The Bitcoin financial investment landscape is established for a significant change as Morgan Stanley, a leading worldwide economic solutions company, prepares to introduce area BTC Exchange Traded Finances (ETFs) via its network of 15,000 economic consultants beginning tomorrow, August 7. This action, at first reported by CNBC on August 2, notes the very first circumstances of a significant Wall surface Road financial institution making it possible for such extensive straight accessibility to Bitcoin financial investment items.

Why This Is Massive For Bitcoin

Complying With the United States Stocks and Exchange Compensation’s authorization of 11 area BTC ETFs previously this year, Morgan Stanley’s news highlights a modern approval of Bitcoin within conventional economic solutions. Beginning Wednesday, Morgan Stanley consultants will certainly be enabled to provide shares of BlackRock’s iShares Bitcoin Trust fund (IBIT) and Integrity’s Wise Beginning Bitcoin Fund (FBTC) to their customers.

” The Japanese bring profession relax will certainly discolor in to the rearview as soon as Morgan Stanley’s 15,000 economic consultants begin placing the BTC ETFs in customer profiles. I can inform that lots of people do not truly recognize what this indicates yet. The United States riches administration organization is a monster,” said Mike Alfred, Chief Executive Officer of Digital Properties Information and Handling Companion at Alpine Fox LP.

The ETFs will just be offered to customers that satisfy particular requirements consisting of a total assets of at the very least $1.5 million, a high threat resistance, and a shared rate of interest in speculative financial investments. “This targeted strategy guarantees that the offering is matched with the threat account and financial investment goals of ideal customers,” a resource aware of the plan specified.

Haseeb Qureshi, Handling Companion at Dragonfly, highlighted the modification in procedure for personal riches consultants, “This is substantial. Presently every one of the personal riches consultants are “reverse questions just”, suggesting they are not enabled to market the BTC ETF to their customers. That’s just currently transformed.”

Scott Melker, understood online as “The Wolf Of All Streets,” commented on the effects of this action:” This action shows expanding customer need and indicates a significant action in Bitcoin’s mainstream fostering. Just customers with a total assets of at the very least $1.5 million, high threat resistance, and a rate of interest in speculative financial investments are qualified, and these financial investments are restricted to taxed broker agent accounts.”

Quinten Francois, a popular crypto expert, underscored the size of this advancement: “Morgan Stanley will certainly quickly enable economic consultants to provide Bitcoin ETFs. Morgan Stanley’s consultants handle $5.7 trillion in customer possessions, the largest of the wirehouses.”

Popular Bitcoin expert British HODL (@BritishHodl) added using X: “Morgan Stanley simply transformed the consultatory video game and began the appetite ready consultants, they’re bringing 15,000 starving, compensation driven sales individuals to the Bitcoin military to assault their $1.46 T of possessions under administration.

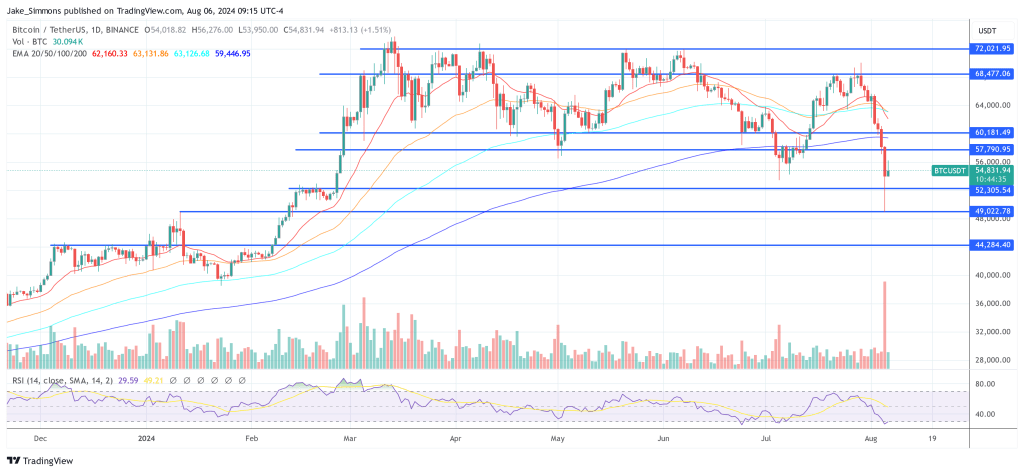

At press time, BTC traded at $54,831.

Included picture developed with DALL.E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.