Solana’s (SOL) cost responded to the more comprehensive market collision as the altcoin signed up an enormous decrease in the last 10 days.

This developed panic amongst the institutional capitalists that decided to draw their cash out of the possession.

Solana Institutions Transform Unconvinced

Solana’s cost goes to $137, attempting to recuperate from the other day’s lows. SOL made a reduced of around $110 as a result of marketing stress, which has actually appeared in establishments’ habits for over a week.

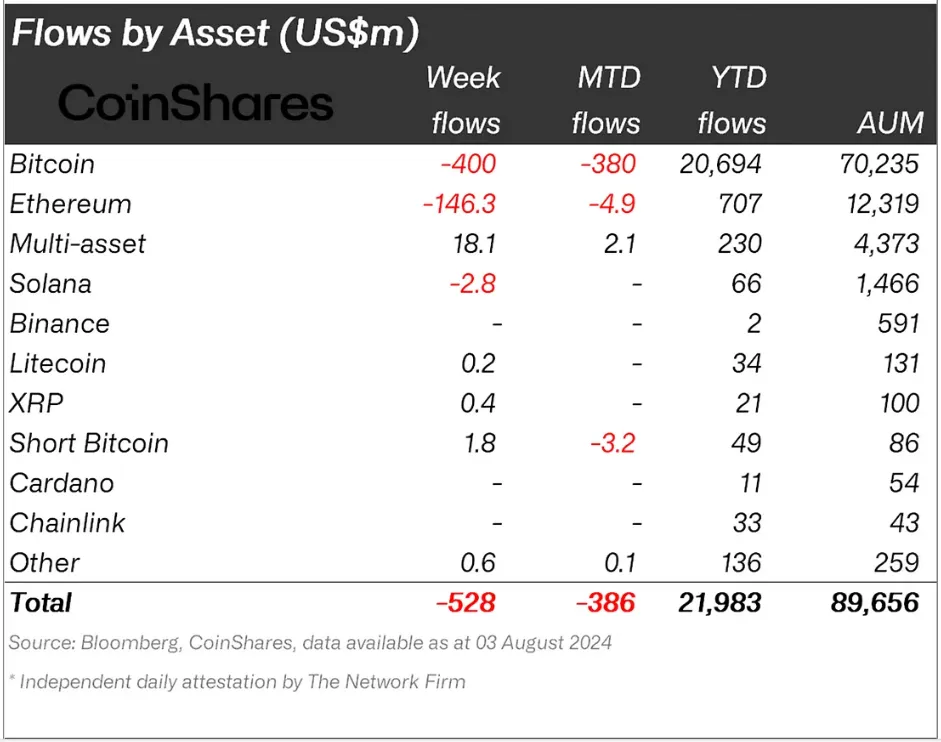

According to the CoinShares record, for the week finishing August 3, institutional capitalists took out over $528 million from crypto properties. While the majority of it originated from Bitcoin (BTC), Solana additionally signed up $2.8 million well worth of discharges.

Learn More: Solana ETF Explained: What It Is and Just How It Functions

Various other altcoins did not witness any type of discharges, which reveals that capitalists are considerably much more include d with SOL, which shares the very same phase as BTC and Ethereum (ETH).

Despite the fact that institutional information for the last 3 days has yet to be launched, marketing stress is plainly escalating. The Family Member Toughness Index (RSI) highlights this, resting listed below the neutral line at 50.0.

The RSI determines the rate and adjustment of cost activities to determine overbought or oversold problems. It varies from 0 to 100, with worths over 70 suggesting overbought problems and listed below 30 recommending oversold problems.

The decrease in the indications reveals that the marketing stress is still energetic and greatly affects the token’s cost. This stress will certainly need to dissipate for the altcoin to keep in mind a recuperation once more.

SOL Rate Forecast: Failing After Failing

Solana’s cost got rid of the current 44% gains and additionally entirely revoked the favorable double-bottom pattern. The pattern had actually recommended a prospective 31% rally that would certainly have sent out SOL to $245.

Nonetheless, the altcoin stopped working the outbreak and is presently trading at $137 at the time of creating. Nonetheless, in spite of the drawdown, SOL did not fail the important assistance flooring of $126. Therefore, a recuperate is most likely, which may battle to breach previous $156.

Learn More: 6 Ideal Systems To Acquire Solana (SOL) in 2024

However, if the institutional capitalists were to put refund right into the possession, Solana’s cost might press previous $156. This would certainly send out the crypto possession to $180, revoking the bearish thesis.

Please Note

In accordance with the Count on Task standards, this cost evaluation short article is for educational functions just and need to not be taken into consideration economic or financial investment guidance. BeInCrypto is devoted to exact, honest coverage, however market problems undergo transform without notification. Constantly perform your very own research study and seek advice from a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.