Fantom’s (FTM) cost has actually dropped by 20% in the previous 24-hour amidst the more comprehensive market slump. Trading hands at $0.29 at press time, the altcoin presently trades at a cost reduced last observed in October 2023.

FTM’s cost tip over the previous 24-hour has actually placed numerous owners in losses. Its place market has actually videotaped less rewarding deals, while its by-products market has actually seen a rise in lengthy liquidations.

Fantom Investors Are Costing a Loss

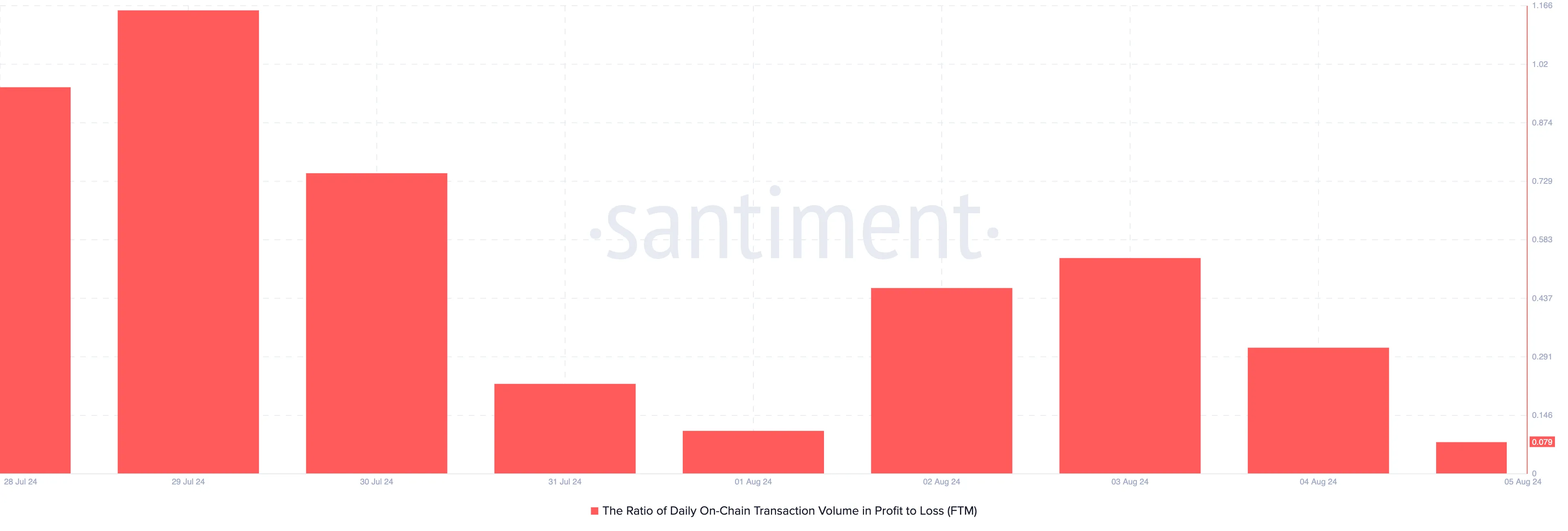

An evaluation of the proportion of FTM’s day-to-day on-chain purchase quantity in earnings to loss reveals that coin owners have actually seen much more losses than earnings in the previous 24-hour. At press time, the metric’s worth is 0.07.

This statistics procedures the complete quantity of FTM deals, causing an earnings for the sender contrasted to the complete day-to-day on-chain purchase quantity. At 0.07, it suggests that for each purchase causing a loss today, just 0.07 deals have actually paid.

