OpenEden lately introduced a collaboration with Surge to bring tokenized United States Treasury expenses (T-bills) to the XRP Journal (XRPL).

This collaboration will certainly include a significant financial investment of $10 million from Surge to OpenEden’s front runner tokenized item, TBILL.

DeFi Fulfills TradFi: Changing T-Bills right into Digital Possessions

In its main declaration, Markus Infanger, Elder Vice Head Of State of RippleX, highlighted the considerable results of real-world property (RWA) tokenizations. He kept in mind that organizations are much more very closely analyzing just how to tokenize their RWAs.

Jeremy Ng, the founder of OpenEden, likewise shared his enjoyment regarding this effort. He clarified that incorporating tokenized treasury right into the XRP Journal notes an essential stage in both firms’ trips.

” Buyers will certainly have the ability to mint our TBILL symbols through stablecoins, consisting of Surge USD, when it introduces later on this year,” Ng included.

Find Out More: What is Tokenization on Blockchain?

Along with OpenEden’s initiatives, Surge has actually partnered with Archax, the UK’s initial Financial Conduct Authority-regulated electronic property exchange. Archax intends to tokenize thousands of countless bucks well worth of RWAs on the XRPL over the coming year.

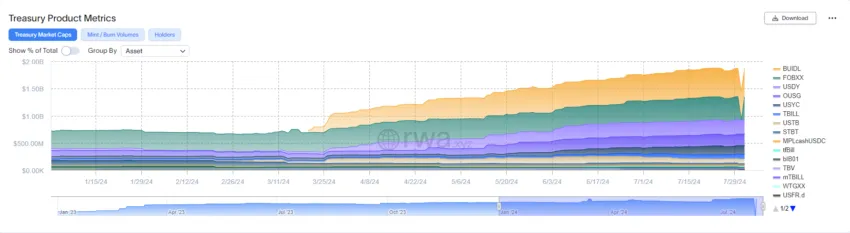

BeInCrypto reported in June that OpenEden’s TBILL symbols have actually likewise accomplished an investment-grade “A” score from Moody’s score firm. Information from RWA.xyz discloses that TBILL rankings 6th to name a few tokenized United States Treasury items, with a market capitalization of $90.64 million since August 1.

T-bills are temporary United States national debt commitments backed by the Division of the Treasury. They stand for a safe and very fluid property course. Tokenization offers capitalists smooth accessibility to standard RWAs via a decentralized system.

The tokenized United States Treasury market has actually seen exceptional development in 2024. RWA.xyz information suggests the complete worth of this section has actually broadened from $726.23 million to $1.88 billion year-to-date. BlackRock’s BUIDL and Franklin Templeton’s FOBXX are considerable factors, with market capitalizations of $522.81 million and $414.300 million, specifically.

Find Out More: What is The Influence of Real Life Possession (RWA) Tokenization?

Additionally, experts anticipate proceeded development, with the marketplace possibly getting to $3 billion by the end of 2024. Need from decentralized self-governing companies (DAOs) and decentralized financing (DeFi) tasks looking for steady, safe returns within the blockchain environment will certainly drive this development. In the longer period, speaking with company McKinsey & & Business likewise anticipates the tokenized economic possessions market might get to $2 trillion by 2030.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is dedicated to honest, clear coverage. This newspaper article intends to offer precise, prompt details. Nonetheless, visitors are encouraged to confirm realities separately and speak with an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.