions of $568.65 million since the exact same day, rating it as the 3rd biggest area Ethereum ETF in the United States market after Grayscale’s ETHE and Ethereum Depend On.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to offer precise, prompt info. Nevertheless, visitors are suggested to confirm realities individually and seek advice from an expert prior to making any kind of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.