RippleX, the designer arm of Surge, is partnering with OpenEden Labs to present tokenized United States Treasury costs (T-bills) to the XRP Journal (XRPL), according to a main news release from August 1. OpenEden Labs is a tokenization system and introduced the launch of its TBILL symbols, which are backed by short-dated United States T-bills and turn around repurchase arrangements collateralized by United States Treasuries.

Surge Additional Expands Its Series Of Products

The intro of these tokenized possessions on the XRPL straightens with a more comprehensive pattern of incorporating real-world possessions (RWAs) right into blockchain networks. In an initiative to reinforce the fostering and liquidity of OpenEden’s tokenized T-bills, Surge has actually devoted to spending $10 million right into TBILL symbols.

Via X, Surge X shared: “Information alert– tokenization system OpenEden Labs is bringing tokenized United States Treasury costs (T-bills) to the XRPL! What’s even more, Surge is producing a fund to purchase tokenized T-bills, and will certainly designate USD$ 10M to OpenEden’s TBILL symbols as component of it.”

Markus Infanger, Senior Citizen Vice Head Of State at RippleX, stressed the importance of this combination: “OpenEden’s tokenized United States Treasury costs stand for one more interesting instance of just how all kinds of real-world possessions are being tokenized to drive energy and brand-new possibilities,” he mentioned. “Organizations are significantly considering where to tokenize their real-world possessions and the arrival of T-bills on the XRPL powered by OpenEden strengthens the decentralized Layer 1 blockchain as one of the leading blockchains for real-world possession tokenization.”

Especially, OpenEden has actually currently accumulated over $75 million in Complete Worth Secured (TVL) for its tokenized United States T-bills, suggesting solid market self-confidence in its version. The system has actually likewise obtained an investment-grade “A” score from Moody’s, even more confirming its economic security and attract institutional financiers.

Jeremy Ng, Founder of OpenEden, kept in mind the varied passion in their offerings: “OpenEden has actually drawn in a large range of institutional customers, consisting of structures, business treasuries, and buy-side funds, adding to a secure and varied customer base,” he stated. “Bringing tokenized T-bills to the XRP Journal is the following action in our interesting trip. Buyers will certainly have the ability to mint our TBILL symbols using stablecoins, consisting of Surge USD when it releases later on this year.”

Especially, this is not the initial step by Surge in the RWA market. In June, the firm increased its collaboration with Archax, a UK based Financial Conduct Authority managed electronic possession exchange, broker, and custodian. This cooperation intends to present “numerous countless bucks of tokenized RWAs” to the XRP Journal in the future.

According to Surge, the XRPL has actually assisted in over 2.8 billion deals given that its creation in 2012 and currently sustains greater than 5 million energetic purses, flaunting a network of over 120 validators without a solitary failing or safety and security violation.

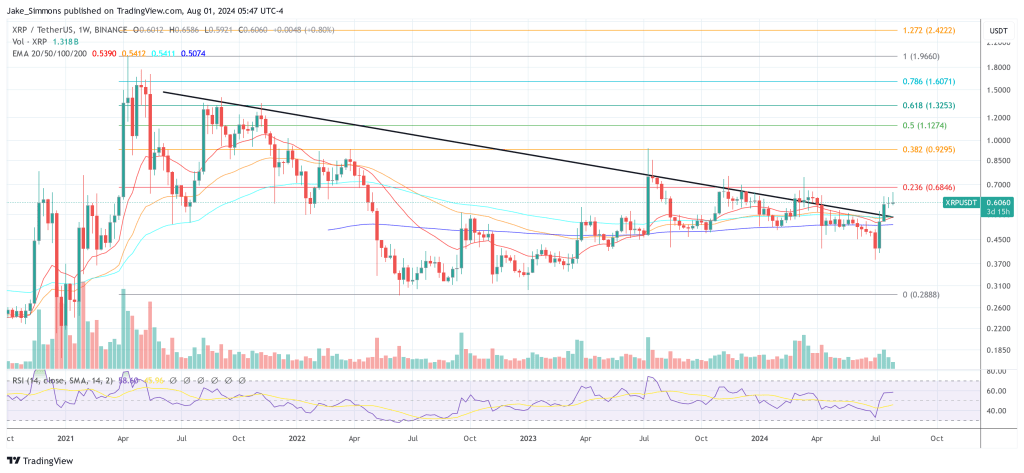

At press time, XRP traded at $0.606.

Included photo produced with DALL.E, graph from TradingView.com

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.