TAO, the altcoin that powers Bittensor’s decentralized maker finding out network, has actually seen a 36% rate rally in the previous 24 hr as the basic cryptocurrency market rebounds adhering to Monday’s decrease.

This has actually resulted in an uptick in the token’s by-products market task. Nevertheless, this is not without a catch.

Bittensor Futures Traders Wager Versus a Rate Rally

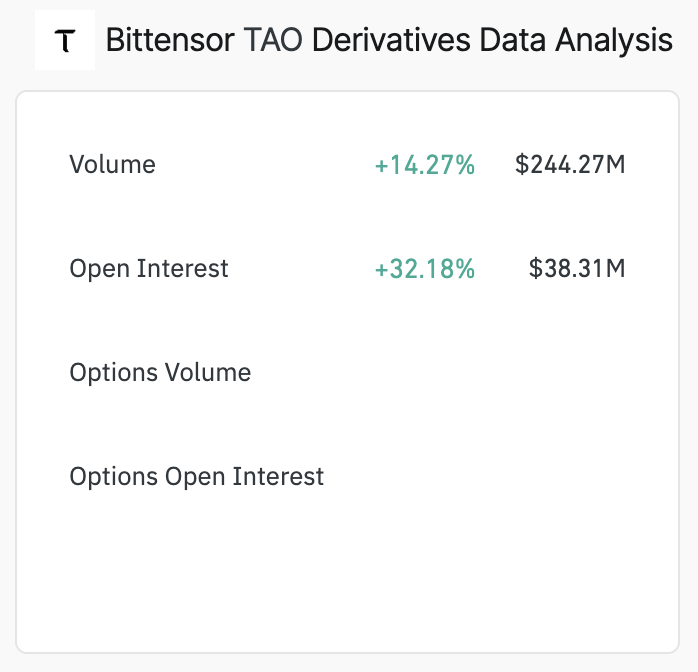

According to Coinglass, TAO’s by-products market has actually videotaped a 14% growth in day-to-day trading quantity in the previous 24 hr.

When a property sees a rise in by-products trading quantity, it recommends an expanding passion in the hidden possession. Given that by-products enable investors to hypothesize on rate activities without having the hidden possession, a spike in trading quantity might recommend that even more investors are taking part in speculative tasks, which might increase rate volatility.

TAO’s increasing open passion validates this increase of brand-new investors over the previous 24 hr. According to Coinglass, the coin’s open passion has actually raised by 32% throughout that duration, amounting to $38.31 million.

Learn More: Leading 9 Best Crypto Exchanges in 2024

A possession’s open passion describes the overall variety of exceptional acquired agreements, such as choices or futures, that have actually not been worked out. When it surges such as this, a lot more investors are opening up brand-new settings on the market.

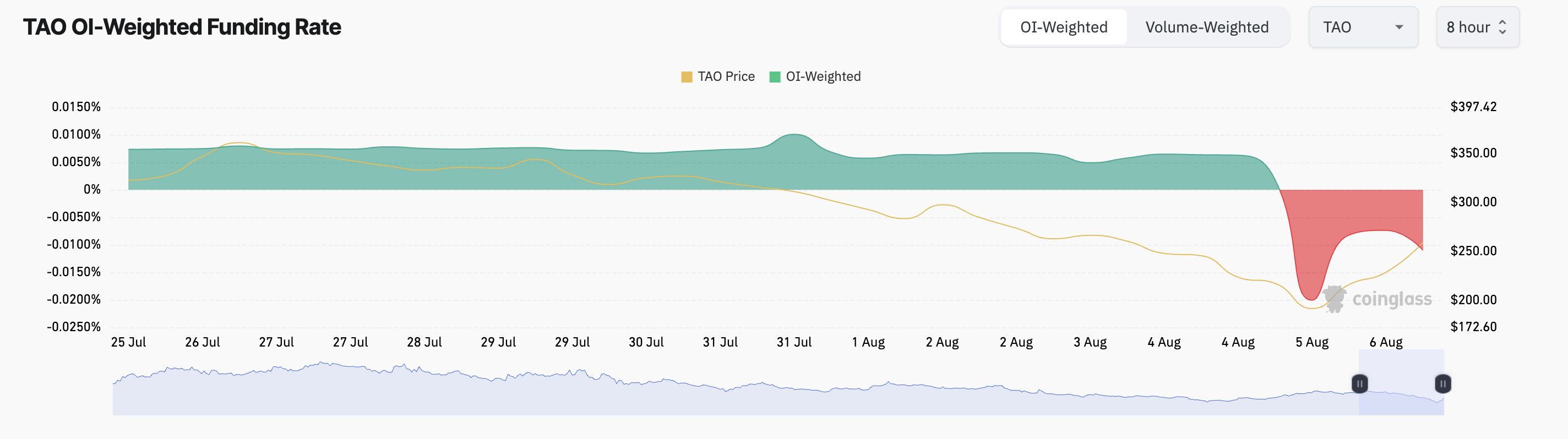

Nevertheless, TAO’s unfavorable financing price signals that these brand-new investors have actually primarily opened up brief settings. Since this writing, the token’s financing price throughout cryptocurrency exchanges is -0.01%.

Financing prices are made use of in continuous futures agreements to guarantee a property’s agreement rate remains near its area rate. When they are unfavorable, it suggests a lot more investors are acquiring the possession, anticipating a decrease, than those acquiring in expectancy of a rally.

