On Thursday, Ethereum (ETH) exchange-traded funds (ETFs) videotaped their cheapest everyday inflows because their launch on July 23.

The 9 US-based funds saw internet inflows completing $26 million that day. Although moderate, this stands for the 3rd time place ETH ETFs have actually videotaped inflows because their launch 10 days earlier.

The Waning Passion in Place ETH ETF

When these funds went survive July 23, they saw a web inflow of $107 million and a trading quantity of over $1 billion. Nevertheless, the buzz around them just lasted a day, as the ETFs videotaped discharges in the 4 days that adhered to.

According to information from SosoValue, everyday web discharges from place ETH ETFs amounted to $653 million in between July 24 and 29. Everyday trading likewise diminished throughout that duration, coming by 22% over the four-day period.

While the general pattern suggests subsiding interest, there are significant variations amongst the Ether ETF service providers. For instance, Grayscale’s Ethereum Trust fund (ETHE) threw the general pattern by being the only fund recording discharges the other day, completing $78 million.

On the other hand, BlackRock’s iShares Ethereum Trust fund (ETHA) drew in inflows of $90 million throughout the duration in evaluation.

Learn More: Ethereum ETF Discussed: What It Is and Just How It Functions

On Thursday, various other funds, consisting of the Integrity Ethereum Fund (FETH) and the Bitwise Ethereum ETF (ETHW), likewise saw inflows of $12 million and $3 million, specifically.

ETH Rate Forecast: Need For the Leading Altcoin Leans

At press time, ETH professions at $3,140. The leading altcoin began a brand-new cycle of decrease on July 22 and has actually because developed a coming down triangular. This bearish pattern is developed when a possession’s cost develops a pattern of reduced highs and a straight assistance degree. Investors translate it as a signal that marketing stress is enhancing.

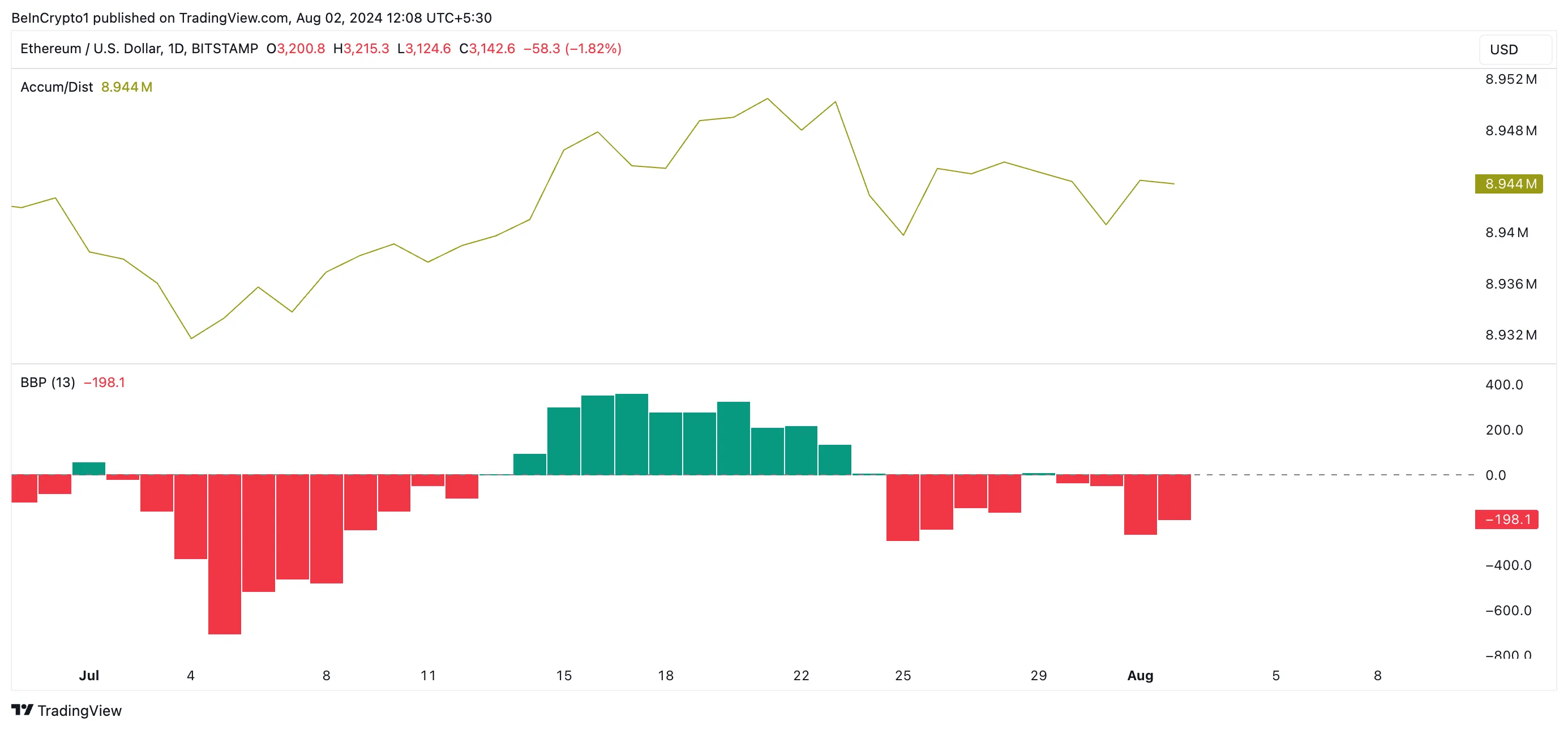

ETH’s decreasing Accumulation/Distribution (A/D) Line validates the rise in marketing task. Given that July 22, the indication’s worth has actually stopped by 6%.

A property’s A/D Line gauges the collective circulation of cash right into and out of a possession over a given time period. When it decreases in this fashion, it recommends that liquidity is draining of the possession, showing circulation.

Even More, ETH is presently tormented by considerable bearish views. This is shown by its unfavorable Elder-Ray Index. At press time, the indication’s worth is -198.1.

This indication gauges the connection in between the stamina of purchasers and vendors in the marketplace. When its worth is listed below absolutely no, it suggests that bear power is leading in the marketplace.

ETH’s cost might go down to $3,114 if the bearish prejudice continues. If it damages listed below the straight assistance line of the coming down triangular ($ 3,085), its cost could drop even more to $2,811.

Learn More: Ethereum (ETH) Rate Forecast 2024/2025/2030

Nevertheless, if view changes to favorable and buildup climbs up, ETH might damage over the triangular to trade hands at $3,301.

Please Note

In accordance with the Trust fund Task standards, this cost evaluation write-up is for educational functions just and need to not be taken into consideration economic or financial investment recommendations. BeInCrypto is dedicated to precise, objective coverage, however market problems go through transform without notification. Constantly perform your very own study and speak with a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.