Throughout the very early trading session on Tuesday, Litecoin (LTC) saw a 12.16% cost rise to get to a short-term high of $58.96. This noted the altcoin’s biggest single-day gain because March 29. The rally comes as an alleviation for LTC owners adhering to Monday’s market-wide decrease.

Nevertheless, regardless of the temporary uptick, an evaluation of the LTC’s cost motions on a 12-hour graph recommends that the coin might remain to encounter descending stress.

Litecoin Bulls Remain Beaten Down

Since this writing, LTC professions at $58.29. While it has actually decreased from the Tuesday early morning high of $58.96, the coin has actually taped a 10% cost uptick in the previous 1 day. Nevertheless, this rally just mirrors the uptrend in the more comprehensive cryptocurrency market as the altcoin deals with bearish headwinds.

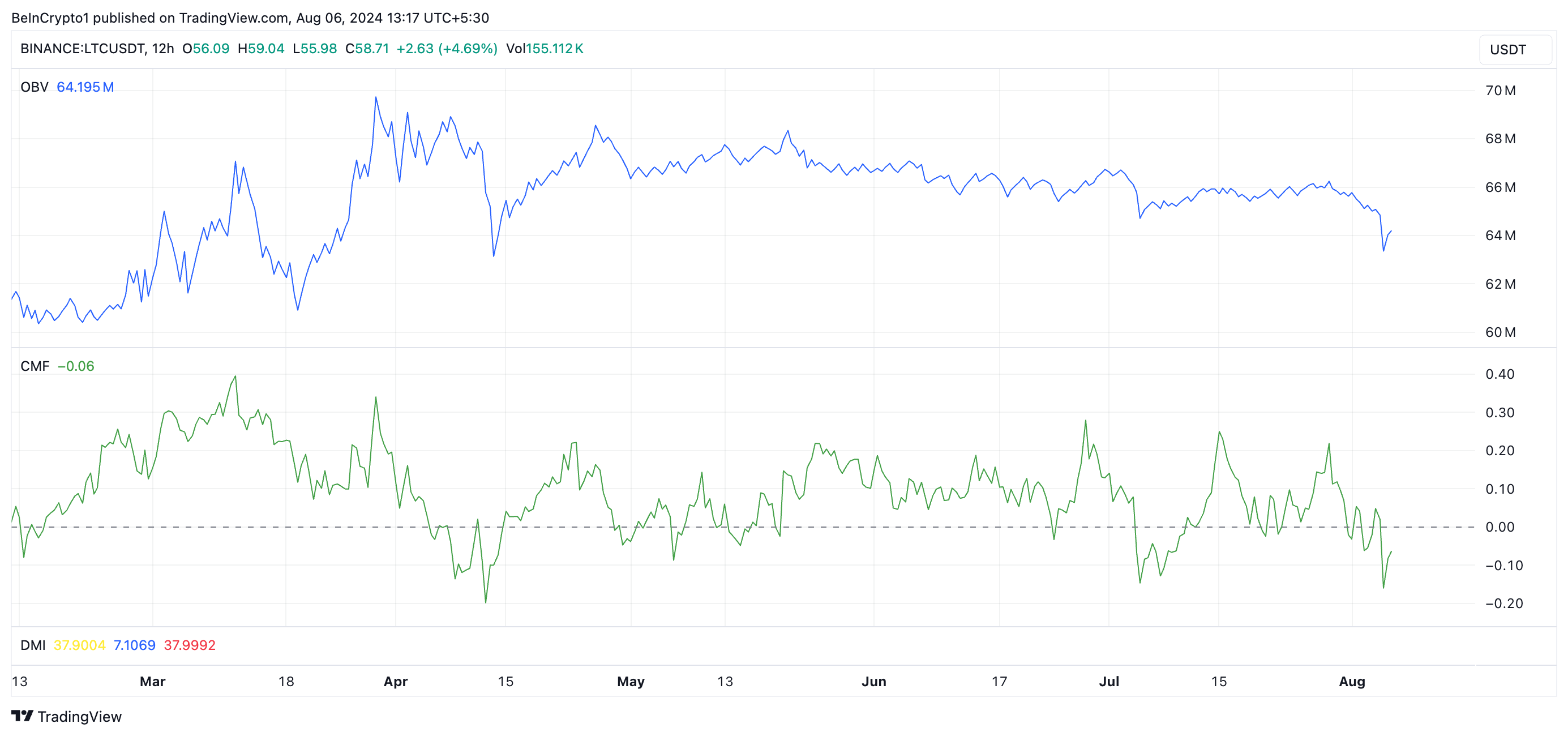

LTC’s decreasing On-Balance-Volume (OBV) validates the decrease in coin build-up. This indication procedures dealing stress in a property’s market. When it lowers, it suggests that marketing stress outweighs purchasing stress, meaning a bearish fad.

Additionally, LTC’s Chaikin Cash Circulation (CMF) stays listed below the absolutely no line. This indication gauges exactly how cash moves right into and out of a property’s market. At -0.07 at press time, the coin’s CMF signals enhanced liquidity leave from the marketplace. An unfavorable CMF worth recommends market weak point and is typically a forerunner to a continual cost decrease.

Furthermore, analyses from LTC’s Directional Activity Index (DMI) reveal its favorable directional indication (+ DI) (blue) relaxing listed below its adverse directional indication (- DI) (red).

A property’s DMI gauges the stamina and instructions of a fad. When the +DI is under the -DI, it recommends that the sag is more powerful than the uptrend. It suggests the existence of bearish market problems, where marketing stress controls, and the possession is most likely to proceed its sag.

Additionally, LTC’s ADX (Typical Directional Index) (yellow), which gauges the general stamina of the fad, no matter instructions, goes to 37.90 at press time. When this line is over 20, the marketplace fad is stated to be solid.

Find Out More: Litecoin (LTC) Cost Forecast 2024/2025/2030

Consequently, LTC bulls may locate it testing to launch a change far from the present bearish fad in the close to term.

LTC Cost Forecast: Will the Coin Review its Two-Year Low?

Monday’s market slump led LTC to shut at a two-year low of $50. If the dominating bearish belief heightens and it sheds its current gains, its cost might review this degree or go down better, possibly trading at $49.96.

Find Out More: Exactly How To Acquire Litecoin (LTC) and Every Little Thing You Required To Know

Nevertheless, if market belief changes and the bulls restore control, LTC’s cost might reach $64.79.

Please Note

According to the Depend on Task standards, this cost evaluation write-up is for informative objectives just and must not be taken into consideration economic or financial investment guidance. BeInCrypto is dedicated to exact, objective coverage, however market problems undergo alter without notification. Constantly perform your very own research study and speak with an expert prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.