TAO Cost Forecast: A Favorable Aberration Provides Hope

Analyses from TAO’s one-day graph expose that its double-digit rate rally over the previous 24 hr could not be lasting. This is since the bearish prejudice towards the altcoin is still substantial.

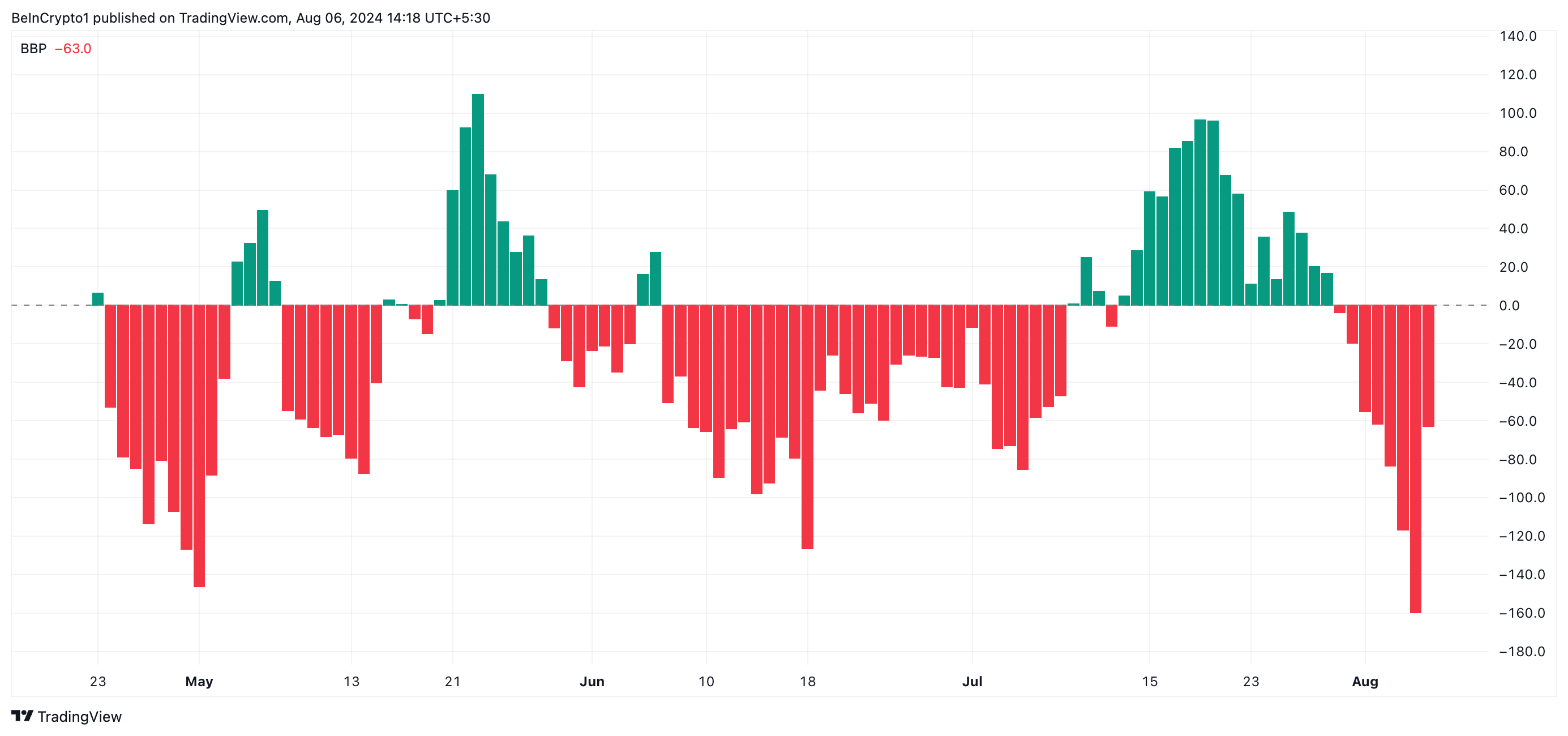

At press time, its Elder-Ray Index returns an unfavorable worth of -64.2. For context, this sign has actually returned worths listed below absolutely no because July 30, and the current rate rally has actually not altered that.

A possession’s Elder-Ray Index gauges the connection in between the stamina of purchasers and vendors on the market. When its worth is unfavorable, it suggests that bear power outweighs favorable visibility.

If the bears continue to be in control and remain to place descending stress on TAO, its rate might drop listed below $200 to trade at $163.70.

Nevertheless, the favorable aberration in between TAO’s rate and its Chaikin Cash Circulation (CMF) mean the opportunity of a rally. While TAO’s rate has actually preserved a drop because July 28, its CMF has actually climbed, producing a favorable aberration.

This aberration usually indicates a prospective favorable turnaround. While the rate is decreasing, acquiring stress is enhancing, which can result in a cost uptrend.

Learn More: Exactly how To Purchase Expert System (AI) Cryptocurrencies?

If this acquiring stress obtains energy, it can press the token’s worth to a two-month high of $419.80.

Please Note

According to the Trust fund Job standards, this rate evaluation post is for educational functions just and need to not be taken into consideration economic or financial investment suggestions. BeInCrypto is devoted to precise, honest coverage, yet market problems undergo transform without notification. Constantly perform your very own study and talk to a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.