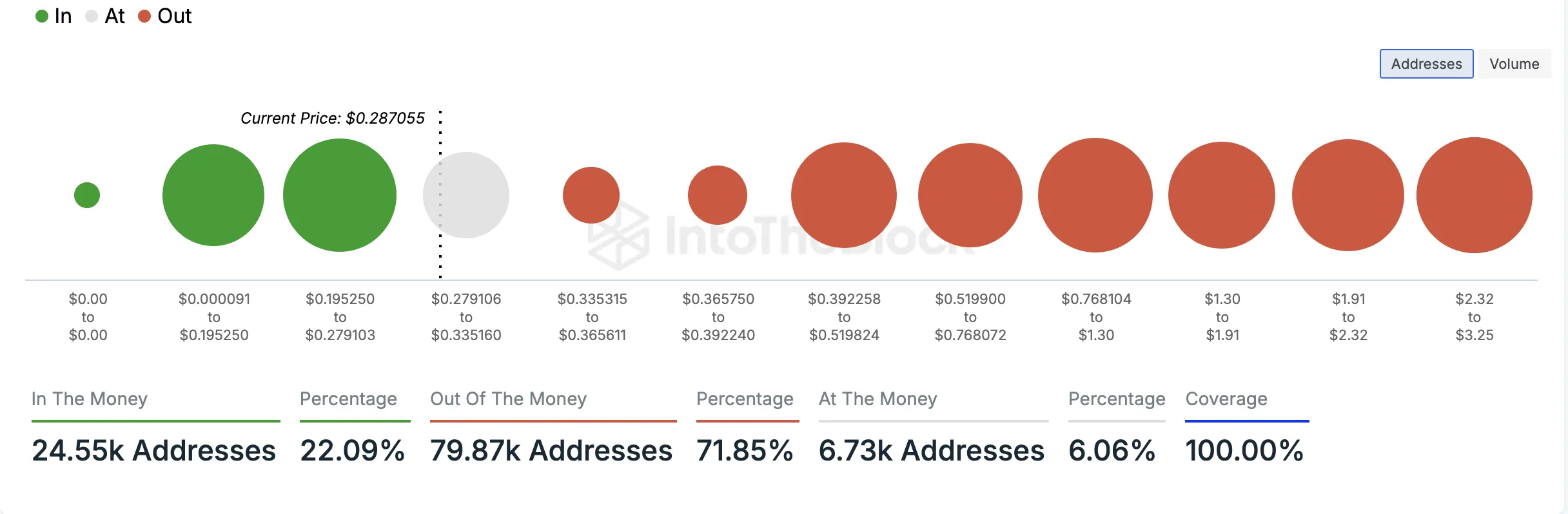

Presently, 80,000 pocketbook addresses, which consist of 72% of all its owners, are “out of the cash.” According to IntoTheBlock, an address is taken into consideration out of the cash if the existing market value of a possession is less than the typical price at which the address acquired (or obtained) the symbols it presently holds.

Alternatively, just 23,000 addresses, standing for 23% of all FTM owners, hold their coins at an earnings.

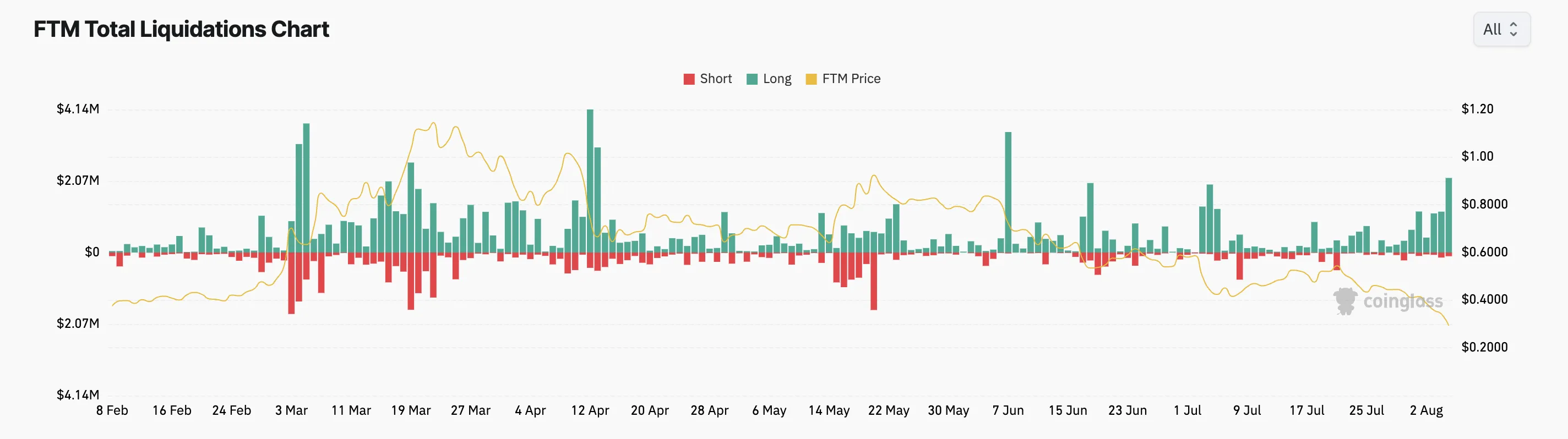

The coin’s by-products investors are not saved from the losses. According to Coinglass, numerous lengthy settings have actually been sold off over the previous 24-hour. Since this writing, this amounts to $2.16 million and stands for the coin’s single-day highest possible lengthy liquidations in 2 months.

Learn More: What Is Fantom (FTM)?

FTM Rate Forecast: Even More Discomforts Lie Ahead

As evaluated on a one-day graph, FTM’s essential technological indications mean the opportunity of an additional cost decrease. For instance, the coin’s Elder-Ray Index signals that the bearish belief that tracks it is considerable. At press time, the indication’s worth is -0.19.

The Elder-Ray Index gauges the partnership in between the toughness of purchasers and vendors out there. When its worth is listed below absolutely no, it suggests that bear power is leading out there.

Likewise, FTM trades listed below its 20-day rapid relocating standard (EMA), indicating a decrease in acquiring task. The 20-day EMA gauges the typical cost of a possession over the previous 20 days. When a possession’s cost drops listed below it, it indicates a spike in offering stress.

If FTM preserves this fad, its worth might dive to $0.25.

Nonetheless, if it witnesses a fad modification and its need increases, this might press its cost towards $0.48.

Please Note

According to the Trust fund Job standards, this cost evaluation write-up is for informative functions just and need to not be taken into consideration economic or financial investment recommendations. BeInCrypto is devoted to precise, impartial coverage, yet market problems undergo alter without notification. Constantly perform your very own study and talk to a specialist prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.