Heaps (STX) rate is observing bearishness regardless of visiting a little over 12% in 4 days.

This bearishness results from the absence of sentence amongst STX owners, that are currently preferring a decrease.

Stacks Investors Transform Downhearted.

STX rate is birthing the force of the decreasing sentence amongst capitalists that changed their commitment at the tiniest decrease. The adverse financing price suggests that STX owners expect a decrease and have actually begun putting brief wagers. This recommends a bearish view amongst investors, anticipating the rate to drop.

The change in financing price over the last 12 hours was unusual, thinking about no adverse prices had actually been signed up in the last 2 weeks.

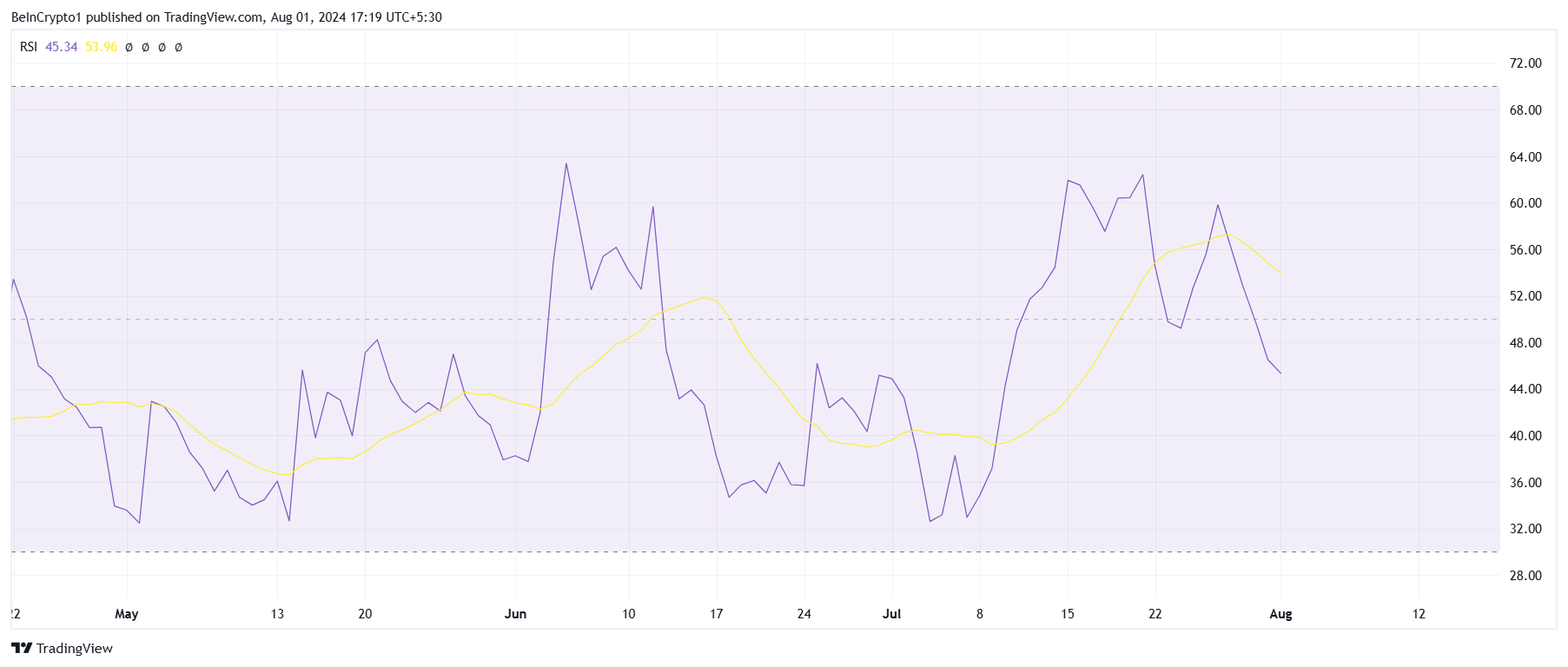

The family member stamina index (RSI) more corroborates this absence of bullishness. Over the previous 72 hours, the STX RSI has actually slid listed below the neutral line. The RSI is an energy oscillator that gauges the rate and adjustment of rate motions.

Dropping listed below the neutral line signals deteriorating energy, with marketing stress exceeding purchasing rate of interest. This can cause a self-fulfilling cycle where enhanced marketing stress results in also reduced rates, drawing in even more vendors.

Learn More: What Are Decentralized Exchanges and Why Should You Try Them?

STX Cost Forecast: Going For Assistance

STX rate at $1.70 is well listed below the previous assistance of $1.80 and is currently more than likely intending to support its drawdown at $1.53. The altcoin has actually checked this line as assistance in the past, so there is an opportunity STX will certainly recover from it.

If the assistance is not continual, a more rate decrease will certainly cause Stacks getting to $1.24. This would certainly eliminate the 47% gain kept in mind by the cryptocurrency in both weeks of mid-July.

Learn More: Leading 10 Aspiring Crypto Coins for 2024

Yet if the recover from $1.53 succeeds, STX can wind up climbing to $1.80 once again. This would certainly necessitate solid favorable signs from the more comprehensive market. Breaching this resistance can additionally revoke the bearish thesis.

Please Note

According to the Depend on Job standards, this rate evaluation short article is for educational functions just and need to not be thought about economic or financial investment suggestions. BeInCrypto is devoted to precise, objective coverage, yet market problems undergo alter without notification. Constantly perform your very own study and speak with a specialist prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.