Morgan Stanley revealed on Friday that it will certainly quickly enable its monetary experts to provide Bitcoin ETFs to particular customers, making it the initial significant Wall surface Road financial institution to do so.

Beginning Wednesday, the company’s 15,000 monetary experts can provide qualified customers shares of 2 Bitcoin exchange-traded funds: BlackRock’s iShares Bitcoin Trust fund and Integrity’s Wise Beginning Bitcoin Fund.

Morgan Stanley Permits Bitcoin ETF Pitches to Customers

This action by Morgan Stanley, among the biggest riches administration companies around the world, represents an essential action in the fostering of Bitcoin by mainstream money. In January, the United States Stocks and Exchange Compensation (SEC) authorized applications for 11 area Bitcoin ETFs. This made the biggest cryptocurrency a lot more obtainable, economical, and simpler to trade.

” This action remains in feedback to customer need and our need to equal the developing electronic possession market,” CNBC reported, describing a resource aware of the financial institution’s plans.

Originally, significant Wall surface Road riches administration services bewared, not enabling their experts to pitch the brand-new ETFs. Goldman Sachs, JPMorgan, Financial Institution of America, and Wells Fargo still follow this plan.

Learn More: Crypto ETN vs. Crypto ETF: What Is the Distinction?

Morgan Stanley’s choice was driven by high customer need. Nonetheless, the financial institution continues to be careful in its method. Just customers with a total assets of a minimum of $1.5 million, a high danger resistance, and a rate of interest in speculative financial investments are qualified for Bitcoin ETF solicitations. These financial investments are restricted to taxed brokerage firm accounts, not pension.

The financial institution will certainly keep track of customers’ crypto holdings to guarantee they do not have too much direct exposure to this unpredictable possession course. Presently, the only accepted crypto financial investments at Morgan Stanley are the Bitcoin ETFs from BlackRock and Integrity.

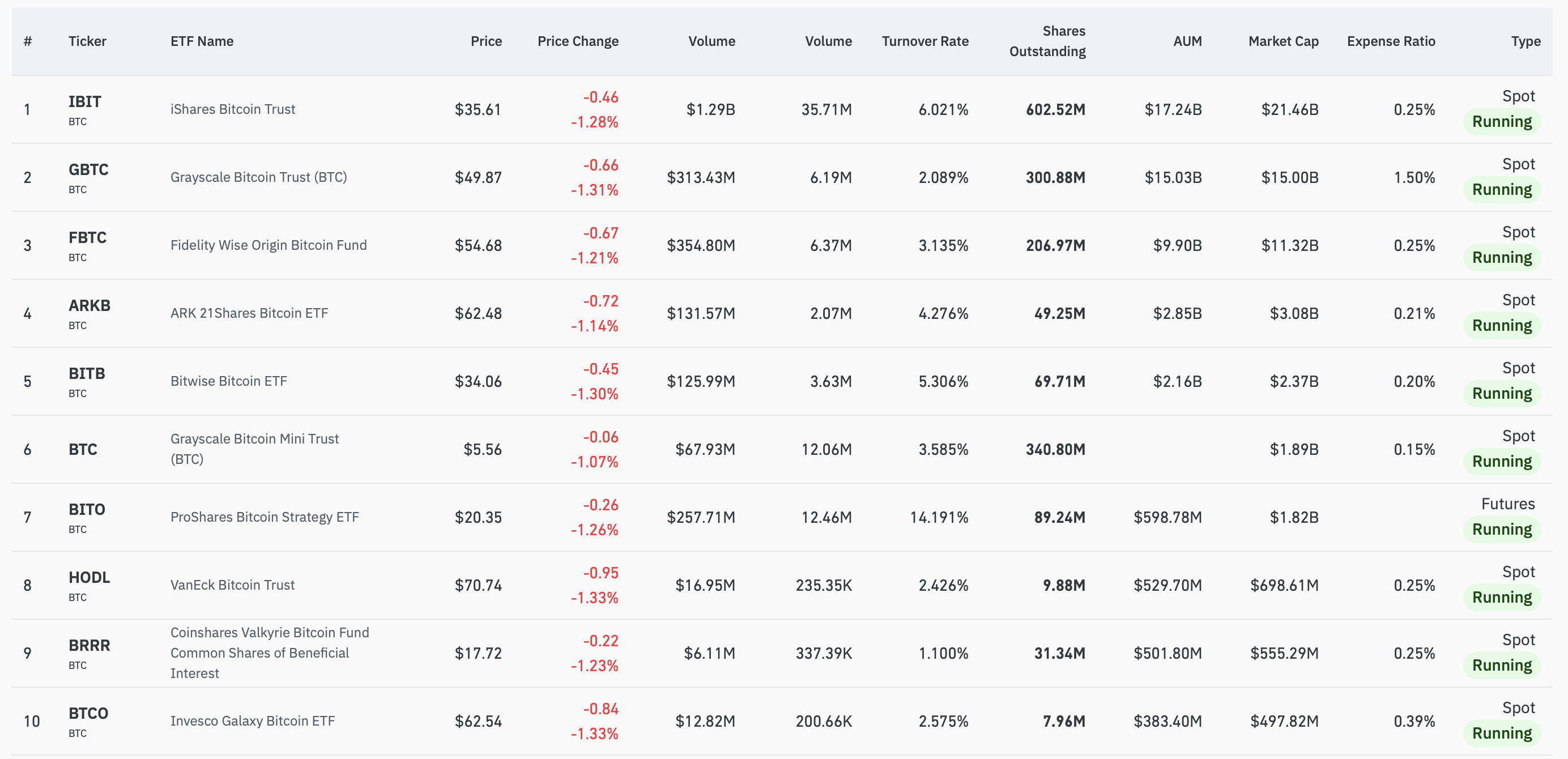

BlackRock’s IBIT has actually collected almost $18 billion in possessions because its beginning, while Integrity’s FBTC has actually collected $11 billion. Jointly, United States Bitcoin ETFs’ possessions under administration exceed $49 billion.

Learn More: Just How To Profession a Bitcoin ETF: A Step-by-Step Method

Previously this year, Morgan Stanley eliminated exclusive funds from Galaxy and FS NYDIG, which had actually been offered because 2021. The financial institution is likewise observing the marketplace for freshly authorized Ethereum ETFs and has not yet made a decision whether it will certainly provide accessibility to those.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to give precise, prompt info. Nonetheless, visitors are encouraged to validate truths individually and speak with a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.