Bitcoin (BTC-USD) backers are increasing down on their forecasts of brand-new all-time highs for the globe’s biggest cryptocurrency after getting rid of a thrashing that sent out the electronic possession rolling as high as 20% in between Sunday and Monday.

After collapsing over the weekend break to listed below $50,000– a reduced not seen considering that February– bitcoin’s rate has actually restored approximately $6,000, placing it down 14% for the last 7 days.

As the dirt decides on the most awful week for bitcoin considering that the collapse of the FTX cryptocurrency exchange in 2022, bulls claimed they still anticipate an additional leg in a rally that would certainly place the cryptocurrency over $100,000 by the end of 2024. It established an all-time high of $74,000 last March.

The situation for it to make brand-new all-time highs in 2024 “is still significantly in play,” Martin Leinweber, supervisor of electronic possession research study at MarketVector, informed Yahoo Money.

” If we can restore the old highs around $72,000, I assume it’s not impractical to see bitcoin in between $80K and $100K.”

An additional bull– Onramp Bitcoin head of macro method Mark Connors– claimed Tuesday that a forecast he made in March that bitcoin will certainly strike $110,000 in 2024 continues to be unmodified.

Bitwise Possession Administration primary financial investment policeman Matt Hougan likewise anticipated brand-new all-time highs later on this year complying with the pullback previously today.

” We’re seeing that bitcoin financiers are lasting financiers,” Hougan informed Yahoo Money Monday. “They’re not, type of, paper hands that are folding.”

Amidst every one of this positive outlook are some restored inquiries concerning whether the biggest cryptocurrency is still executing as its fans have actually promoted.

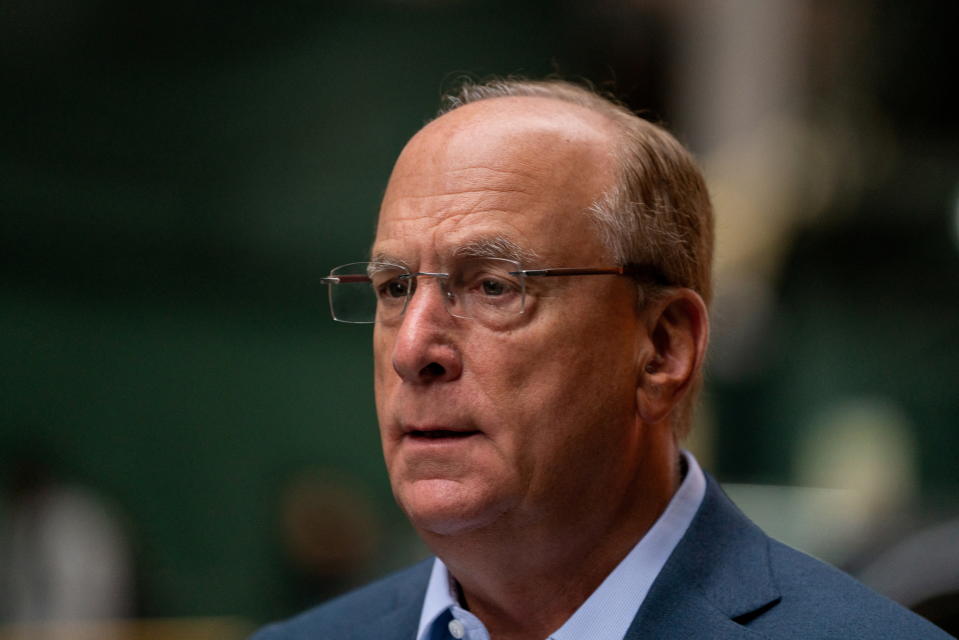

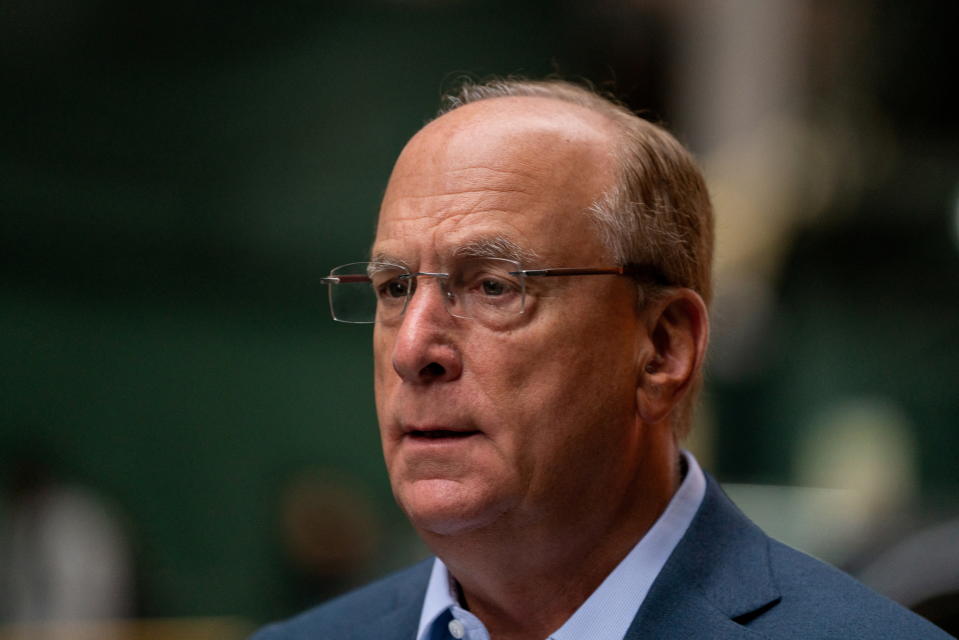

On Monday, doubters fasted to seem the alarm system on whether bitcoin is, actually, a safe house or uncorrelated possession– a refrain that backers and also BlackRock chief executive officer Larry Fink like to promote.

Such an adjustment, in overstated lockstep with modern technology supplies, would certainly show up to verify the contrary.

” Bitcoin is still a threat possession,” claimed Leinweber. “It’s not the exact same sort of shop of worth as gold. It’s still the smaller sized relative due to the fact that it’s doing not have the record and institutional buy-in.”

Leinweber and others likewise mentioned that due to the fact that bitcoin professions 24/7, it’s commonly offered initially throughout market-wide drawdowns.

Bitcoin’s rate decreases over the recently seem connected to a cross-market loosening up of professions associated with the United States buck’s family member stamina to the Japanese yen.

With such levered wagers gone, numerous companies claimed they will certainly be paying closer focus to circulations in and out of a collection of brand-new bitcoin exchange-traded funds looked after by huge Wall surface Road cash supervisors.

On Monday United States bitcoin ETFs saw web discharges of $168 million while quantities surpassed $5.2 billion, increased contrasted to the previous day, according to initial price quotes from JPMorgan.

” Investors will certainly be a lot more mindful since they have actually melted their fingers, so it’s even more a financier’s market moving forward,” MarketVector’s Leinweber claimed.

Fundstrat International Advisors’ electronic possession team claimed in a note Monday that it is maintaining its forecast for bitcoin to get to $126,000 in 2024 and it does not see the current drawdown as crypto’s “market top.”

Bitcoin’s double-digit decrease in current days is “actually simply a spit in the sea,” Mark Newton, head of technological method with Fundstrat, informed Yahoo Money.

David Hollerith is an elderly press reporter for Yahoo Money covering financial, crypto, and various other locations in money.

Go Here for the current crypto information, updates, and a lot more pertaining to ethereum and bitcoin rates, crypto ETFs, and market ramifications for cryptocurrencies

Review the current monetary and service information from Yahoo Money

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.