Ripple-backed XRP Journal (XRPL) saw a noteworthy decrease in purchase quantity in Q2 2024, according to the most up to date XRP Markets Record. This decrease belongs to a broader fad impacting significant blockchain procedures, with XRPL experiencing a comparable slump.

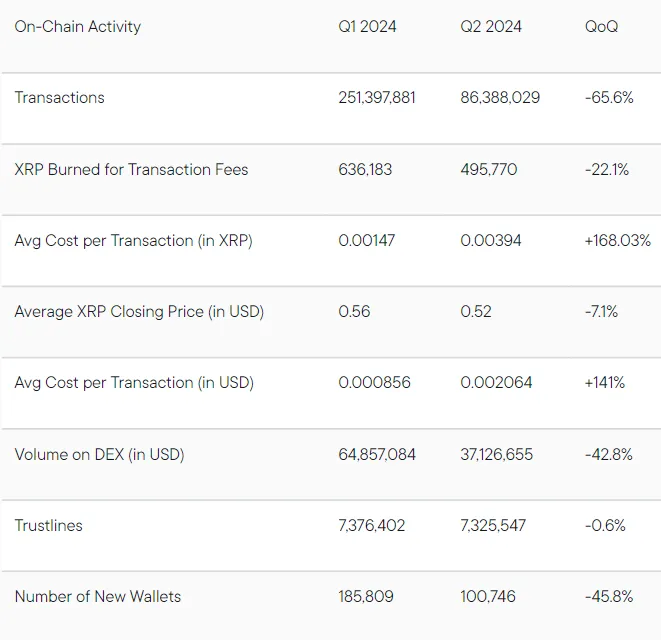

In Q2 2024, XRPL logged 86.39 million deals, a 65.6% decline from the previous quarter. In spite of this decrease, ordinary purchase costs on the network rose by 168% to 0.00394 XRP.

Surge Stays Favorable on XRPL Regardless Of Falling Quantity

XRP’s trading quantity, in addition to Bitcoin and Ethereum, dropped by 20% throughout the 2nd quarter. However, area trading quantities for XRP continued to be high throughout the majority of the quarter. Binance remained to control the trading quantity, with various other exchanges like Bybit and Upbit revealing diverse payments.

Trading of XRP versus fiat money lowered to 10%, with the majority of trading taking place versus the USDT stablecoin. Ripple sights this change favorably, especially with the upcoming launch of its USD Stablecoin later on this year.

Learn More: Surge (XRP) Rate Forecast 2024/2025/2030

On the other hand, Surge continues to be confident regarding XRPL’s future. The firm anticipates enhanced network task because of upcoming updates. Secret growths consist of the combination of Archax, a controlled exchange and custodian, and OpenEden, which can bring substantial tokenized real-world properties to XRPL.

Surge likewise highlighted numerous advancements coming up. These consist of the XRPL Ethereum Virtual Equipment (EVM) sidechain, Axelar interoperability, and the brand-new Oracle and Multi-Purpose Symbol (MPT) criterion. These innovations are anticipated to drive XRPL’s development in the future quarters.

“[The] progression with the XRPL EVM sidechain and Axelar for interoperability, and Archax’s anticipated increase of tokenized real-world properties, [alongside] the prep work for future Oracle and Multi-Purpose Symbol (MPT) conventional, thrills me regarding Q3 and Q4.” Monica Long, Surge Head Of State, commented.

On a different note, Surge waits for a court choice on its historical instance versus the United States Stocks and Exchange Compensation (SEC). The company mentioned that the court would certainly rule on the treatments connected to institutional XRP sales and it continues to be enthusiastic for a reasonable judicial result.

Learn More: Every little thing You Required To Learn About Surge vs SEC

Better, Surge kept in mind the importance of the upcoming November political elections, calling them “one of the most substantial in crypto’s background to day” and important for the future of crypto policy in the United States. The firm highlighted its $25 million contribution to Fairshake, a government extremely special-interest group sustaining pro-crypto prospects, bringing its complete payments to $50 million.

” This is an industry-wide, bipartisan initiative to make sure there is a solid future with regulative clearness for crypto in the United States. The SEC’s duplicated efforts to surround the crypto sector with enforcement activities has actually profited various other essential international markets that have actually accepted liable technology and financial development,” Surge included.

Please Note

In adherence to the Count on Task standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to give exact, prompt info. Nevertheless, visitors are recommended to validate truths individually and talk to an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.