Bitcoin bulls have actually had a sizzling week. Considering the cost activity in the day-to-day graph, not just is the coin down approximately 7% after breaching $70,000 early today, however splits are starting to create. On the whole, confident investors keep that the uptrend stays, taking into consideration the sharp growth in between July 14 and 21. Nevertheless, ever since, costs have actually been uneven and mainly relocating reduced, signifying the feasible existence of bears.

Extra Discomfort For Bitcoin Owners?

Because of this unstable cost activity, one expert bewares of what exists in advance, also anticipating that Bitcoin might, besides, proceed decreasing in the sessions to find. Requiring to X, the expert shared trading information, which recommends that bears remain in control, at the very least in the meantime.

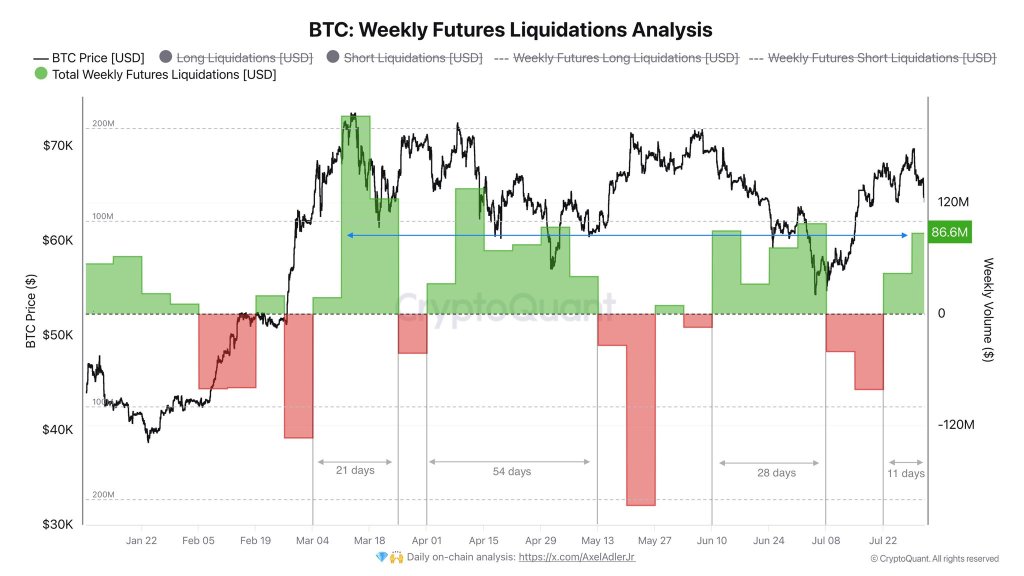

Especially, the expert noted that the once a week collections of liquidation quantity have actually been boosting, accompanying the current cost decrease over the previous trading day. With this signal printing, the expert is encouraged that bears may proceed pressing the coin reduced at the very least in the following week.

While this publishes out, the web taker quantity throughout leading continuous exchanges remains adverse. The web taker quantity, which on-chain experts utilize to determine market view, varies relying on market assessment.

When the web taker quantity penetrates adverse region, it recommends that many investors are taking brief placements. According to the expert, costs may recoup just when this analysis transforms environment-friendly, enabling bulls to organize the marketplace.

Considering the Bitcoin day-to-day graph, purchasers have assistance at around the $63,000 degree. Nevertheless, a degree greater, the area in between $60,000– a rounded number– and $63,000 will certainly be essential.

If bulls hold this degree, stopping vendors from pressing costs lower, the probabilities of Bitcoin recuperating will certainly be high. Any type of growth over $70,000 would certainly be critical and abreast with the favorable fad developed in the 3rd week of July.

Establishments Collecting: Place ETF Providers Regulate Virtually 300,000 BTC

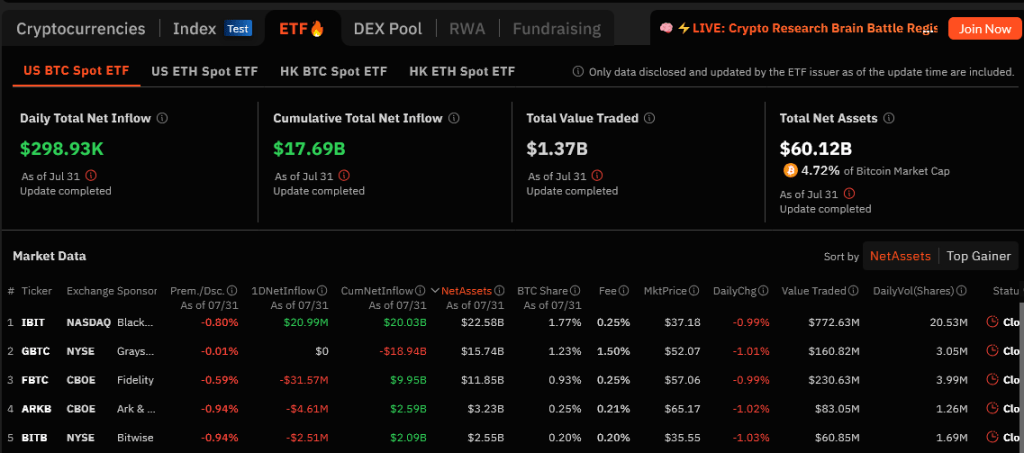

Regardless of the existing weak point, establishments are eager to obtain direct exposure to Bitcoin. Considering that the authorization of place Bitcoin ETFs in the USA, Ecoinometrics information shows that leading companies like Integrity and BlackRock have actually collected almost 300,000 BTC.

On August 1, Soso Worth information revealed that all place Bitcoin ETFs hold over $60 billion well worth of BTC. On July 31 alone, BlackRock acquired almost $21 million well worth of BTC.

However, there were significant discharges from various other companies, mostly Integrity. That establishments are increasing down, gathering the coin is extremely favorable for Bitcoin, specifically in the long-term.

Attribute photo from Canva, graph from TradingView

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.