MicroStrategy (Nasdaq: MSTR) announced it is preparing to substantially raise its Bitcoin holdings by elevating $2 billion with a brand-new at-the-market equity offering. The news followed the marketplace shut on Thursday, complying with a record of durable Q2 2024 revenues, which revealed a significant boost in the firm’s properties.

Presently, MicroStrategy holds 226,500 BTC, which the firm obtained at a typical rate of $36,821 per BTC, setting you back an overall of $8.3 billion. These holdings are currently valued at about $14.4 billion, mirroring a monstrous recognition in worth.

MicroStrategy’s Q2 financials were durable, with the firm highlighting a “BTC Return” of 12.2% year-to-date. This brand-new essential efficiency sign (KPI) becomes part of a wider technique targeting a 4-8% BTC Return each year over the following 3 years. The firm’s Head of state and chief executive officer, Phong Le, highlighted their continuous dedication to BTC, keeping in mind “an enhanced understanding of bitcoin and the raising assistance for the ecological community from bipartisan political leaders and organizations,” particularly throughout the current Bitcoin 2024 Seminar in Nashville.

Andrew Kang, the CFO of MicroStrategy, described the monetary maneuvers that promoted the boost in BTC holdings, consisting of the issuance of $800 million in 2.25% exchangeable elderly notes due in 2032 and the very early redemption of $650 million well worth of exchangeable notes due in 2025. These calculated monetary choices have actually permitted the firm to raise its holdings by 12,222 BTCs given that the begin of the 2nd quarter.

The firm additionally introduced a substantial 10-for-1 supply split of its course A and course B ordinary shares, reliable in very early August, which is anticipated to raise the liquidity of its shares.

Responses To The Substantial Bitcoin Acquire Statement

The possible upcoming $2 Bitcoin buy was concealed inside the main news with one sentence: “We remain to carefully handle our equity resources, and are submitting an enrollment declaration for a brand-new $2 billion at-the-market equity offering program.”

Responses within the neighborhood have actually been mainly favorable, mirroring a solid recommendation of MicroStrategy’s hostile Bitcoin procurement technique. Will Certainly Clemente III, a famous crypto expert, revealed awe at the range of the intended acquisition. He remarked: “Divine crap Saylor’s shopping an additional $2 billion of BTC.”

Matt (@matt_utxo), a recognized number in the crypto X neighborhood, noted, “MSTR Approximated ~ 6.7% dilution to obtain ~ 31,000 Bitcoin. Saylor & & Co. are proceeding the technique of trading business shares for the hardest property in the world.”

Smeet Bhatt, creator of Theya Bitcoin, hailed the technique as a brand-new standard of monetary design, contrasting Michael Saylor to epic financier Warren Buffet. He specified, “Accretive dilution is an entire brand-new standard of monetary design that MSTR has actually let loose by shorting a constantly debasing money to pile even more tough cash. Unfathomably based. Michael Saylor is the Warren Buffet of 21st century.”

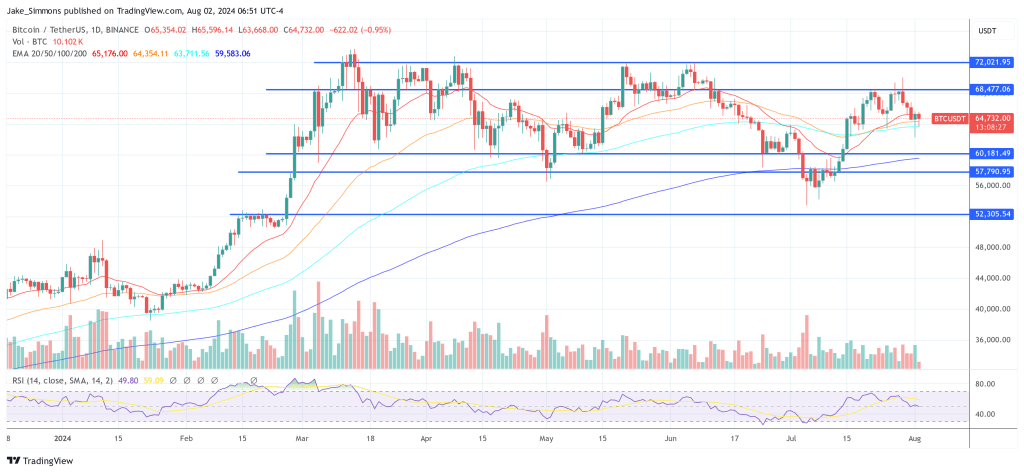

At press time, the Bitcoin rate really did not respond to the information. BTC is a little up 0.1% in the last 24 hr, trading at $64,732.

Included photo from YouTube, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.